Top Forex Brokers

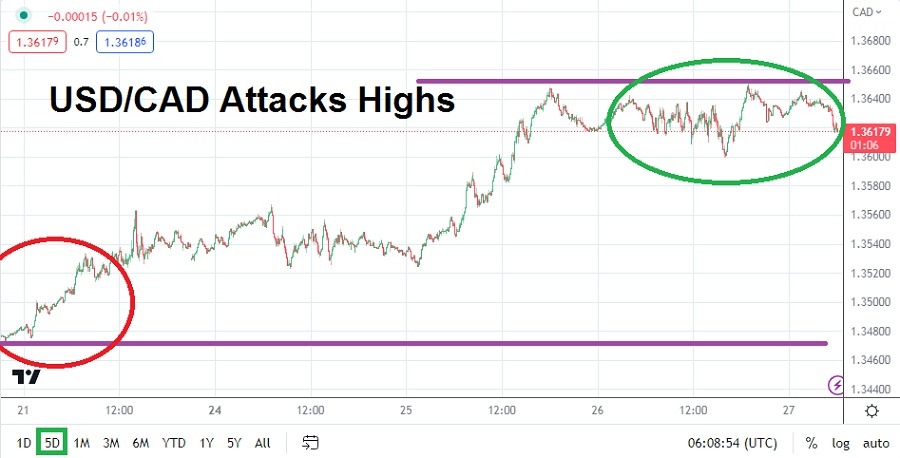

Speculators intent on trading today and tomorrow in the USD/CAD, before the U.S. central bank’s Federal Funds Rate and FOMC Statement pronouncements need to have solid risk management in place. The USD/CAD has delivered quick price action and traders can count on an increase in velocity within the next twenty-four hours of building. The USD/CAD remains near the lower price levels of its mid and long-term charts technically. Reversals higher however have also been abundant and strong.

The 1.31000 Level is acting as Durable Support for the USD/CAD

Inflation data from Canada last week via the Consumer Price Index numbers came in higher than expected. The USD/CAD has threatened to trade lower and is near the 1.31650 mark as of this writing. A low of nearly 1.30950 was touched last Friday but produced a reversal higher. The 1.31000 ratio remains attractive support, but day traders aiming for this value should not be overly ambitious, and be willing to cash out profits via selling positions before reversals upwards cause money to vanish. The range of 1.31000 to 1.32300 should be monitored in the near term.

Tomorrow’s News via the U.S Federal Reserve will create a Wide Range for USD/CAD Traders

- Traders wanting to participate in the USD/CAD today and tomorrow should be prepared for the price range of the currency pair to widen and test technical boundaries with sudden volatility.

- The Fed is expected to raise its interest rate by another 0.25% tomorrow, but it is the outlook of the FOMC Statement which will cause a reaction.

Traders need to anticipate the USD/CAD price velocity which will certainly increase over the next day as the U.S Fed’s decisions approach. The ability of the USD/CAD to incrementally trade lower and keep near important mid and long-term support levels is significant. If the USD/CAD continues to sustain prices below the 1.32000 mark in the short-term it may signal that financial institutions are positioned for a less aggressive FOMC Statement tomorrow.

The price of the USD/CAD has digested the interest rate hike into the value of the Forex pair already. Choppy trading will build over the next day and erupt into fast conditions, and traders need to have stop loss orders working if they choose to pursue the USD/CAD today and tomorrow. The last time the USD/CAD traded below the 1.31000 level in a sustained manner was in September of 2022. Traders need to stay realistic and not pursue price movement which could prove to be volatile particularly if they are using leverage.

Canadian Dollar Short-Term Outlook:

Current Resistance: 1.31820

Current Support: 1.31530

High Target: 1.32150

Low Target: 1.31175

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.