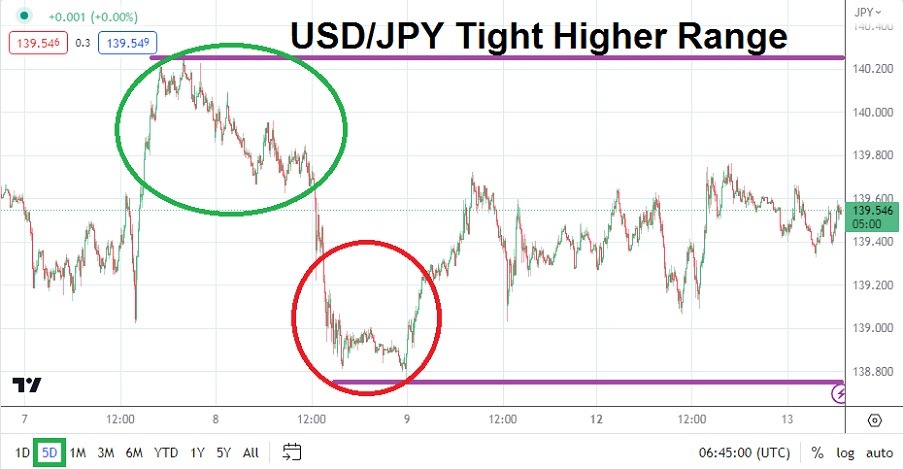

A rather cautious higher price range in the USD/JPY has made itself clear in the past week of trading. In fact, it can be argued the USD/JPY has experienced a rather consolidated higher value since the 25th of May. Day traders may be getting hit with plenty of volatility based on the amount of leverage they are using and the targets they pursue, but for financial institutions, the upper realms of the USD/JPY have been rather consistent over the past three weeks.

Top Forex Brokers

A conservative approach by some of the world’s most sophisticated traders is being seen in the USD/JPY because of U.S. Federal Reserve’s FOMC policy announcement coming tomorrow. But this is not the only risk event on the calendar in the short term. Today the U.S. will release its Consumer Price Index statistics and these inflation numbers will either make traders more nervous or calmer in the next handful of hours.

Weaker inflation results from the CPI data will put financial institutions in a more comfortable spot and allow them to believe the U.S Fed will not raise its Federal Funds Rate tomorrow. A stronger-than-expected inflation number might not cause a Federal Reserve increase tomorrow of interest rates, but it will certainly lead to a warning that additional hikes could take place in the mid-term.

The Height of USD/JPY is Not New and Could Grow More Volatile

The current price range is demonstrated in the USD/JPY is touching highs not seen in six months. As of this writing the USD/JPY is trading near the 139.500 vicinity with seemingly rather comfortable results being displayed. Traders should not expect this to last; the consolidation of the USD/JPY could break over the next handful of hours and certainly tomorrow.

The risk events from the U.S coming will shake all of Forex and the USD/JPY. Financial institutions may have positioned for current conditions, but their outlooks are unclear. Clarity if delivered by tomorrow night could cause momentary nervous reactions. On the 22nd of November 2022, the USD/JPY was trading near the 142.100 level.

USD/JPY Reactions Should be monitored to Learn and Gain Perspectives

- After falling below the 130.000 ratios briefly on the 24th of March, the USD/JPY has incrementally climbed higher.

- Day traders may be tempted to believe the buying in the USD/JPY will cease and the pair may begin to reverse lower, but they should be careful and use solid risk management with stop losses.

- An aggressive-sounding U.S. Fed tomorrow could spark buying of the currency pair in the near term. Nothing is guaranteed and traders need to be prepared for fast conditions.

USD/JPY Short-Term Outlook:

Current Resistance: 139.890

Current Support: 139.250

High Target: 141.100

Low Target: 138.700

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.