- The GBP/USD has experienced significant gains again during Monday's trading session as the US dollar continues to depreciate.

- The higher inflation rate in the United Kingdom has boosted the British pound, as the Bank of England is expected to maintain a tight monetary policy.

- This has led many traders to believe that the Federal Reserve will have to cut rates sooner rather than later, particularly as the United States is currently experiencing numerous banking issues from regional banks.

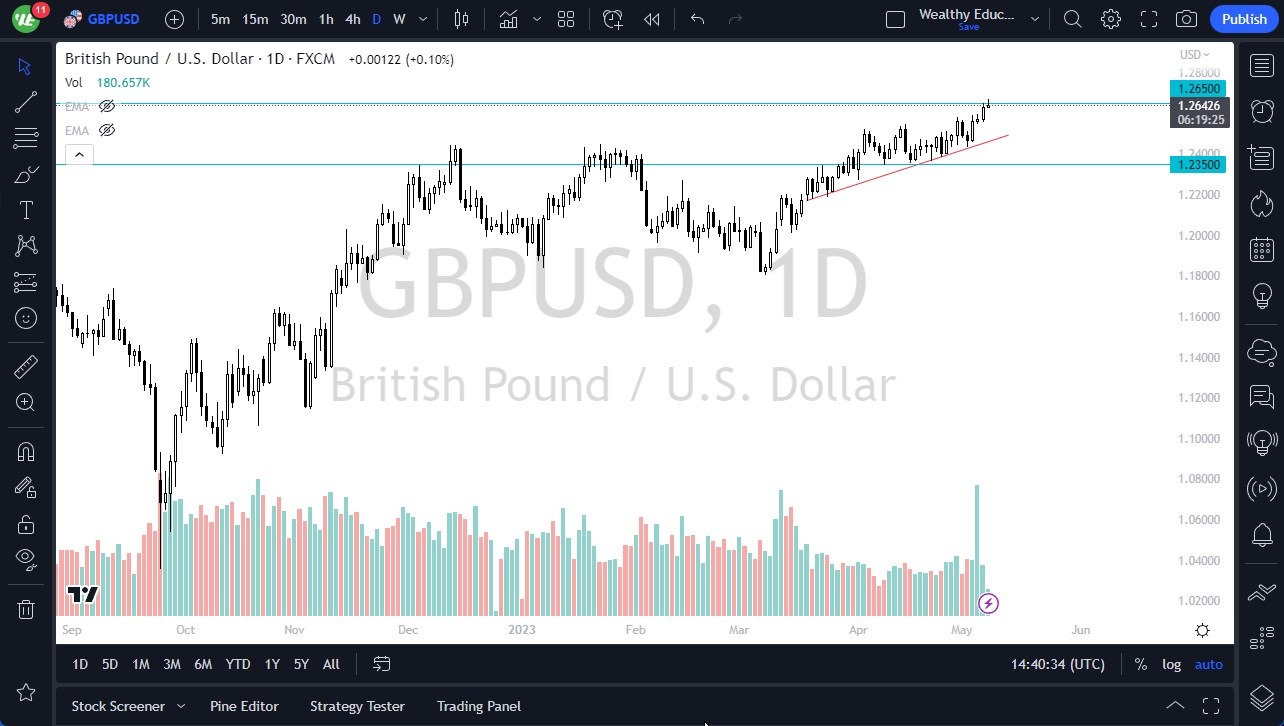

The 50-Day EMA sits at the 1.2350 level and is on the rise, with strong support at this level in the past. As such, traders will be closely monitoring this as a "floor in the market." The market is firmly in the "buy on the dips" category, and traders expect it to continue to expand. Although the 1.2550 level was previously resistant, it should provide enough support for any pullback.

As for going higher, the market is expected to reach the 1.2750 level, which was previously significant. Breaking above that level would enable the British pound to reach the 1.30 level, which is a significant psychological and round figure. Despite these positive signs, it's important to note that the market is highly volatile and there are several concerns regarding global growth and economic health. Any market unraveling could prompt traders worldwide to seek the US dollar.

Traders Expect the Market to Continue Expanding

It's also important to consider that the current market is not necessarily one that will shoot straight up in the air. Occasional pullbacks should be expected along the way, particularly as there are still a lot of questions regarding the global economy. However, traders remain bullish about the market's long-term prospects.

The British pound has been enjoying a positive run as the US dollar struggles. The Bank of England's tight monetary policy, coupled with higher inflation, has been key to boosting the British pound. Meanwhile, traders believe that the Federal Reserve will have to cut rates soon, given the current banking issues in the United States. As the 50-Day EMA continues to rise, traders will be closely monitoring this level as a potential floor in the market.

Overall, the market remains firmly in the "buy on the dips" category, with traders expecting the market to continue expanding. While there are occasional pullbacks, traders are optimistic that the market will reach the 1.2750 level and eventually the 1.30 level. However, given the market's volatility and global economic uncertainties, traders should remain cautious and anticipate occasional pullbacks along the way.

Ready to trade our daily Forex analysis? We’ve made this UK forex brokers list for you to check out.