- Natural gas markets have been rather volatile recently, with a lot of back-and-forth behavior seen during Monday's trading session.

- Despite the rally, many analysts believe that the market is trying to form a bottom.

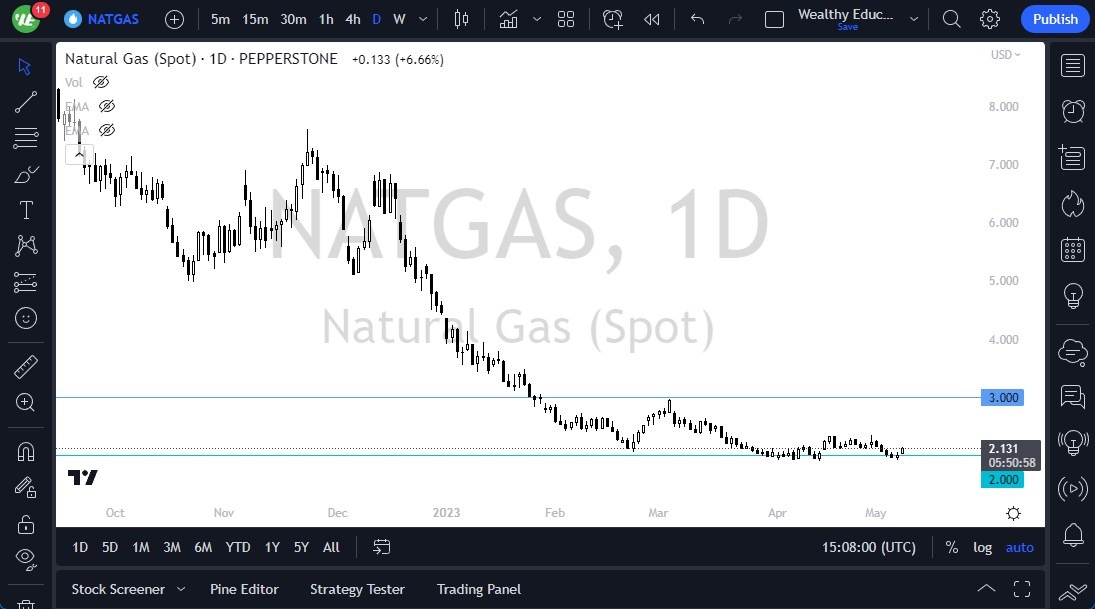

- The $2.00 level is currently seen as the key support area, with many buyers stepping in multiple times to prevent a further decline.

- Even if the market were to break below this level, there is expected to be strong support down to the $1.80 level, which is considered a significant "support zone".

However, just because a bottom may be forming, it doesn't mean that the market will suddenly stop selling off. Natural gas is expected to experience lighter demand during the summer months, except for a few heat waves. As a result, the market is likely to remain noisy and unpredictable throughout the summer.

Looking ahead, analysts expect to see the market attempting to build a basing pattern in anticipation of the Europeans needing to replenish their natural gas supply as the war in Ukraine continues. In terms of potential resistance levels, the 50-Day EMA is expected to act as a key resistance point, followed by the $3.00 level. However, a lot of patience will be needed to realize gains due to the uncertain timeline that the EU energy ministers will adopt, but the close we get to fall, the more likely it will be that natural gas picks up again.

Some Analysts Expect to See a Potential Recovery Later in the Summer

Many traders are looking for signs of exhaustion on any rallies, to start shorting again. With a lack of industrial demand due to the current state of the global economy, there seems to be little reason for natural gas markets to rally significantly in the near term. Some analysts expect to see a potential recovery later in the summer, likely around September, but between now and then, the market is expected to remain volatile.

At the end of the day, natural gas markets are experiencing a lot of back-and-forth behavior, but the market appears to be forming a bottom around the $2.00 level. However, traders are cautioned to be aware of potential resistance levels and to look for signs of exhaustion on any rallies to short the market. With a lack of industrial demand and a potentially slower global economy, natural gas markets are not expected to experience significant upward momentum in the near term.

Ready to trade our daily Forex forecast? Here’s a list of some of the best online forex trading platforms to check out.