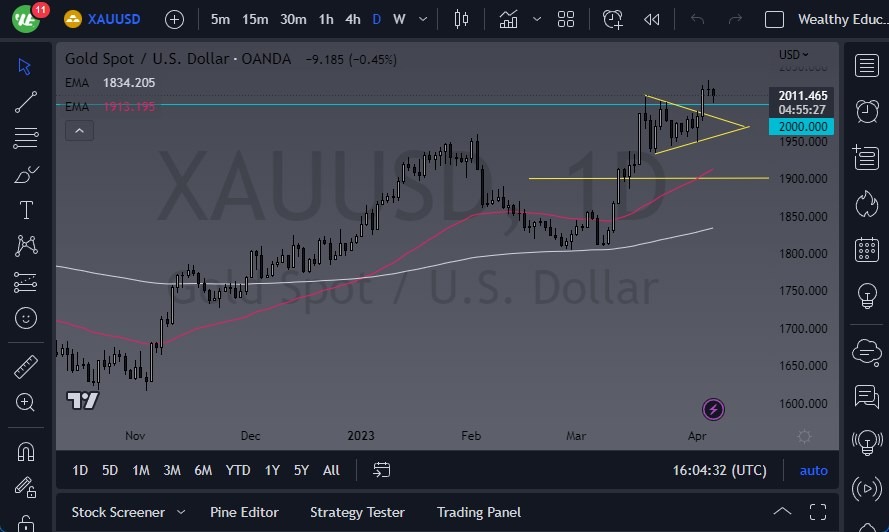

- Gold markets experienced a slight pullback during Thursday's trading session, as the yellow metal has reached an overextended level.

- With the approaching Good Friday holiday and Non-Farm Payroll numbers coming out, the market may experience a lack of volume and conviction.

- Despite the bullish trend, the market has gotten ahead of itself too quickly, suggesting that a little bit of pullback could offer some value.

If the price of gold drops down to the $2000 level, it could provide a perfect buying opportunity. This area is a significant level as it is a large, round, and psychologically significant figure. Moreover, it has been essential in the past, and there is a lot of interest in it. Therefore, a drop to this level would provide an attractive opportunity for traders.

On the other hand, if the price breaks above $2050, it is highly likely that it will reach the $2100 level, leading to a longer-term “buy-and-hold” type of situation. Despite this, the market is still highly volatile, and it's not advisable to sell gold at this point. The pullback offers "cheap gold," and most traders are looking forward to such a scenario.

The Buying Pressure is Increasing

Gold has seen increased buying pressure in recent times, as traders seek a safe haven asset due to market volatility. With the fear of losing wealth, gold has been the perfect choice for traders looking for a reliable asset to preserve wealth. Moreover, some traders are starting to buy gold, anticipating that the Federal Reserve will have to go back into quantitative easing. In any case, gold is exceptionally bullish, and every dip in its price should be viewed as an opportunity to buy.

Despite its bullish trend, the market may face significant challenges in the coming days. Traders will have to deal with the lack of liquidity and volatility that comes with a market holiday. Furthermore, the market has become too dependent on the idea of wealth preservation, which has contributed to the massive rise in gold prices. Therefore, traders need to be cautious and patient, waiting for the market to stabilize before making significant trading decisions.

In conclusion, the pullback in gold prices offers traders an opportunity to buy "cheap gold." The $2000 level provides a crucial area for traders to look out for, and a break above $2050 could lead to a longer-term bullish trend. However, traders must remain cautious in light of the current market conditions and the impending holiday. Despite these challenges, gold remains an excellent asset to consider for traders looking to preserve wealth in the current economic climate.

Potential signal: Buy gold on dips, with an eye on the $2000 level as support. The stop loss would be $1990, and the target would be $2060.

Ready to trade our Gold forecast? We’ve shortlisted the best Gold brokers in the industry for you.