The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which direction, and not on the exact methods you might use to determine trade entries and exits.

So, when starting the week, it is a good idea to look at the big picture of what is developing in the market as a whole, and how such developments and affected by macro fundamentals, technical factors, and market sentiment. There are a few valid long-term trends in the market right now, which might be exploited profitably. Read on to get my weekly analysis below.

Fundamental Analysis & Market Sentiment

I wrote in my previous piece on 26th February that the best trade opportunity for the week – the only one which set up given my conditions - was likely to be long day trades in the USD/JPY currency pair. This was a good call, as we did see an upwards trajectory in this currency pair until Thursday’s New York session, so there was likely at least one good trade entry on the long side.

The news is dominated by public remarks from Federal Reserve members about inflation and interest rates sending stock markets higher or lower. On Friday, Fed member Bostic signaled his expectation for only a 25bps rate hike at the next Fed meeting, which sparked a strong rally in US stock markets, sending the S&P 500 Index up by more than 1.6% and the NASDAQ 100 Index closed well over 2% higher. However, on Sunday, Federal Reserve Bank of San Francisco President Mary Daly suggested that the Fed will probably need to raise interest rates to a higher than expected level and keep them there for a while to deal with inflation. Earlier on Friday, Richmond Federal Reserve Bank President Thomas Barkin stated that he could see a terminal rate between 5.5% and 5.75%.

It may be that these remarks will dominate sentiment when markets open tomorrow and push stock markets lower, although the S&P 500’s close above the former resistance level at 4018, and the fact it has not fallen by very much since it made a golden cross a few weeks ago, suggests that bulls are still in play – there are many historical precedents which suggest the US stock market is ready to trade higher over the coming months.

Before Bostic’s remarks, the week was dominated by risk-off price movement, with the US Dollar retaining most of its strength and the 2-year US treasury yield reaching its highest level in 15 years, just below 5%. This is a good example of just how strongly markets are dominated by the Fed’s policy right now on rates.

There were a few significant data releases last week:

- Bank of Japan governor-designate testified before Parliament, signaled likely to keep ultra-loose monetary policy.

- Australian CPI (inflation) data showed a stronger-than-expected fall, from 8.4% to 7.4%.

- US ISM Services PMI data came in slightly better than expected.

- US ISM Manufacturing PMI data came in slightly worse than expected.

- Canadian GDP data came in very slightly worse than expected, showing no economy growth over the previous month.

- US CB Consumer Confidence data came in a little worse than expected.

The Week Ahead: 6th March – 10th March 2023

The coming week in the markets is likely to see a higher level of volatility than last week, as there are only several major data releases due over the coming week. They are, in order of importance:

- US Federal Reserve Chair Powell testifies before congress.

- US non-farm employment change, unemployment rate, and average hourly earnings

- Bank of Japan Monetary Policy Rate and Statement

- Bank of Canada Overnight Rate and Rate Statement

- Reserve Bank of Australia Cash Rate and Rate Statement

- Swiss CPI (inflation) data

- US JOLTS job openings data

- UK GDP data

- Canadian Unemployment data

Technical Analysis

US Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a bearish candlestick rejecting the key resistance level at 104.93.

The candlestick is quite large but has a substantially lower wick, suggesting neither bulls nor bears are decisively in control here. Another bearish sign is that the Dollar is again trading below its levels of both 3 and 6 months ago.

I do not like to trade against long-term trends, so I will only take trades against the US Dollar this week.

