Top Forex Brokers

Bearish view

- Sell the BTC/USD pair and set a take-profit at 36,000.

- Add a stop-loss at 37,900.

- Timeline: 1-2 days.

Bullish view

- Set a buy-stop at 37,100 and a take-profit at 39,000.

- Add a stop-loss at 36,000.

The BTC/USD pair retreated in the overnight session even as more institutions embraced cryptocurrencies. Bitcoin price retreated to a low of $36,770, which was a few points below last week’s high of 37,985.

CBOE Bitcoin futures

Bitcoin has done well in the past few months, helped by the ongoing concept of TradFi. TradFi refers to a situation where companies in traditional finance are embracing digital assets.

The most prominent of these companies are firms like Blackrock, Invesco, Fidelity, and Franklin Templeton, which have all applied for a spot Bitcoin ETF. If approved, these companies aim to attract billions of dollars from both retail and institutional investors.

On Monday, Cboe, a leading company in the financial services industry, said that it would launch trading and clearing in margin futures for Bitcoin and Ether. This launch will make it the first US regulated crypto native combined exchange and clearing house. It will support both spot and leveraged derivatives in a single platform.

Cboe joins CME to offer these futures. CME’s futures volume recently passed those of other companies like Binance, Deribit, and OKX.

Bitcoin also retreated in line with the performance of US equities. The S&P 500 index dropped slightly while the Nasdaq 100 fell by over 12 points. This performance happened as traders reacted to the warning by Moody’s, which warned about the soaring public debt and dysfunction in Congress.

There is also a rising possibility that the American government will shut down next week as Democrats and Republicans differ on the way forward. Democrats have rejected the proposal by Speaker Mike Johnson to keep the government open.

The next important catalyst for the BTC/USD pair will be the latest US consumer inflation data. Economists believe that inflation retreated slightly in October as the price of gasoline drifted lower.

BTC/USD technical analysis

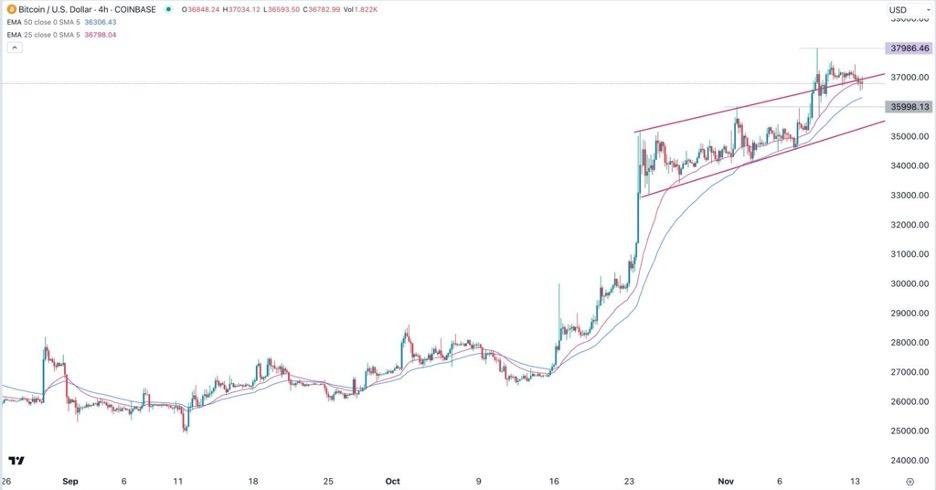

The BTC/USD pair peaked at 37,986 last week as demand continued soaring. It has now pulled back as some traders have started taking profits. Along the way, Bitcoin has moved back to the ascending channel, which connects the lowest and highest swings since October 24th.

Bitcoin has also remained above the 50-day and 25-day Exponential Moving Averages while the Relative Strength Index (RSI) has pulled back to the neutral point of 50. Therefore, the outlook for Bitcoin is bearish for now, with the next reference level being at 36,000, the highest swing on November 2nd.

Ready to trade our free Forex signals? Here are the best MT4 crypto brokers to choose from.