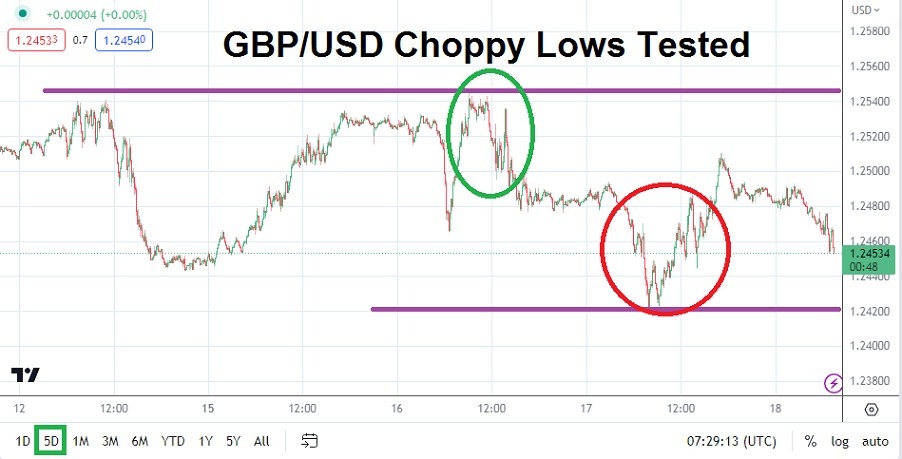

Economic data from the U.K. has not been fantastic. GDP numbers last week showed that U.K. growth statistics are facing recessionary pressures and this likely was the cause for the GBP/USD to quickly nosedive last week. However as this week of trading opened, financial institutions were also keenly aware that U.S. economic data isn’t particularly great either. And taking into consideration the bad outlooks on both sides of the Atlantic the GBP/USD has produced a rather choppy range the past handful of days.

Monday’s trading opened rather well and created a high of nearly 1.25350 which came in sight of Friday’s high – this before the GBP/USD cratered to 1.24425 nearly before going into last weekend. However, Monday’s trading dropped from the highs on early Tuesday and the 1.24650 mark came into sight before this week’s high thus far of approximately 1.25475 was attained a few hours later. In other words, price velocity has been abundant, as financial institutions show signs of nervous behavior which are causing uneasy price action.

Support Levels Proving Intriguing as Choppy Price Action is Demonstrated

Yesterday’s trading continued at a choppy pace and the GBP/USD fell to a low of nearly 1.24215, but the currency pair recovered and moved above 1.25100 briefly. The choppy saga for the GBP/USD did not end there because since hitting Wednesday’s high, the Forex pair has stumbled lower again and as of this writing is near 1.24450 which is within sight of intriguing support levels.

Financial institutions are dealing with nervous sentiment regarding the economic outlooks of the U.K and the U.S. However, this should have not come as a surprise to them, and day traders need to understand the choppy conditions are likely to continue near-term. However, support levels may look attractive as potential speculative spots to look for upside momentum to develop technically. The 1.24400 to 1.24300 support levels should be monitored. If the GBP/USD were to fall below the 1.24200 mark and sustain prices below this would be a surprise for many.

Lack of Significant Economic Data from the U.K and U.S Remainder of the Week

- While the Philly Fed Manufacturing Index and housing numbers will come from the U.S. today, this is likely to be more noise that is meaningless, unless a significant surprise in the data is delivered.

- The GBP/USD seems to be moving via behavioral sentiment generated from nervous market conditions for the moment and this is likely to continue and will produce more near-term choppiness.

GBP/USD Short-Term Outlook:

Current Resistance: 1.24590

Current Support: 1.24410

High Target: 1.24950

Low Target: 1.24250

Ready to trade our daily Forex analysis? We’ve made this UK forex brokers list for you to check out.