Top Forex Brokers

EUR/USD

The EUR/USD had a slightly positive week, but at this point, it seems as if we are hanging around the 50-Week EMA, and then, of course, the market will have to pay close attention to the 1.08 level above. Underneath, the 1.06 level is offering support, so we have a short-term consolidation phase. However, this market is one to leave alone until we get through the week, as we have both the Federal Reserve and the European Central Bank making interest rate decisions within 24 hours of each other.

GBP/USD

The GBP/USD initially pulled back during the trading week to reach the 1.2350 level before shooting straight up in the air. At this point, the market looks as if it will test the 1.2650 level above, which has shown itself to be important multiple times. If the market breaks above there, then it’s very likely that the British pound will continue to go much higher, perhaps reaching the 1.30 level. On the other hand, the 1.2650 level offering enough resistance to turn the market around might make this market continue to consolidate in general.

Gold

Gold markets have shown a little bit of strength during the course of the week, but we continue to go back and forth, as we have seen multiple times over the course of the last couple of weeks. Ultimately, the $2000 level above could be the target, but breaking above that opens up the possibility of moving to the $2050 level. If the market were to turn back around, the gold market could drive down to the $1900 level rather quickly, perhaps testing the 50-Week EMA rushing toward that area yet again

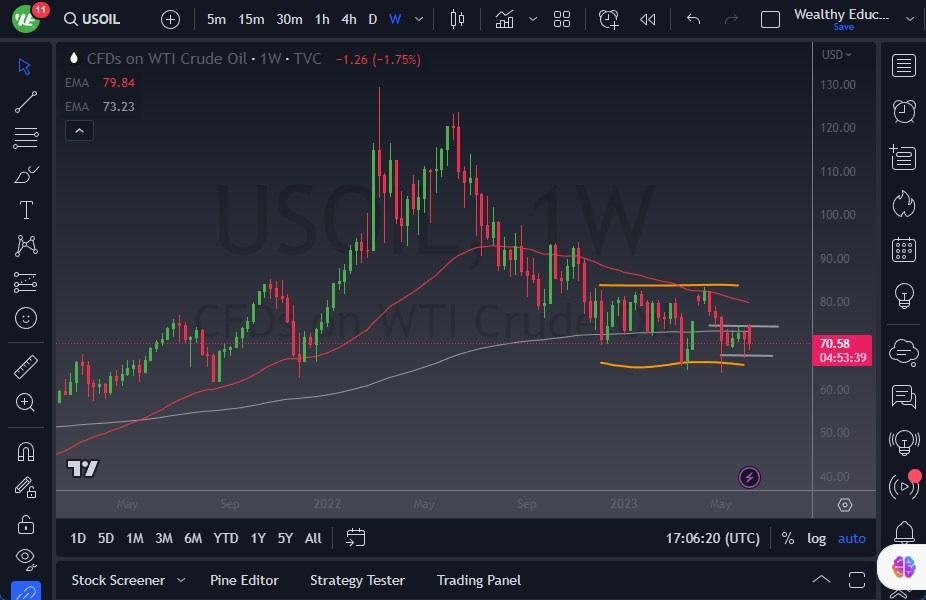

WTI Crude Oil (US Oil)

The West Texas Intermediate Crude Oil market had a negative week, but we are still very much wrapped in a tight week. This is interesting, considering that the Saudi Arabian decision to withdraw 1 million barrels of production voluntarily has had little effect on the market once it is all said and done. Ultimately, I think this market continues to go sideways over the summer, as we are now settling into the “summer range” that we see quite often. Range-bound trading will continue to be a major factor in this market, with the $67.50 level underneath offering support and the $80 level above offering resistance.

USD/JPY

The USD/JPY has had a slightly negative week, but it looks as if we have plenty of support underneath, especially near the ¥138 level. The ¥138 level was the previous resistance in the ascending triangle, and therefore, I think it makes sense that we would see “market memory” in this neighborhood. Regardless, the Federal Reserve meeting next week could significantly influence where we go next as the Bank of Japan continues its yield curve control. Ultimately, this remains a “buy on the dip” situation.

AUD/USD

The AUD/USD had a stellar week, as it looks like it is trying to get to the 50-Week EMA and of course, the 0.68 level. The 0.68 level has been important resistance in the past, so the market is trying to get to that level to retest it as a barrier. If the Aussie breaks out above there, we could see it go looking to the 0.70 level. On the other hand, if we find that level too difficult to overcome, we may reenter the consolidation that we had seen between the 0.68 level at the top and the 0.66 level at the bottom from a few months ago.

NASDAQ 100

The NASDAQ 100 had initially pulled back during the week but found plenty of buyers to turn things around. By the end of the week, we are forming a hammer-shaped candlestick, suggesting that we could return to the previous resistance barrier at the 15,250 level. Short-term pullbacks continue to get bought into because we are in the midst of a major “FOMO market.” 13,750 underneath should be a bit of a floor in the meantime. Expect a lot of volatility, but it’s obvious that the buyers are very much in control of this market.

Bitcoin

Bitcoin has fallen during the week but is testing the 200-Week EMA along with the 50-EMA. The $25,000 level seems to be supported, while the $30,000 level seems to be resistant. It is more likely than not going to be a market that sees buyers jump into it this coming week, but I would not anticipate some major breakout. That being said, be very well aware that the Federal Reserve has a meeting this coming week, and if they do something somewhat drastic, it could have a major influence on Bitcoin measured against the US dollar.