Advertisement

Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

- Entering a buy deal with a pending order from the 19.30 level.

- Place a close stop loss point below the 18.99 level.

- Move the stop loss to the entry area and follow the profit with the price moving by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance levels at 19.50.

The best-selling entry points

- Entering a sell deal with a pending order from the 19.50 level.

- The best points for placing a stop loss close at the 19.65 level.

- Move the stop loss to the entry area and follow the profit with the price moving by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level at 19.05.

The TRY/USD stabilized unchanged during early trading this Thursday morning. Investors followed the decision of the Federal Reserve Bank, which raised the interest rate by 25 basis points during the meeting held yesterday. The Turkish lira was not affected by the strong movements witnessed by various markets with large movements in the price of gold, oil, and other major currencies, amid the continued control of the Turkish Central Bank over the price of the lira, which supports it by approving some measures that would provide support for the local currency before the upcoming elections in the coming days. The Turkish Central Bank had recorded the interest rate in the country during the past week, as part of its effort to keep the situation stable until the elections are passed.

It is mentioned that several international institutions have expected the Turkish lira to record losses in the post-election period, regardless of whether the ruling party is the winner or the opposition. The expectations also included that the interest rate in the country will be raised to near 40% levels before it will decline to about 23% by the end of this year. The latest data released this week revealed that inflation in the country had dropped to 43.68% during the month of April compared to 51% during March.

USD/TRY Technical Analysis

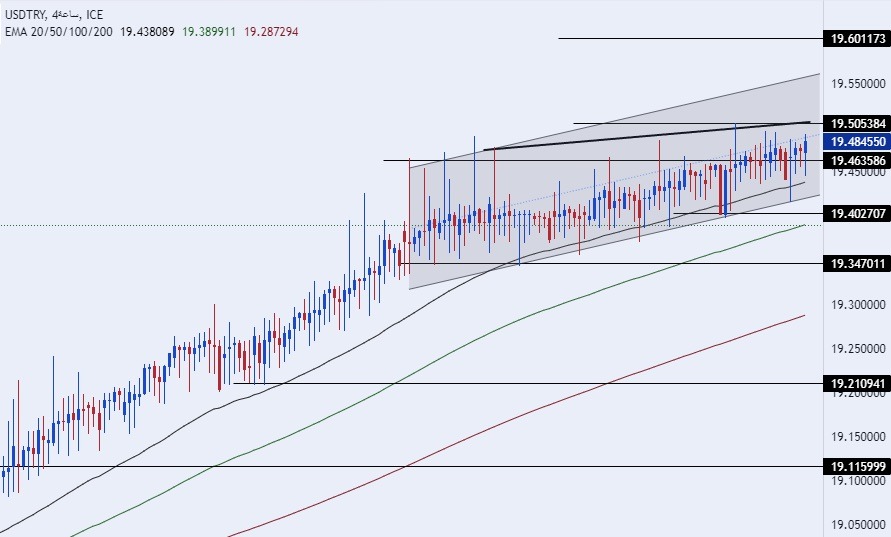

On the technical level, the dollar pair against the Turkish lira recorded a variation amid slight changes near the highest record levels it recorded during the beginning of the week, where the pair fell from a level of 19.50 lira per dollar. The dollar recorded a rise against the lira which is declining at a slow pace under continuous support from the Turkish Central Bank. At the moment, the pair has maintained its trading within the range of the ascending price channel on the four-hour time frame as shown through the chart, and the pair is trading above the support levels of 19.40 and 19.34 respectively.

On the other side, the price settles below the resistance levels of the correct number 19.50, and the levels of the correct number 20.00. The price is moving above the 50, 100, and 200 moving averages on the daily time frame, as well as on the four-hour time frame and the 60-minute time frame, indicating a strong general upward trend. Due to the difference in monetary policy and the economic situation in Turkey, any drop in the dollar against the lira represents an opportunity to buy back again. Please adhere to the numbers in the recommendation while maintaining capital management.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.