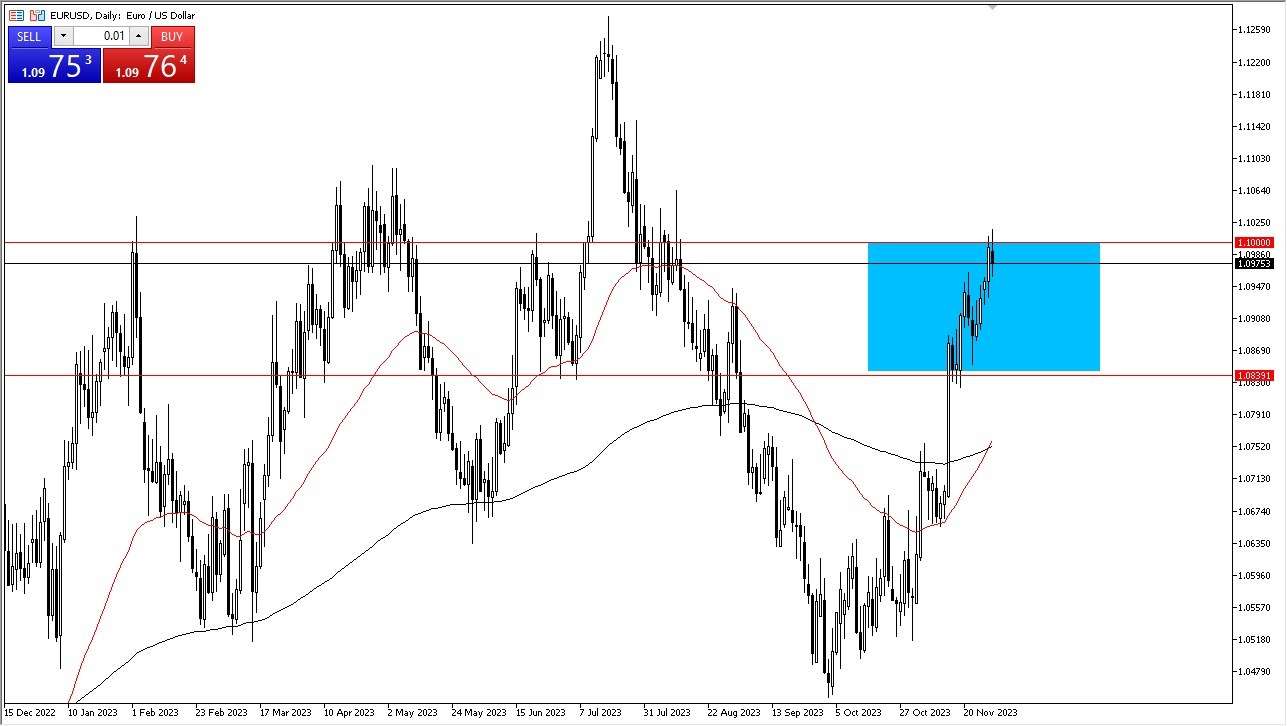

- After making an initial attempt to rally, the euro experienced a notable decline, steering the market towards bearish sentiment. Currently, there is a growing consensus that the market is positioning itself to target the 1.05 level below.

- This level, characterized by its roundness and psychological significance, is expected to attract a considerable amount of attention, leading to heightened volatility and what can be described as 'noisy' market behavior.

- This I think it something that we are stuck with at this point. To drive the point further, we have seen a recovery later in the day again. At this point, the markets don’t seem to know what to do.

Top Forex Brokers

The prevailing mood within the market seems to be one of negativity, though there remains a sliver of possibility that the currency may exhibit some resilience. However, should the euro succumb to the downward pressure and break below the 1.05 mark, this would pave the way for an even steeper decline, potentially taking it down to the 1.0250 level.

Historically, the 1.0250 level has acted as a support zone, offering a temporary support level to the falling euro. Nonetheless, it is crucial to recognize that this is not a strong support level, raising the likelihood of the euro continuing its descent to reach parity with the US dollar.

Be Vigilant

Conversely, if the market were to experience a dramatic shift in momentum, it could set the stage for an ascent towards the 50-Day EMA, currently situated around the 1.0650 level. Although the odds seem to be stacked against such a bullish reversal, it remains a scenario that traders should be cognizant of, keeping it in mind as a potential outlier.

At present, the market is exhibiting signs of breaking through the lower boundary of a bearish flag pattern, a development that is capturing the attention of traders and analysts alike. In these turbulent times, the US dollar continues to be perceived as a safe-haven currency, a reputation bolstered by the higher interest rates and the overall rising interest rate environment prevalent in the United States.

Taking a broader perspective, it is hard to envisage a scenario where the euro makes a substantial recovery for a sustained period, at least not until there is a significant shift in the monetary policies of either the European Central Bank (ECB) or the Federal Reserve. In summary, while the euro is navigating through a challenging period, marked by potential further declines and bouts of volatility, traders should remain vigilant, closely monitoring the key levels and market signals to make informed trading decisions.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.