- Bitcoin demonstrated a mixed performance during the Thursday trading session, leaving market participants oscillating between bullish aspirations and concerns of potential overextension.

- While many are eager to propel the cryptocurrency to new heights, there is a growing sense that a pullback may be on the horizon, and such a correction could be seen as a welcome development.

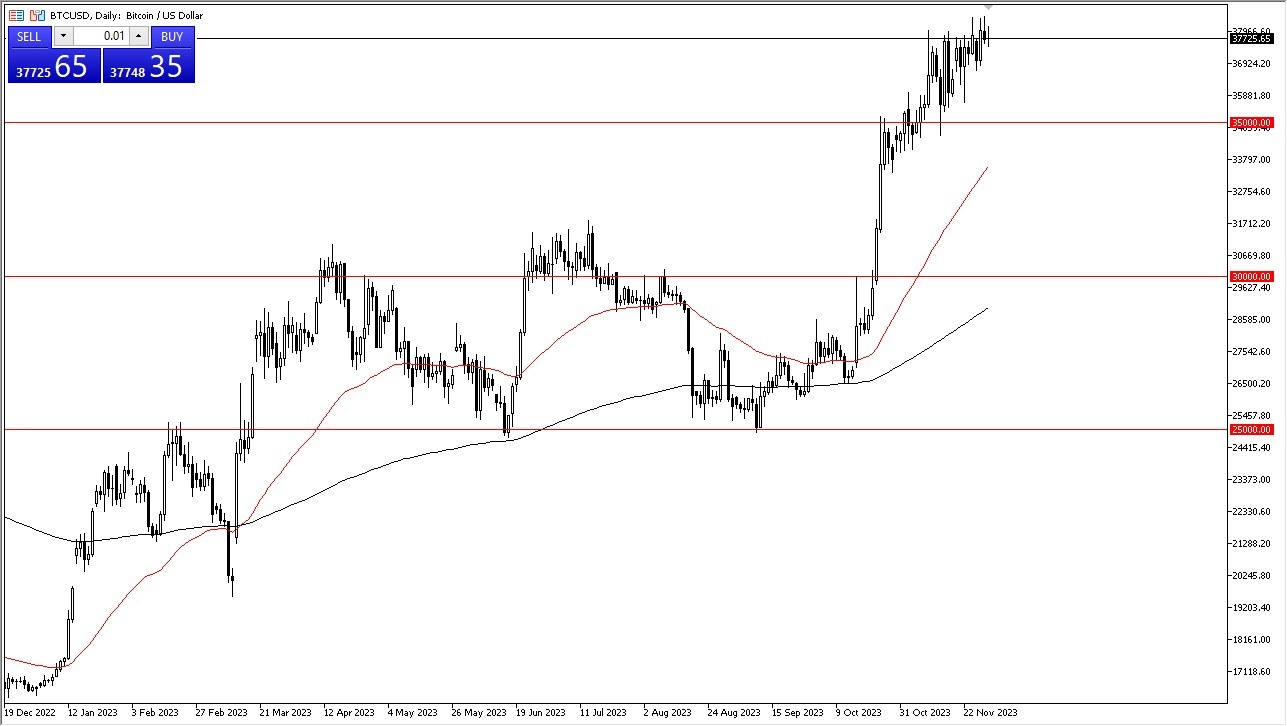

- Specifically, a descent to the $35,000 mark holds an enticing promise, one that could inject vibrancy into the market's dynamics.

Top Forex Brokers

The 50-Day Exponential Moving Average maintains its determined upward trajectory, positioning itself to intersect with the $35,000 level soon. Such a convergence of factors unquestionably presents a compelling case for potential buyers, warranting close attention.

Even Lower Levels of Support

Beneath the surface, the $30,000 level stands as another layer of support, although a dip to this threshold might result in the shaking out of some "weaker hands." It is crucial to recognize that Bitcoin's fate, especially in the eyes of institutional investors, hinges on the movements of interest rates in the United States. A decrease in these rates could potentially provide tailwinds for Bitcoin, offering support on its journey ahead. Nonetheless, the momentum in the cryptocurrency market has undeniably surged ahead of itself, prompting a need for a cautious approach.

A potential breakout to the upside would open the door to the formidable $40,000 level, a zone anticipated to unleash a robust wave of resistance. The breach of this level could potentially usher in significant shifts in the market's landscape, altering the established status quo.

In the broader context, adopting a "buy on the dips" strategy appears to be the most prudent course of action. Chasing rapid price movements in the cryptocurrency market has proven to be risky, considering Bitcoin's recent $8,000 surge over just a few weeks. The presence of institutional players in the market has reduced the likelihood of witnessing explosive 15% gains within a single day, unless accompanied by a substantial transformation in the economic backdrop. Thus, exercising patience and seizing opportunities when the market offers value remains the prevailing approach in the Bitcoin arena.

Furthermore, it remains paramount to monitor the bond market, as any indications of monetary easing could act as a catalyst for Bitcoin's further ascent. In the current landscape, staying attuned to both market dynamics and broader economic trends in the bond markets will be instrumental in determining Bitcoin's success.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.