Gold markets experienced a rally during Wednesday’s trading session, showing signs of a potential impulsive move. The recent boost in the gold market can be attributed to the slowing down of the economy in the United States. Many traders are anticipating a recession and believe that the Federal Reserve will have to cut interest rates sooner than they have been stating. This belief may result in gold continuing to rise as the US dollar weakens.

Bullish Pressure Should Continue to Push the Gold Pice Higher

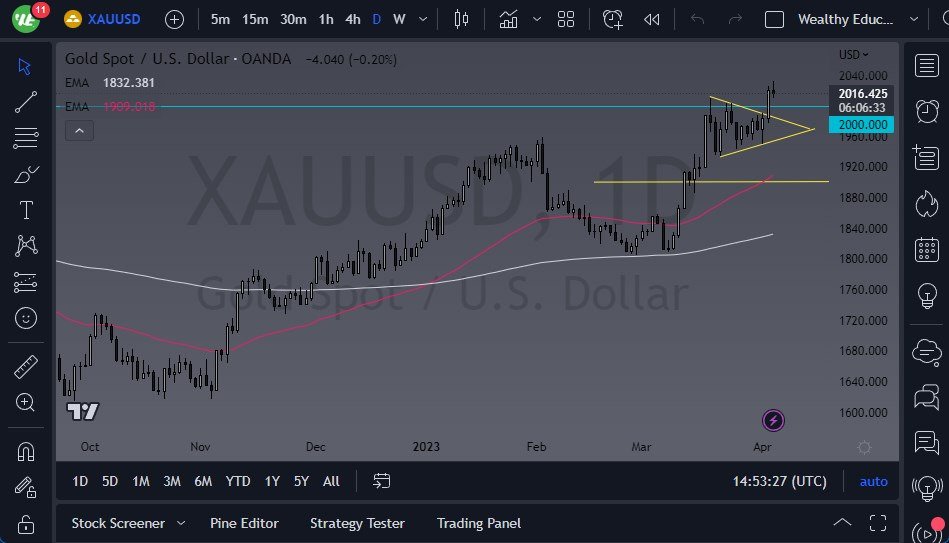

Currently, it appears that gold could be aiming for the $2100 level, which is a large, round, and psychologically significant figure. However, this area could potentially serve as a pause in gold’s momentum. Nevertheless, as long as the economic situation continues to crumble, it is likely that the bullish pressure will continue.

In the current market, investors are more concerned with protecting their wealth in the face of an economic slowdown than anything else. The $2000 level underneath serves as a significant support level, not just psychologically but also as an area that has attracted price back and forth multiple times.

Although the market is bullish at the moment, it is possible that we will see a short-term pullback. This would allow for a breather and the opportunity for additional buyers to enter the market. However, the overall trend in the gold market seems to be bullish, with buying pressure continuing to increase. It is worth noting that on longer-term charts, there is still some noise above, which may contribute to a pullback.

It seems that the market is currently driven by the idea of slowing down the economy and protecting wealth. As such, the gold market has become a safe haven for investors looking to safeguard their assets. While it is important to pay attention to the economic situation and the Federal Reserve's policies, it is clear that the gold market will continue to see a lot of bullish pressure, making it a promising opportunity for those trying to protect their wealth and therefore find a longer-term “buy-and-hold” type of market.

Potential XAU/USD Signal

- Any time gold drops, it should be thought of as a buying opportunity.

- Of particular interest will be the $2010 level, followed by the $2000 level.

- I would be a buyer with a stop loss at $1990, adding to a position in building it up over time.

- Small incremental buying on the dip positions continue to be optimal.

- The overall target at this point is the $2100 level.

Ready to trade our free trading signals? We’ve made a list of the best brokers to trade Forex worth using.