Top Forex Brokers

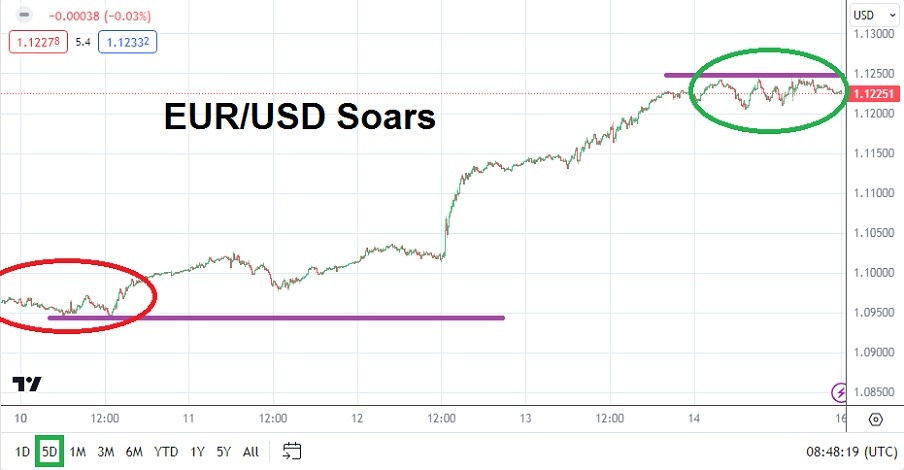

EUR/USD traders who were fortunate enough to be on the correct side of the upwards price direction of the currency pair last week are likely enjoying the weekend. The EUR/USD began the last week of trading near the 1.09460 ratio, but incrementally climbed upwards and built up a significant amount of bullish behavior. Economic data from Europe has continued to make the European Central Bank voice aggressive interest rate rhetoric, while U.S inflation data produced a less than anticipated gain.

By late Monday and Tuesday of last week the EUR/USD began to flirt with the 1.10000 ratio, and on Wednesday after showing the higher value could be sustained, started to develop increased buying. By late Wednesday the EUR/USD penetrated the 1.11000 ratio and for the remainder of the week did not look backwards. Thursday saw highs of nearly 1.12290 and on Friday the EUR/USD continued to see financial institutions remain active buyers. The EUR/USD will begin its trading tomorrow near the 1.12250 ratio.

Technical Perspectives in the EUR/USD and Timeframes to Consider

On the 1st of June the EUR/USD was trading near the 1.06800 level. If long term charts are pulled out it starts to become clear the EUR/USD has enjoyed a strong bullish run higher since August of last year. However, the day to day trading results of speculators has certainly not been a one way avenue higher, because intraday changes in value and leverage often knock day traders out of the game even if they know what the correct perspective is for the EUR/USD.

The ability of the EUR/USD to show price velocity last week, which returned the currency pair to values not seen since February of 2022 can teach traders how sudden changes to behavioral sentiment affects Forex. The EUR/USD went into this weekend above the 1.12000 with solid momentum and some short-term speculators may be dreaming of the 1.13000 to 1.15000 levels now, but those values would be dangerous targets for day traders to pursue blindly.

ECB President Christine Legarde Speaking on Monday

- ECB President Legarde will deliver a message to an ECB conference this Monday.

- On Wednesday Consumer Price Index data will come from the E.U. Inflation readings remain troubling in Europe and a stronger than anticipated outcome could continue to cause bullish momentum in the EUR/USD to occur.

- The U.S releases manufacturing and retail data this week. The U.S Fed monetary policy remains under the microscope.

- While a Federal Funds Rate increase is expected at the end of July, some traders believe the U.S central bank will be forced to become less aggressive in the mid-term.

EUR/USD Weekly Outlook:

Speculative price range for EUR/USD is 1.10790 to 1.14260

Looking for more upwards momentum may be asking a lot from the EUR/USD considering the results of last week, but the trend has tended to be bullish. Last week’s strong price velocity upwards was extraordinary and day traders should not expect the EUR/USD to be able to maintain this type of price action. Reversals lower in fact can happen and traders must use risk management wisely to make sure they are not being overly ambitious. Remaining realistic about targets is important for EUR/USD traders. Quick hitting tactics for traders who do not have deep pockets should be practiced.

If the EUR/USD is able to maintain the 1.12000 level early this week, this may be another bullish signal for the currency pair. The combination of U.S and E.U data this week will cause some volatility, but it is likely many financial institutions have positioned for the U.S Federal Reserve’s FOMC Statement on the 26th of July.

Trading conditions in the broad markets remains rather fragile, but there can be no denying that risk appetite seems to have increased. Traders looking for higher values in the EUR/USD should consider take profit targets that cash out winning positions if they materialize. The strength of the EUR/USD climb last week was noteworthy, perhaps price velocity will continue to be fast this week, but the currency pair could also begin to show equilibrium as financial houses brace for the U.S Fed in a week and half.

Ready to trade our weekly Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.

Ready to trade our weekly Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.