- The USD/JPY demonstrated a rally during Wednesday's trading session, maintaining upward pressure against the Japanese yen.

- This trend can be attributed to the Bank of Japan's yield curve control policy, which involves flooding the market with the Japanese yen if interest rates approach 50 basis points.

- As a result, the attractiveness of the Japanese yen diminishes for traders. The current market environment, therefore, comes as no surprise.

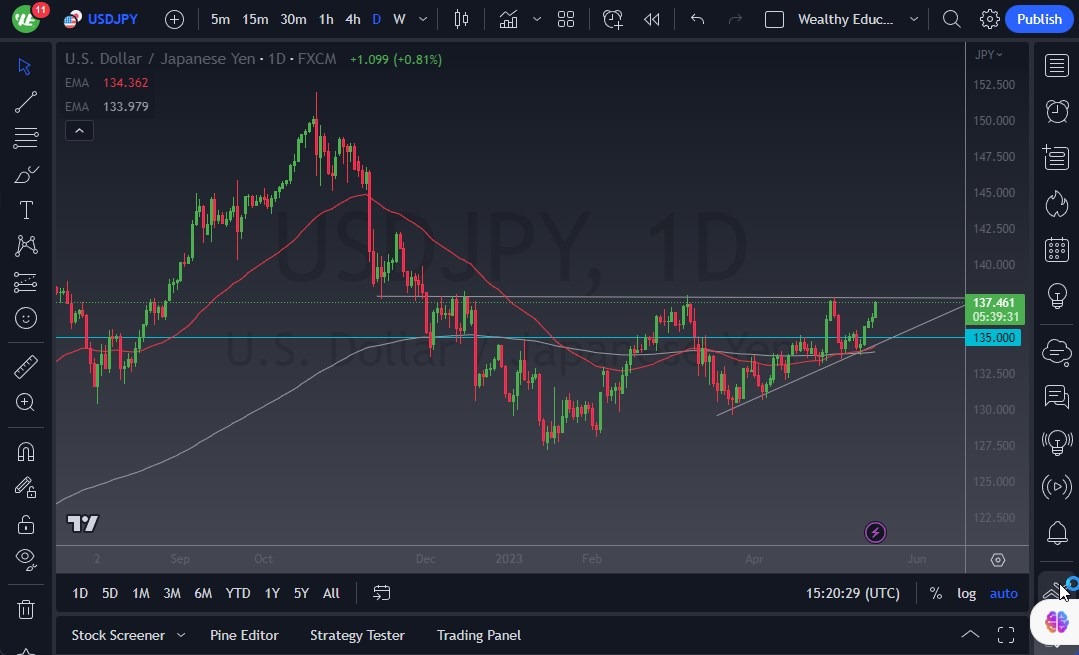

In this scenario, the market must determine its course of action, with significant attention focused on the ¥138 level. Breaking above this level would signify a breakthrough above the top of the ascending triangle pattern that has been forming for an extended period. Following this breakout, it is highly probable that the market will move toward the ¥148 level over the long term. However, this upward move is expected to take time rather than overnight. Despite my bullish stance, I acknowledge the possibility of short-term pullbacks that may present opportunities to enter the market. Once the breakout occurs, momentum is likely to increase. Nevertheless, it is important to note that the market will continue to be influenced by interest rate differentials, necessitating close monitoring of bond markets and central bank actions.

Attention is Focused on the ¥138 Level

Looking at the technical indicators, the 50-Day Exponential Moving Average (EMA) is trending higher, indicating a building momentum. Both the 50-Day EMA and the 200-Day EMA are positioned near the ¥135 level, which currently acts as the short-term floor in the market. However, global growth concerns will influence the US dollar's trajectory, resulting in expected volatility. Despite this volatility, it is evident that the market is inclined towards further upward movement in the future.

The US dollar rallied against the Japanese yen during Wednesday's trading session, driven by sustained upward pressure. The Bank of Japan's yield curve control policy, which involves flooding the market with Japanese yen to prevent interest rates from reaching 50 basis points, contributes to this market environment. Attention is focused on the ¥138 level, representing a potential breakthrough above the ascending triangle pattern. A successful breakout could lead the market toward the ¥148 level over the long term. While short-term pullbacks may occur, momentum will increase once the breakout occurs. Interest rate differentials will continue to play a significant role, requiring monitoring of bond markets and central bank actions. Technical indicators, such as the upward-trending 50-Day EMA, suggest building momentum. The ¥135 level currently serves as the short-term floor. While global growth concerns may introduce volatility, the market is inclined towards higher levels.

Potential signal: When the USD/JPY pair dips – buyers return. At this point, a breakout is imminent. A move above the 138 level on a 4-hour close offers a huge potential move. Stop loss at 136, targeting 141.

Ready to trade our free trading signals? We’ve made a list of the top 10 forex brokers in the world for you to check out.

Ready to trade our free trading signals? We’ve made a list of the top 10 forex brokers in the world for you to check out.