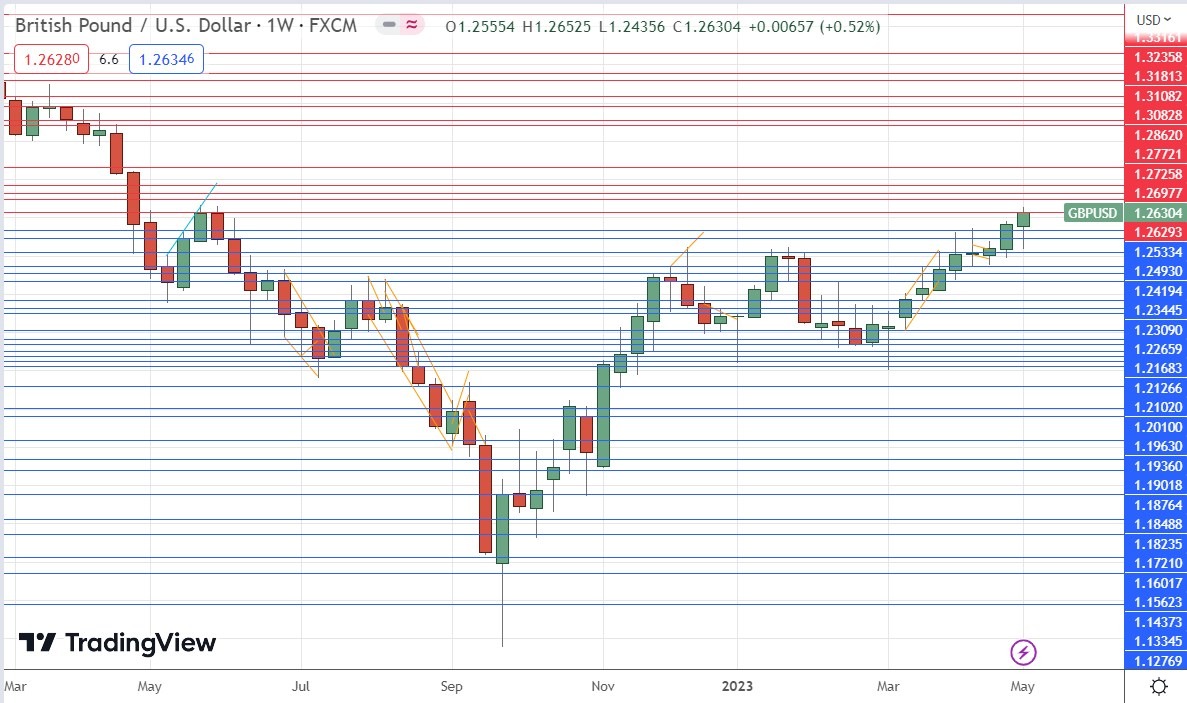

The GBP/USD will begin this week of trading near the 1.26300 level which essentially is near values seen in June of last year. Because of the King’s coronation celebrations financial institutions in the U.K. will be closed on Monday, but global Forex will continue and the GBP/USD will certainly still be traded. The rather remarkable climb of the currency pair to one-year highs last week is likely to get the attention of speculative bulls who may feel inclined to try and jump on the bandwagon, but short-term considerations should be given thought before a speculator trades blindly.

U.S Consumer Inflation and Sentiment Data are on the Schedule this Coming Week

The U.S. Federal Reserve delivered its much-anticipated interest rate hike of 0.25% on Wednesday. This Thursday the Bank of England is likely to raise its Official Bank Rate by 0.25% also. However, in the middle of this week, the U.S. will release CPI data which may cause a reaction in the GBP/USD if there are any harsh surprises. While the GBP/USD certainly moved according to the Fed’s ‘potential pause’ rhetoric delivered this past Wednesday, the possibility remains that higher-than-expected U.S. inflation numbers could bring about another hike to the Federal Funds Rate.

Consumer Price Index data should be given attention and if the number is higher than expected this would put the U.S. Fed in a rather ugly position. The ability of the GBP/USD to climb and sustain a value of over the 1.26000 level is significant, but short-term traders should be cautious for any volatility which may be produced this coming Wednesday. Also, the risk of escalated fear from a potential U.S. corporate banking sector crisis remains a concern in the coming week.

Steady Rise in the GBP/USD Still Faces Prospect of Natural Reversals Lower

- GBP/USD traders pursuing upwards momentum cannot be blamed, but a constant one-way avenue is not going to happen.

- Traders must brace for the potential of short-term cyclical reversals lower, which tests technical support, even if bullish behavior outweighs selling pressure in the long term.

The U.K will also release Gross Domestic Product numbers this coming Friday and the economic outlook is expected to remain challenging. The GBP/USD has been able to gain most likely based on the assumption the U.S Federal Reserve is going to have to turn dovish at some point. Last week’s Fed rhetoric however gave no clear answer regarding when a decrease of the Federal Funds Rate is going to take place. Inflation remains troubling in the U.S., and the Fed is in an uncomfortable position of potentially stubborn consumer prices and less than spectacular economic prosperity continuing. Optimistic GBP/USD traders should not be overly ambitious regarding their targets higher for the currency pair.

GBP/USD Weekly Outlook:

The speculative price range for GBP/USD is 1.24600 to 1.27080

Trading in the GBP/USD will be lighter than normal on Monday because of the U.K. banking holiday. However, volumes will remain significant enough to cause rather stable conditions because of global GBP/USD trading. If the GBP/USD can sustain the 1.26000 price level that would be fairly remarkable and potentially a solid signal that buying remains potentially strong regarding sentiment.

If the GBP/USD falls below the 1.26000 level and tests the 1.25800 mark, this still may not be a bearish indicator. Movements lower in the GBP/USD of significance may only happen if FOMC members in the U.S come out this week and say they still want to increase the Federal Funds Rate in June. A fall below the 1.25500 to 1.25100 mark would be surprising, but still not wildly out of consideration taking into account the rapid climb the GBP/USD has achieved lately.

Buying the GBP/USD on movements lower may look attractive for bullish traders who remain optimistic that upwards value will dominate. However, looking for a stronger climb past the 1.27000 ratio this week may be too ambitious, and many traders should be happy with quick hitting take profit targets while practicing solid risk management.