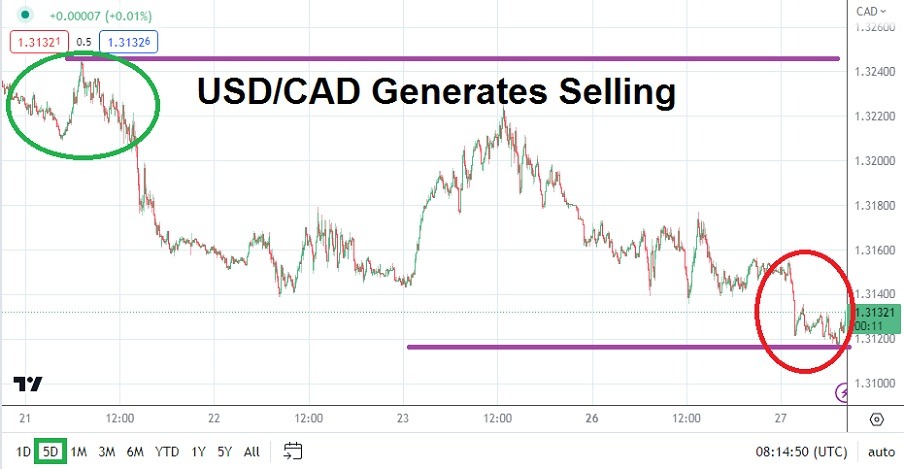

The past four weeks of trading in the USD/CAD have found a solid trend downwards. The current value of the USD/CAD is near 1.31360 vicinities. A low only a few hours ago, touched the 1.31175 ratio, a mark which had last been seen in the second week of September 2022. The trend lower in the USD/CAD has continued to make support appear vulnerable, even as the U.S. Federal Reserve appears to be threatening another interest rate hike in late July.

Top Forex Brokers

Important Inflation Data Coming from Canada Today via the CPI

Consumer Price Index readings will come from Canada in a few hours and USD/CAD traders should pay attention to the results. Inflation numbers are anticipated to remain elevated but show a slight decline from the previous month’s results. If there is a surprise higher outcome via the CPI data this could fuel additional selling of the USD/CAD. The reason why a stronger-than-anticipated inflation number might help selling momentum is because it will cement the notion the Bank of Canada may have to remain more aggressive regarding its interest rate policy.

The Bank of Canada has already let it be known they are likely to raise their Overnight Rate in July, which has likely helped sustain a rather consistent bearish sentiment for the USD/CAD. Short-term traders should be braced for today’s CPI outcome. If the number is weaker than expected this may have the effect of creating some buying power within the USD/CAD near-term. The USD/CAD has been demonstrating a solid bearish trend since late May when the currency pair traded near a high of 1.36500.

Contrarians in the USD/CAD Should be Careful Betting against the Trend

- Experienced traders who like to bet against trends and look for reversals may be tempted to do so within the USD/CAD, but they should be careful and they may want to wait for today’s inflation reports to be published.

- The U.S. will publish Gross Domestic Product numbers on Thursday and the growth statistics will also affect near-term sentiment in the USD/CAD.

The trend has been strong in the USD/CAD the past handful of weeks and traders should be careful betting against the momentum. Yes, reversals higher certainly can and will materialize in the USD/CAD, but timing when this will happen can be challenging. Today’s CPI data will have an impact on the USD/CAD if there are any surprises. Support has proven vulnerable consistently in the USD/CAD the past four weeks and looking for additional moves lower may not be a bad wager in the short term, but risk management is definitely needed.

Canadian Dollar Short-Term Outlook:

Current Resistance: 1.31425

Current Support: 1.31230

High Target: 1.31600

Low Target: 1.30940

Ready to trade our daily Forex forecast? Here’s some of the best regulated forex brokers in Canada to check out.