- Gold markets experienced a significant upward trend during the trading session on Thursday, with the US dollar struggling after the PPI numbers were missed.

- This suggests that inflation may be on the rise, while a recession could be on its way.

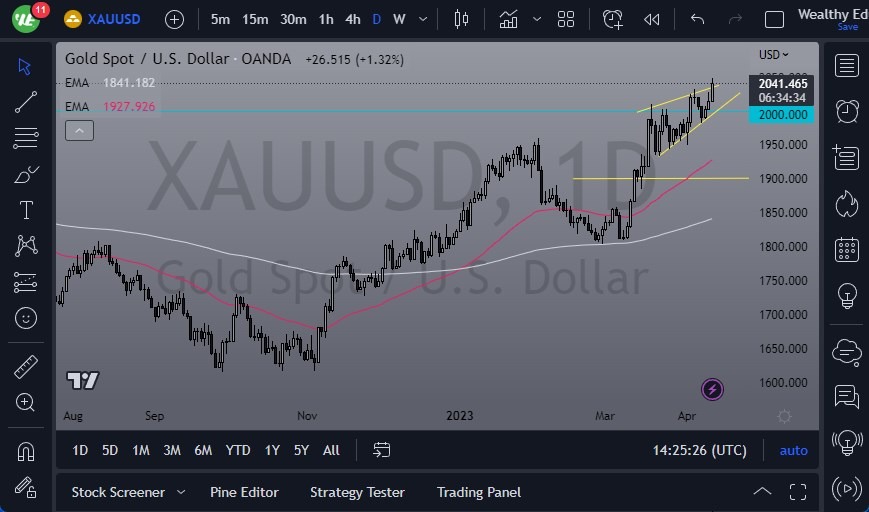

- The bullish momentum in the gold market has been persistent, and we are now at the top of an overall rising wedge.

- With this being the case, the market could very well take off to the outside and try to go to the $2100 level.

Any short-term pullback at this point is likely to be seen as a buying opportunity, as it should open up plenty of value. The $2000 level is expected to continue to be a significant support level, as it holds a lot of psychological significance. While it may appear that gold is overdone at this point, the momentum in the market cannot be ignored, as it has been the leading force in trading for some time.

Even if the market breaks down below the $2000 level, there should be plenty of support underneath, particularly near the $1950 level. This area is also where we see the 50-Day EMA, and there was previously a gap in the futures market. It's reasonable to assume that there will be significant support in this general vicinity. However, assuming a pullback occurs, it's difficult to predict whether the market will continue its upward trajectory or if it will experience a significant correction.

Markets Will Remain Volatile

Overall, while the gold market is currently experiencing significant bullish momentum, it's important to pay attention to key support and resistance levels. The $2000 level will likely continue to be a significant support level, while the $2100 level may provide some resistance. The $1950 level is also an important area to watch for potential support.

In conclusion, while the gold market is currently experiencing bullish momentum, it's important to remain cautious and aware of potential pullbacks or corrections. The market has been on a significant upward trend, and while it may continue to rise, it's important to be prepared for any shifts in momentum or changes in market conditions. Having said that, the shifts to the downside should continue to offer buying opportunities, as traders around the world are trying to protect wealth at any cost it seems. The markets will remain volatile, so trade accordingly.

Ready to trade our Gold forecast? We’ve shortlisted the best Gold brokers in the industry for you.