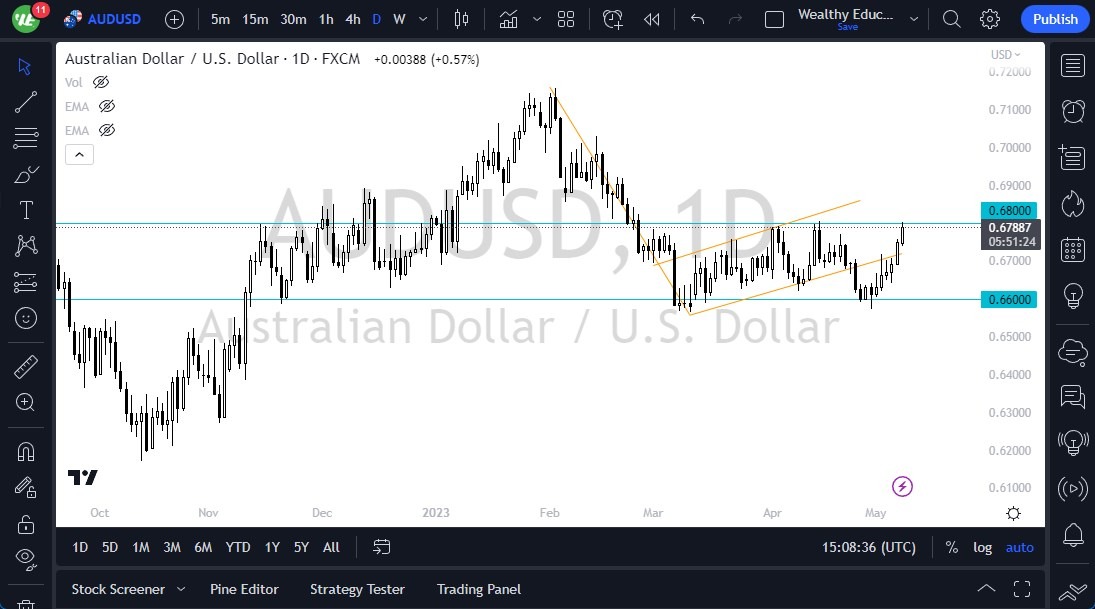

- The AUD/USD has seen a significant rally in Monday’s trading session, reaching the 200-day exponential moving average (EMA) just below the 0.68 level.

- This area was a significant resistance level in the past and will be a critical juncture for the currency going forward.

- Traders will be closely watching the next 24 hours to see whether the Aussie can break out, or whether it will show signs of weakness.

Recently, the market has been fluctuating between 0.66 and 0.68, and now that it is at the upper end of the range, traders will be paying close attention to what happens next. If the market can break above the 0.68 level, it could lead to a move to the 0.70 level. However, if the market falls from here, then a move down to the 0.67 level is very likely. This is where the 50-day EMA sits, and it is also the center of the consolidation range. A move below this level could take the market down to the 0.66 level, where it has recently bounced from.

It is important to keep in mind that the Australian dollar is highly sensitive to commodity markets, particularly to the Chinese mainland and its economy. China is Australia's biggest customer for raw materials, so any developments in that country will have a significant impact on the currency. Additionally, the Australian dollar is a gauge for risk appetite, as it reflects the desire to expand economically.

Pay Attention

Overall, the next 24 hours will be critical for the Australian dollar as it looks to decide about its future direction. If it can close above the 0.68 level convincingly, then it may be a good buying opportunity. However, if it begins to sell off again, it may be wise to sell the Aussie. The downside is somewhat limited based on the levels previously mentioned, so traders should be cautious but not overly concerned about potential losses.

Ultimately, the Australian dollar is in a state of flux and the direction it takes will depend on several factors, including commodity markets, economic developments in China, and risk appetite among traders. However, with the market making significant moves, traders should pay close attention to any developments and be prepared to act quickly to take advantage of potential opportunities. This pair could be a big mover over the next few candles.

Ready to trade our daily Forex analysis? Here's a list of the best brokers FX trading Australia to choose from.