Top Forex Brokers

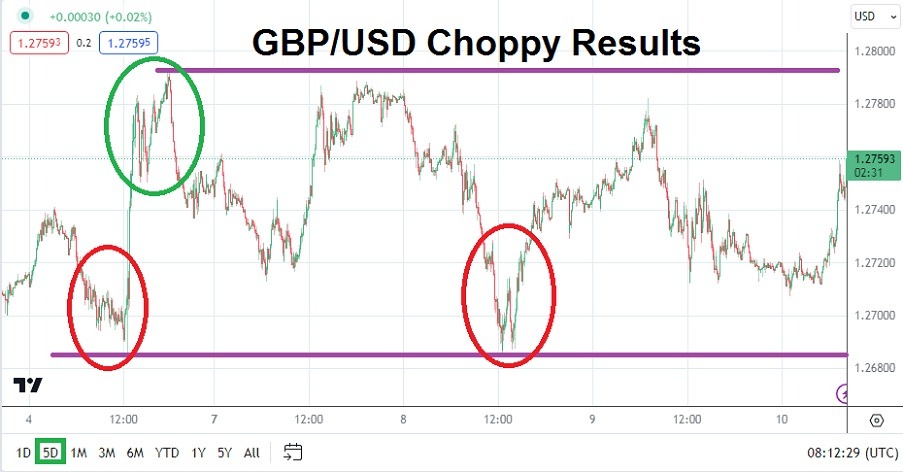

Traders who were starting to believe that calm conditions had returned to the GBP/USD the first three days of last week, were likely hit by rather strong choppiness from the Forex pair on Thursday and Friday. The GBP/USD will begin trading on Monday near the 1.26920 ratio, which is slightly above the lows it traversed early on Friday when it touched a depth around 1.26650. Speculators who were caught by surprise as the GBP/USD created volatility likely didn’t anticipate the economic data which was published the last two days of the week.

U.S. inflation numbers on Thursday came in near expectations, which helped the USD get weaker momentarily and the GBP/USD soared to a level of about 1.28185. However, this wave of good news for bullish traders of the GBP/USD didn’t last long and a reversal lower quickly ensued. On early Friday things got worse for traders looking for upside price action in the GBP/USD, as lows were sustained and any movement upwards was met with steady selling. UK gross Domestic Product numbers on Friday came in stronger than expected, which likely made financial institutions more nervous than they were already because of the mixed results regarding inflation interpretations.

U.S and U.K Data Creating Unclear Outlook for the GBP/USD

Technically the GBP/USD is trading near important lows, and the sudden tests of value beneath the 1.27000 level likely are getting the attention of speculators. The GBP/USD was not able to jump higher after low water marks were touched early Friday; the lack of a recovery that could not be sustained above 1.27000 should be closely watched when the currency pair trades on tomorrow’s opening.

This coming week economic data will be relatively light from the U.S. and the U.K., and traders will likely base their outlooks on information already gathered. The problem for GBP/USD speculators in the short and near-term is that sentiment appears mixed and timeframes along with expectations for the currency pair’s direction are likely skewed depending on which analyst is being asked.

The better-than-expected growth numbers from the U.K. could put the Bank of England in a position in which they may feel tempted to add another interest rate hike in the mid-term, but there are no guarantees. And the U.S. which saw inflation via the CPI meet expectations and also show a slight decline, then followed by Friday’s higher-than-expected PPI numbers. Meaning the Federal Reserve may not raise rates in the mid-term, but they are likely not going to sound dovish either.

Behavioral Sentiment and Risk Adverse Conditions Warning Signs

- The momentum downward in the GBP/USD has turned into a one-month trend. Behavioral sentiment continues to create a stronger USD across Forex and traders should be careful about trying to step in front of the trend without risk management in place.

- Traders looking for sustained moves upwards in the GBP/USD should likely not try to aim for overly ambitious targets, but feel relieved to be able to capture quick hitting moves that climb and hit realistic goals via take profit orders.

GBP/USD Weekly Outlook:

The speculative price range for GBP/USD is 1.26010 to 1.28150

Nervous trading conditions via the release of the U.S. and U.K. economic data last week were expected in the GBP/USD. The wide trading range for the currency pair late last week may become more comfortable in the days ahead, but traders should remain cautious. While the Empire State Manufacturing PMI will come from the U.S. this week, financial institutions will likely try to examine their longer-term expectations. The GBP/USD still may feel like it is oversold as it traverses below the 1.27000 mark. Traders looking for an upside cannot be blamed, but the trend lower should be a warning sign, and stop losses are highly encouraged.

Trading volumes remain high as always for the GBP/USD and its price action is being driven by technical factors, but also by fundamental outlooks which include rather murky rhetoric from the U.S Federal Reserve and Bank of England. Upside price action had been priced into the GBP/USD built upon the expectation the Fed would become less aggressive and the BoE could remain vigilant, which may have created an overbought currency pair one month ago. Also, current risk-averse trading because of U.S. downgrades to U.S. Treasuries has also created some headwinds in the short term. Betting on the upside from the GBP/USD remains attractive, but it needs to be acknowledged this is also a speculative perspective which may be too early still.