Top Forex Brokers

Bearish view

- Sell the EUR/USD pair and set a take-profit at 1.0650.

- Add a stop-loss at 1.0800.

- Timeline: 1-2 days.

Bullish view

- Set a buy-stop at 1.0765 and add a take-profit at 1.0850.

- Add a stop-loss at 1.0685.

The EUR/USD exchange rate was in a tight range as investors reflected on August’s inflation data. It was also flat ahead of the upcoming interest rate decision by the European Central Bank (ECB) and US retail sales numbers. The pair was trading at 1.0742, where it has been this week.

ECB interest rate decision

The EUR/USD pair moved sideways after the relatively strong US inflation data. According to the statistics agency, the headline Consumer Price Index (CPI) rose from 0.2% in July to 0.6% in July. On a YoY basis, inflation surged to 3.7%, the highest level in almost four months.

Core inflation also ticked upwards from a month earlier. It rose from 0.2% to 0.3% but slipped to 4.3% on a YoY basis. Inflation will likely continue rising now that crude oil prices are at an elevated level. WTI, the American benchmark, rose to $90 for the first time this year.

The US will publish the latest Producer Price Index (PPI) and retail sales numbers on Thursday. Economists polled by Reuters expect the data to show that the headline PPI rose from 0.8% to 1.2% in August. Core PPI is expected to come in at 2.2%, down from 2.4% in August.

These numbers mean that the Federal Reserve will likely deliver one more rate hike this year since inflation remains above the 2% Fed target.

The EUR/USD pair was also muted ahead of the latest ECB decision. This decision comes at a time when the euro has slipped against the US dollar and the European economy is struggling. Germany has contracted in the past two straight quarters.

Therefore, it is still unclear whether the ECB will hike rates or leave them intact. A likely situation is where it leaves them unchanged at 3.75% and points to more hikes in later meetings.

EUR/USD technical analysis

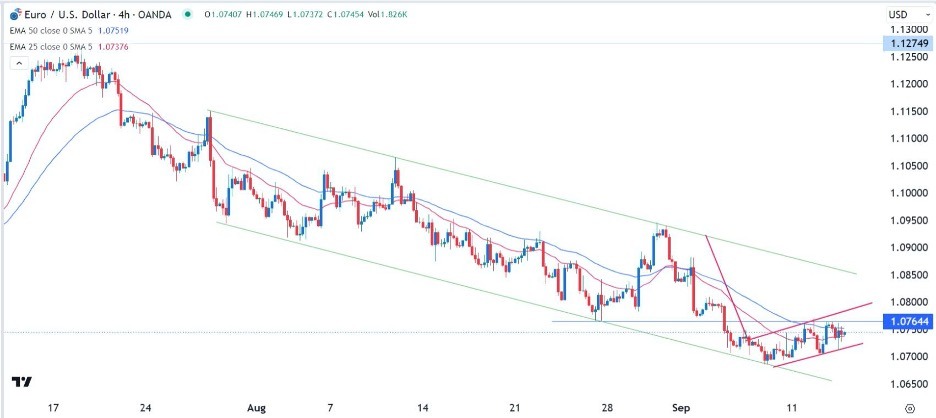

The EUR/USD pair has been in a muted phase in the past few days. It has remained below the important resistance level at 1.0764, the lowest swing on August 25th. The pair has also formed what looks like a bearish flag pattern, which is usually a bearish sign.

It is also consolidating at the 25-period and 50-period moving averages. Further, the pair has formed a descending channel. Therefore, the pair will likely have a bearish flag after the ECB decision. If this happens, the next key level to watch will be at 1.0650.

Ready to trade our daily Forex signals? Here’s a list of some of the top 10 forex brokers in the world to check out.