Bitcoin has been on a roll lately, and it doesn't seem like it's ready to slow down anytime soon. On Wednesday, the cryptocurrency continued its upward journey, showing a strong determination to keep climbing higher.

Top Forex Brokers

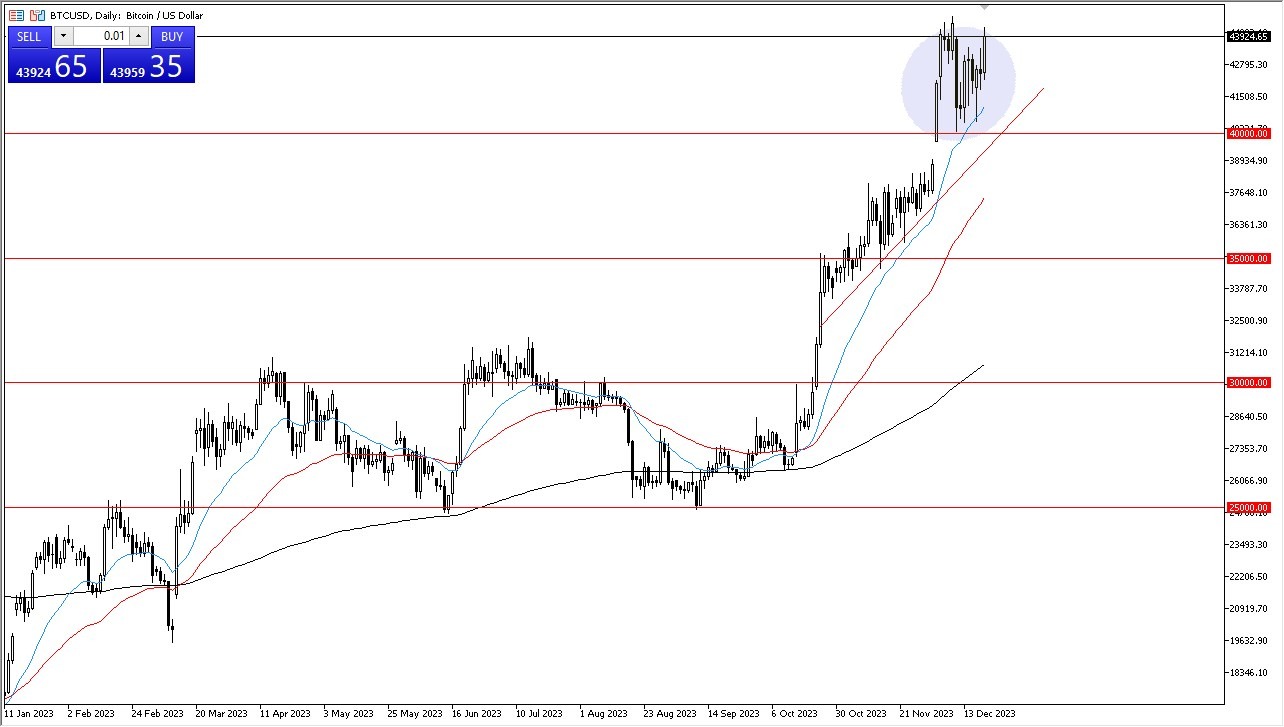

For a little while on Wednesday, the $44,000 level seemed to put up a fight, acting as a minor hurdle for Bitcoin's rally. However, it appears that Bitcoin is eyeing an even bigger target: the $45,000 level. This number holds a special place in the hearts of traders as it's a significant, round figure that carries a psychological weight. But the real prize, according to weekly charts, is set at $47,500, a formidable resistance level.

Beneath Bitcoin's bullish charge, the 20-Day Exponential Moving Average has been lending a helping hand, providing support when needed. Additionally, the 50-Day EMA is catching up with the price action, poised to offer further reinforcement. It's like having a couple of trusty friends by your side when you need them the most.

Upward Momentum

- This upward momentum in Bitcoin's price is likely to attract value-seeking buyers whenever the cryptocurrency experiences a dip.

- It's a bit like a rollercoaster ride – you know there will be ups and downs, but ultimately, the trend is upward.

However, one thing to keep in mind is that as we move forward, liquidity might start to dry up a bit, especially from an institutional perspective. This means that there might be fewer big players in the market, which could lead to erratic price movements. But, despite this, the general direction to look for is up.

The reason behind Bitcoin's resilience and upward trajectory can be traced back to central bank policies, particularly in the United States. The Federal Reserve has been easing monetary policies, flooding the markets with liquidity. When there's a lot of money sloshing around, investors tend to look for assets that offer better returns, and Bitcoin fits the bill.

So, as we navigate the cryptocurrency landscape, buying on the dips seems to be the strategy of choice for most investors and traders. It's a way to take advantage of temporary setbacks in Bitcoin's journey towards $47,500.

Breaking above that level will be no small feat and might take some time, especially with the potential challenges posed by the Federal Reserve's stance on monetary policy. Nevertheless, momentum is on Bitcoin's side, and it seems like it's only a matter of time before it conquers new heights. So, if you're wondering which way to bet on Bitcoin, the answer appears to be a simple one – bet on it going higher.

Ready to trade Bitcoin to the dollar? We’ve made a list of the best Forex crypto brokers worth trading with.

Ready to trade Bitcoin to the dollar? We’ve made a list of the best Forex crypto brokers worth trading with.