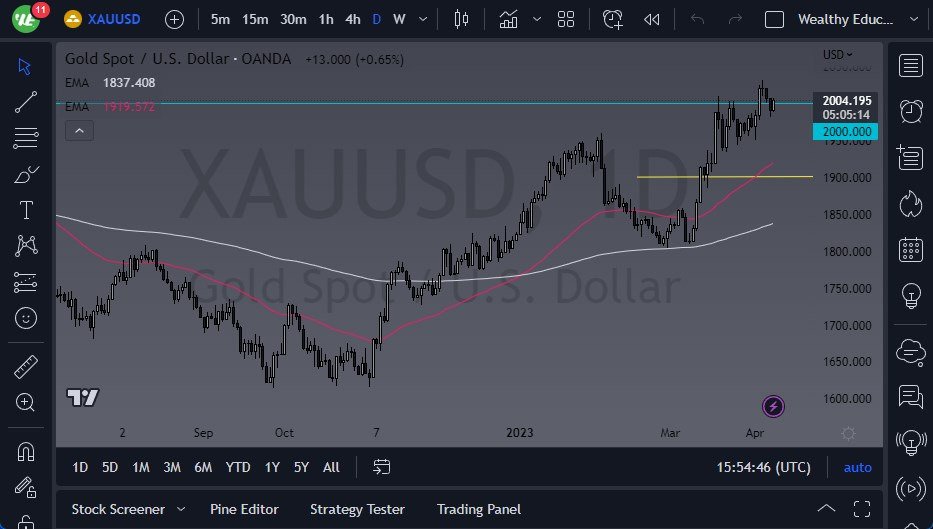

- Gold markets experienced a rally during Tuesday's trading session, with the $2000 level offering support.

- However, it is uncertain whether the market is ready to take off to the upside, and it is possible that a "rising wedge" formation is occurring, which could result in a drop down to the $1950 level.

- If this does happen, selling pressure may drive the market to that area, but there may also be many buyers on the dip.

Less Momentum, Expect Volatility

Currently, gold is seen more as a wealth preservation asset, rather than an "anti-dollar trade." However, both the US dollar and gold can rally at the same time, as seen in the 1980s. The market is likely to remain volatile, and it is important to exercise caution with position sizing to avoid being shaken out of a position.

It is worth paying close attention to the 50-Day exponential moving average, which is racing towards the $1950 level, and it may tie together quite nicely. It is possible that the market may simply go sideways, trying to build up the necessary momentum to break out to the upside, rather than breaking down through the rising wedge. The area between $2000 and $2100 has been significant multiple times, and it is likely to offer a significant barrier. Breaking above this range would be an extraordinarily bullish sign and may result in gold taking off.

It is not advisable to sell gold, and shorting the market is not recommended at this time due to its strength. The key is to exercise patience and wait for the market to show its hand before making any major moves. After all, wealth preservation is going to be a big theme this year, and I just don’t see how gold turns into a bearish market in this environment.

The gold market is experiencing volatility, and it is uncertain whether it is ready to take off to the upside. It is important to exercise caution with position sizing and pay close attention to the 50-Day EMA. Breaking above the $2000-$2100 range would be an extraordinarily bullish sign, and may result in significant gains. However, the market may also go sideways, trying to build up momentum to break out to the upside. The key is to be patient and wait for the market to show its hand before making any major moves.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.