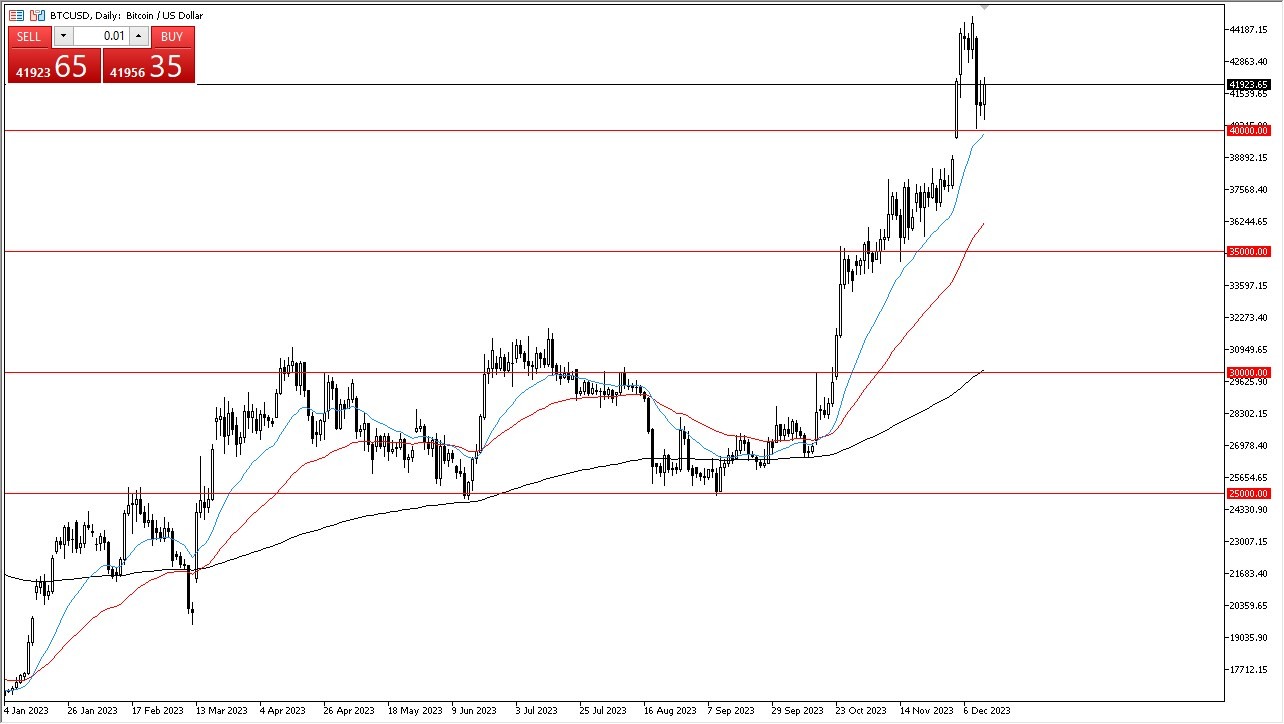

- The Wednesday trading session witnessed Bitcoin experiencing a noticeable decline, settling just above the critical $40,000 level.

- This movement is a reflection of the current market's sensitivity to various external factors, particularly the looming uncertainty around interest rates.

- The crypto community is eagerly awaiting more clarity on this front, with significant announcements expected within the next 24 hours. These updates are crucial as they directly impact investor sentiment and market dynamics.

Top Forex Brokers

The bond market, closely watched by investors, serves as a key indicator for the crypto markets. In environments where interest rates are high, cryptocurrencies like Bitcoin tend to underperform. Therefore, the financial decisions made in major economies such as the United States, European Union, Switzerland, and the United Kingdom are of paramount importance. They have the potential to cause significant fluctuations in the bond markets, which in turn can have a ripple effect on cryptocurrencies.

Despite the current uncertainty and volatility, the market is showing bullish tendencies. The $40,000 level is a significant psychological barrier for Bitcoin, attracting the attention of many investors. Even if the price dips below this mark, there is an expectation of strong support around the $37,500 level. Conversely, a surge above $42,000 could trigger a bullish rally, possibly leading the price towards $45,000 and then potentially to the $47,500 level. This latter figure is especially noteworthy, as it has historically been a pivotal point in longer-term price charts.

Buying on the Dips

The prevailing sentiment in the Bitcoin market is inclined towards "buying on the dips." This strategy involves capitalizing on temporary price declines as potential entry points for investment. Currently, the appetite for shorting Bitcoin is low, at least until the currency breaks below the $35,000 mark. A drop beneath this level could potentially lead to further declines, although this scenario is generally considered unlikely at this juncture.

Ultimately, the Bitcoin market is currently navigating a complex web of global economic influences and investor psychology. The anticipation of decisions on interest rates, the influence of the bond market, and inherent market tendencies all play a role in shaping the current landscape. Investors are advised to remain vigilant, keeping a close eye on the evolving economic indicators and market signals. The ability to swiftly adapt to changing conditions is key in the volatile and unpredictable world of cryptocurrency trading. This environment demands a balanced approach, blending cautious risk assessment with the readiness to seize emerging opportunities.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.