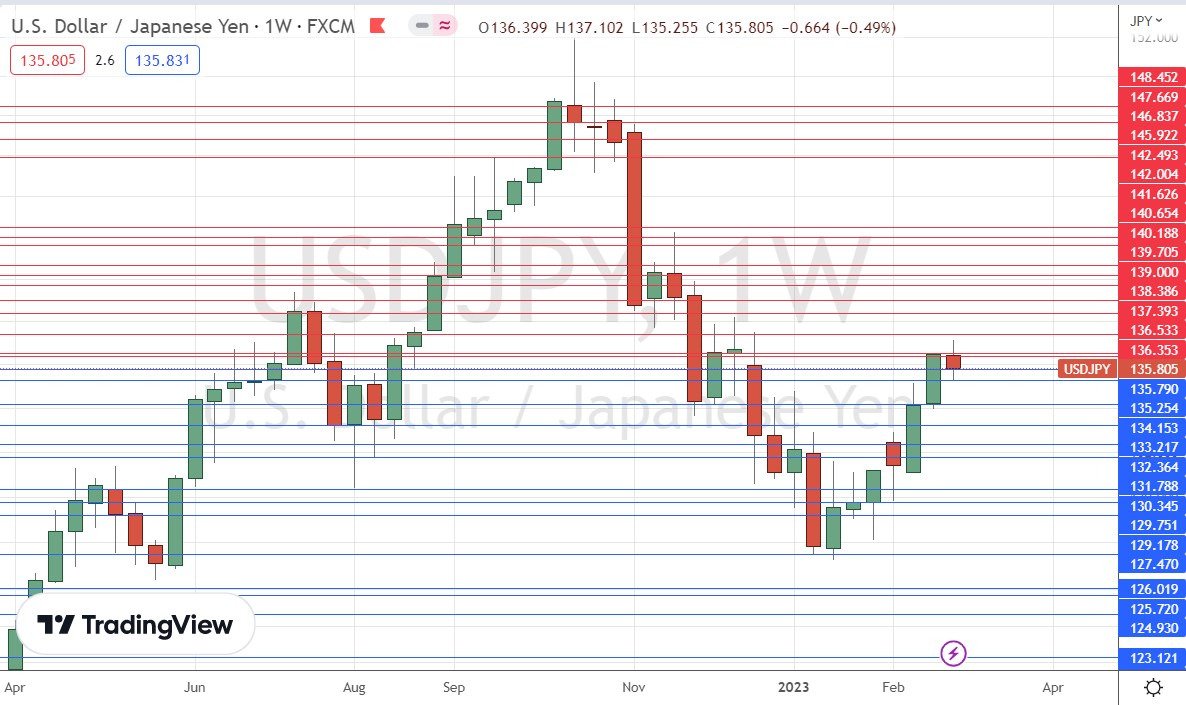

USD/JPY

Last week saw the USD/JPY currency pair pause in its recent bullish advance, printing a doji candlestick on the weekly chart which rejected the resistance levels at ¥136.35 and ¥136.53. This candlestick type usually signifies indecision when it appears at the edge of a price range, so we may be seeing the start of a bearish reversal.

The prospect of a bearish reversal is reinforced by the fact that we again see the US in a long-term downwards trend and making a bearish move off a key resistance level.

However, bears should probably be cautious, as we have a dovish Bank of Japan contributing to long-term Yen weakness, while the US Dollar could strengthen again quickly upon any more hawkish remarks from members of the Federal Reserve.

S&P 500 Index

We saw a strong rise in the stock market index on Friday after it spent the earlier part of the week in a bearish consolidation. This mirrors the longer-term consolidation pattern we have seen overall since May 2022.

Friday’s price action was very bullish, and there is some technical significance to the price again closing firmly above the former support level just below 4018. The price also closed right on its high, and the weekly candlestick is almost outside the previous week’s – these are both bullish signs.

The daily price chart still shows a valid golden cross (or bull cross), where the 50-day MA crosses over the 200-day MA, valid since Thursday three weeks ago. Such a cross historically indicates the beginning of a major bull move, so it could be a great long-term buy signal.

I would be bullish here, but while markets have been closed over the weekend, we have seen more hawkish comments from a Fed member, which could trigger a lower open Monday and bearish price action, at least over the short term.

I am prepared to enter a long trade if we get a daily close above 4050.

NASDAQ 100 Index

We saw a strong rise in the stock market index on Friday after it spent the earlier part of the week in a bearish consolidation. This mirrors the longer-term consolidation pattern we have seen overall since May 2022.

Friday’s price action was very bullish. The price also closed right on its high, and the weekly candlestick is almost outside the previous week’s – these are both bullish signs.

However, the bearish case is strengthened by the fact that the daily price chart still does not show a valid golden cross (or bull cross), unlike the S&P 500 Index, and because the nearby key support or resistance level is above the recent price action and holding at 12819.6.

2-Year US Treasury Yield

Us Treasury Yields rose again last week, notably the 2-year yield, as Fed members continued to talk up rates, raising expectations for rate hikes. However, this reversed quite strongly on Friday, after the yield here had earlier made a new 15-year high price close to 5%.

Technically, the chart looks bullish, and may rise further, but it is worth noting the weekly candlestick is only weakly bullish.

I will not enter a long trade here until these moving averages cross, and the price makes a daily close at a new record high price.

Traders should note that this asset exists as a micro-future, which can be affordable for many.

Bottom Line

I see a long-term investment opportunity as valid in the S&P 500 Index following a daily close above 4050. I also see a long trade in the US 2-Year Treasury Yield if we see the fast-moving average cross above the slower one with a new high at the daily close.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.