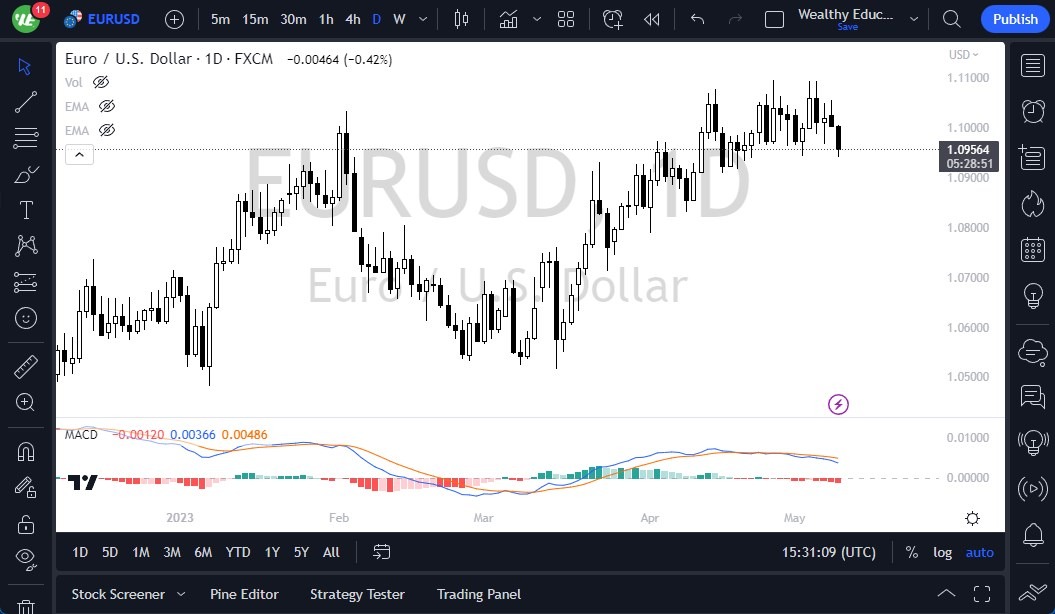

- The EUR/USD experienced a pullback during Tuesday's trading session as the market continued to exhibit a lot of noisy behavior.

- The 1.11 level remains significant, and many traders will pay close attention to it.

- If the market breaks above the 1.11 level, it is likely to continue going to the 1.1250 level, potentially unleashing a huge move higher.

- If this happens, it is likely to see a general US dollar selloff across the board, as we have seen recently.

However, if selling pressure continues, the 1.09 level is an area to watch closely, as the 50-Day EMA sits around that same area, providing some technical support. If the market breaks below the 50-Day EMA, the euro could continue to go much lower, reaching the 200-Day EMA at the 1.07 level. This would also include a general US dollar rally overall, as the euro is known as the “anti-dollar,” If the greenback increases in strength, the euro will continue to sell off as a secondary effect. The Federal Reserve will also have its say as the central bank continues to see the need to remain tight with monetary policy, which can continue to provide at least some kind of support for the greenback.

The Market Remains Volatile

It is important to note that the Federal Reserve remains very tight with its monetary policy, which could put some gravity on the euro market, despite the consensus that the Federal Reserve is done raising interest rates. Monetary policy goes beyond interest rates, and the Federal Reserve will stay tight in other ways, such as running off its balance sheet. Furthermore, there is the question of whether the global economy will start slowing down, which typically drives up demand for US dollars as it is considered a safer asset.

While the euro market remains volatile, with traders paying close attention to the 1.11 and 1.09 levels. If the market breaks above the 1.11 level, it could continue to move higher to the 1.1250 level, while breaking down below the 1.09 level could lead to a move lower toward the 200-Day EMA at the 1.07 level. The Federal Reserve's tight monetary policy and the global economy's potential slowdown could put gravity on the euro market. Traders should cautiously approach the market and look for potential opportunities within the continued consolidation.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.