Top Forex Brokers

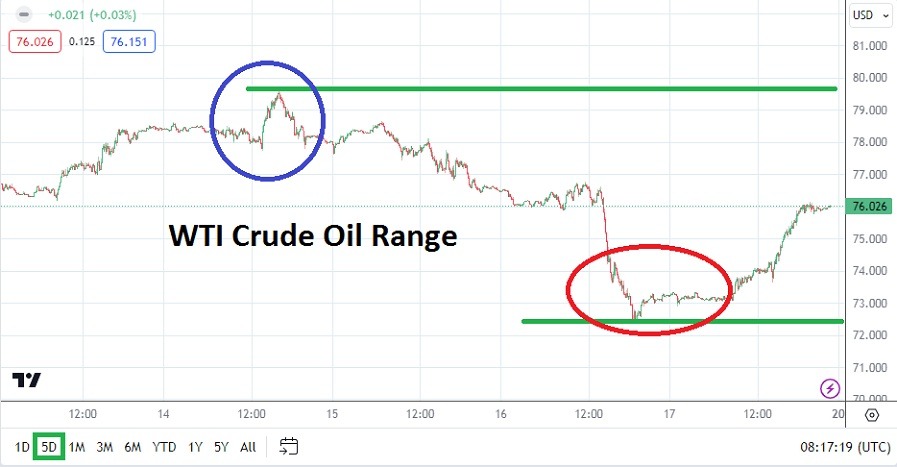

WTI Crude Oil went into this weekend near 76.026 via its cash price per barrel. The value of the commodity was able to come off a low on Thursday which saw WTI trade around 72.350 momentarily. The low for the week in oil hit depths not seen since the second week of July. Importantly however, WTI Crude Oil did seem to find solid price velocity higher after touching the lower value and finished Friday’s trading sustaining higher prices.

WTI Crude Oil finished last week’s trading roughly within the middle of its one week price range. The commodity hit a high around 79.650 on late Tuesday, but began to incrementally track lower from this near-term apex before touching Thursday’s lows. The price range of WTI Crude Oil proved to be rather durable last week, showing rather solid support while also demonstrating rather limited upside. This opens the door to intriguing considerations for the coming week.

Risk Adverse Sentiment Weakens and Risk Appetite Growth

Commodities as a whole have seen prices decline over the past few months among many major resources, this has occurred as a lack of demand has certainly gripped producers, but upticks have started to occur. Crude Oil is always needed and if economic conditions begin to stabilize internationally as the USD shows the potential to actually become weaker, allowing global manufacturers an opportunity to produce goods with better profit potential, this may spark some buying of energy resources over the mid-term. The support level of 72.000 USD was likely seen as important in WTI and if buying remains robust and sustains this price moving forward it could prove to be significant for bullish speculators.

- China is reportedly still taking a massive amount of Crude Oil from Iran. China’s economic numbers have shown more stability the past couple of weeks, which may mean demand from the Asia giant will prove important for the commodity.

- Risk-averse concerns globally seem to have been digested by investors for the time being, and risk appetite is showing signs of awakening. WTI Crude Oil may see some speculative buying based on the belief optimism is coming back into vogue within financial institutions.

WTI Crude Oil Range is Speculative Still

The price of WTI Crude Oil proved to be rather range bound last week as behavioral sentiment certainly ruled the trading landscape. Improving risk sentiment in global markets and spark potential large buyers to speculate on purchases of WTI Crude Oil with the belief demand will start to increase; this could prove attractive to day traders. However conditions should still be seen as potentially volatile and risk management is needed.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 72.400 to 83.100 USD.

Looking for upside in WTI Crude Oil continues to look attractive in the coming days. However, Friday’s surge higher after hitting lows may limit day trading momentum early this week, based on a fear a reversal lower could be seen early on Monday or Tuesday. Yet, if WTI Crude Oil sustains its value early this week it could set the table for speculative buying.

Traders need to remember there is a major holiday in the U.S this coming Thursday and trading volumes will start to drop on Wednesday. Thus, the major trading of the week may be seen early as positions are taken. Traders should keep their eyes open and watch the price of WTI Crude Oil on its opening Monday and early into Tuesday. Quick hitting trades which have realistic targets should be used. Looking for upside is intriguing and if the 76.000 level is maintained near-term, this could mean some upside may develop which aims for higher values by mid-week.