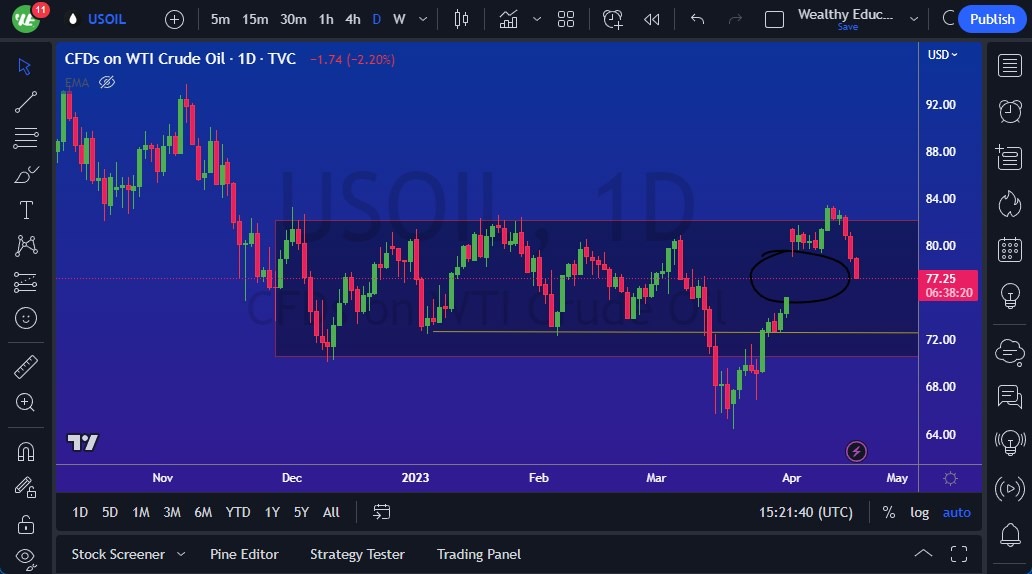

- On Thursday, the West Texas Intermediate (WTI) Crude Oil market fell slightly and is now testing the 50-Day EMA, which is a significant technical indicator for traders.

- There is also a considerable gap in the market that has yet to be filled, leading many traders to look to the downside. This is a trend that has been developing over the past few weeks due to OPEC's decision to cut production, which has not necessarily been interpreted as a bullish sign.

- Although it reduces the supply of oil in the market, OPEC's motivation appears to be a need to protect prices due to the slowing global economy and expected fall in demand.

The question now is whether the gap in the market will be filled and if it bounces, or if the market will continue to decline if it slices through the $75.50 level, which would be a very negative sign. If it does, there could be a lot of negativities in multiple markets, not just this one.

Meanwhile, in the Brent market, the situation is equally concerning as it has sliced through the 50-Day EMA in a very negative turn of events. The market is now looking towards the $80 level, a large, round, psychologically significant figure where the gap started in the first place. If the gap holds and offers support, it might be a good buying opportunity. However, the market needs to resolve questions regarding the global economy and whether it will slow down or not. If there is a significant lack of energy, the oil markets will be in the forefront of where trading will happen next.

Volatility Ahead

The current situation indicates that traders are either short or waiting to see what happens at the $80 level, which is crucial. It's also important to note that on Friday, traders tend to book gains in one direction or the other, as many short-term traders do not want to hold their positions over the weekend.

At the end of the day, the WTI and Brent markets are both facing significant challenges as they test critical levels and grapple with the global economic situation. These markets are likely to continue experiencing significant volatility in the coming weeks as traders react to new information and events. As such, investors need to exercise caution and pay close attention to technical indicators and market trends.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Oil trading brokers in the industry for you.