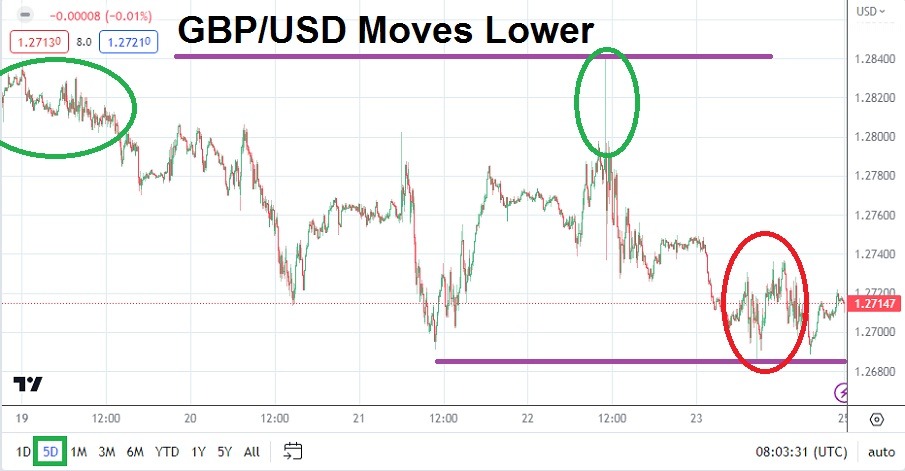

The Bank of England caused a momentary violent reaction for the GBP/USD this past Thursday with its higher than anticipated Official Bank Rate hike. Instead of merely raising borrowing costs by another 0.25%, the BoE turned extremely aggressive and added another 0.50%. The GBP/USD shot to a high of nearly 1.28430 briefly, but the spike did not last long and the Forex pair swiftly returned to a value below 1.28000 again.

Top Forex Brokers

However, the week’s surprises were not quite finished, because on Friday the Manufacturing and Services PMI data from the U.K. came in worse than expected. The GBP/USD started last week’s trading near the 1.28300 vicinities only to finish Friday’s session around the 1.27150 ratios. Traders who were anticipating the bullish momentum of the GBP/USD to start challenging the 1.29000 level last week likely walked away disappointed and perhaps a bit poorer.

UK growth Numbers will come via the Gross Domestic Product Results Late this Week

The 1.27000 level should be watched carefully by traders when the GBP/USD opens for trading on Monday. Before going into the weekend the GBP/USD briefly came within sight of the 1.26900 level, but reversed higher. Traders who remain bullish regarding the GBP/USD based on the notion the U.S. Federal Reserve is going to remain neutral regarding interest rate hikes should not get too comfortable.

The ability of the GBP/USD to launch higher on Thursday was intriguing based on the Bank of England’s surprisingly strong hike, but financial institutions also showed they are plainly dealing with the reality of stubborn inflation, weak growth, and unclear outlooks from global central banks. U.K ‘growth’ numbers will be released this coming Friday and are expected to show recessionary pressures abound. The GBP/USD is within an intriguing trading realm, the 1.27000 could prove to be important in the short term regarding a behavioral sentiment signal.

Additional Risk Events Ahead for GBP/USD Traders Early this Week

- The Russian political saga which erupted yesterday will continue to make news early this week, and could cause volatility for the GBP/USD upon opening on Monday.

- GBP/USD conservative traders should sit on the sideline early this week and see if calmer conditions develop after late last week’s price velocity, which produced choppiness and the potential for additional choppiness to come.

- The ECB banking forum this week will include BoE Governor Andrew Bailey who is scheduled to speak on Wednesday. He will certainly focus on inflation and recessionary data troubling the U.K. and other nations.

GBP/USD Weekly Outlook:

The speculative price range for GBP/USD is 1.26350 to 1.28100

Traders are likely to be cautious early this week as financial institutions seek risk-averse positions which may make the GBP/USD a bit volatile early on. Having broken below the 1.27000 level on Friday shows the GBP/USD remains vulnerable to potential downside price action, but it may also be looked at as an opportunity to buy the currency pair while seeking speculative momentum upwards.

If support near the 1.26900 level remains durable and financial markets turn calmer, the GBP/USD could begin to find price action that starts to test higher realms again. However, traders should not get overly ambitious and be aware that risk events surrounding Russia, and lackluster economic data from the U.K. will have their effects. Conservative trading should be practiced this week by speculators without deep pockets.

The Russia story, the ECB banking forum and GDP numbers from the U.K. will all factor into trading this week and cause volatility. The Russia situation may turn calmer, the ECB banking forum with the Bank of England attending may produce tranquil rhetoric focused on inflation, and growth numbers from the U.K are already anticipated to be lackluster. Meaning the GBP/USD could find a ‘floor’ on which to build off and move higher if risk appetite and outlooks turn slightly optimistic again. Looking for resistance to be challenged near the 1.27400 to 1.27600 would be a good start for GBP/USD bullish speculators. Solid risk management is definitely needed this coming week.