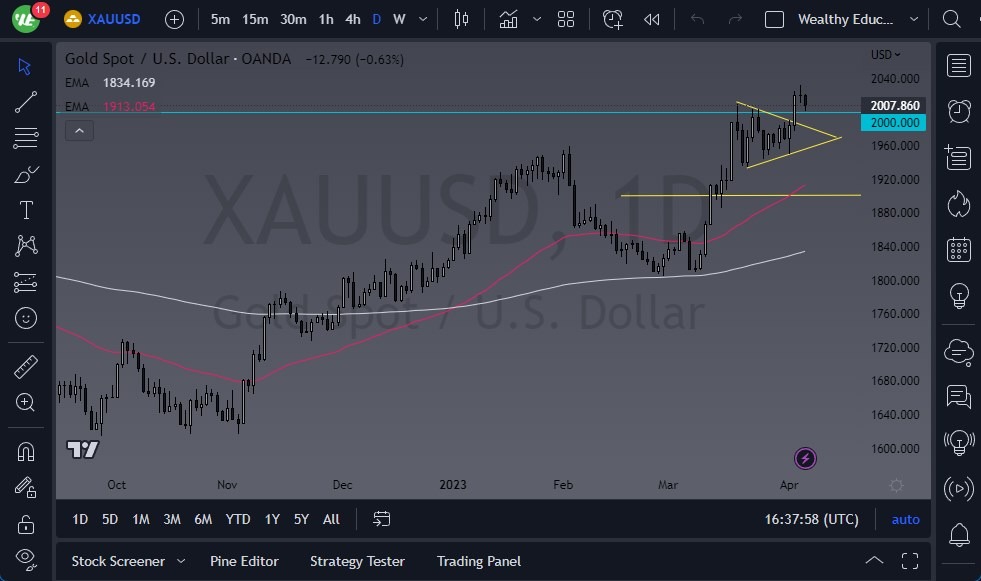

Gold futures markets were closed on Friday, but that doesn't mean there isn't a lot to learn from the charts. The $2050 level has been an area of significant selling pressure, and we formed a massive spending top in that area. If we do pull back from there, then the market could go looking to the $2000 level, which is a psychologically important figure and an area where we may see buyers jump in. Even if we break it down below there, it's likely that we could see a drop to the $1975 level.

Despite the noisy behavior, there are a lot of people out there betting on the Fed cutting rates. If this happens, it makes sense for gold to continue to go higher, as investors believe that the US dollar will continue to fall. Additionally, the market is seeing a lot of wealth preservation at the moment, which makes gold an attractive investment option. However, it's important to note that even if the US dollar picks up strength, gold prices can still rally.

Choppiness Ahead

Looking forward, it seems likely that we will eventually break out, but it won't be an easy feat. It will take a lot of effort, and as a result, there will be quite a bit of volatility ahead of us. After the huge move to the upside, we started to see a lot of choppiness as we hung around the $2000 level. If we do pull back from here, there will still be plenty of buyers interested in gold.

In fact, many experts believe that gold could continue to rise as we move forward. There are a lot of reasons for this, including the ongoing COVID-19 pandemic, which has created a great deal of uncertainty in the markets. Additionally, geopolitical tensions and inflation concerns have made gold a popular choice for investors looking to preserve wealth. As a result, we could see gold prices continue to rise in the coming weeks and months.

- There are still risks considering when trading gold.

- One major risk is the possibility of a stronger US dollar.

- If the US dollar does gain strength, it could put pressure on gold prices, as investors flock to the dollar as a safe-haven asset.

- Additionally, a stronger economy could lead to rising interest rates, which would also put downward pressure on gold prices.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.