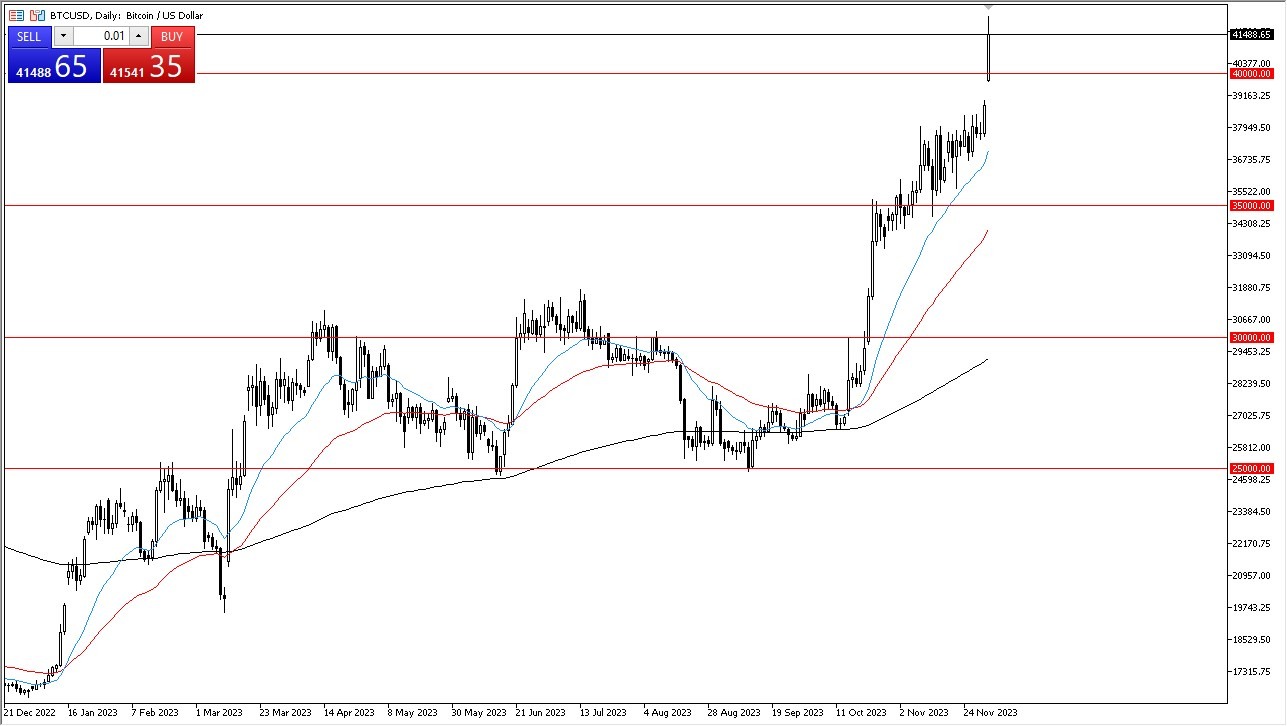

- During Monday's trading session, Bitcoin witnessed a remarkable surge, breaking through the critical $40,000 threshold.

- This increase is largely attributed to the widespread belief among traders that the Federal Reserve is likely to start reducing interest rates as soon as March. Additionally, the potential approval of Bitcoin ETFs by the SEC is expected to further drive demand for Bitcoin.

- Despite these optimistic forecasts, there remains uncertainty around Bitcoin's primary function beyond speculation.

Top Forex Brokers

From a technical analysis perspective, the momentum gained by Bitcoin suggests a continued upward trajectory following this significant breakthrough. The $40,000 level, which previously served as a resistance point, is now anticipated to become a major support level. This shift is underpinned by the concept of "market memory," indicating that traders may seize opportunities to re-enter the market at this level, recognizing it as a point of value.

Shorting All Buy Impossible

The current sentiment strongly discourages shorting Bitcoin. The 20-Day EMA, indicated in blue on the chart, is expected to provide short-term support and act as a market floor in case of any pullback. However, a significant pullback seems unlikely at this stage, and it is widely believed that Bitcoin will soon reach the $45,000 mark. Because of this, I am a buyer overall – right along with almost everyone else it seems.

The trajectory of Bitcoin is closely tied to interest rate movements in the United States. An increase in interest rates could potentially have adverse effects on Bitcoin's value. Currently, the bond market appears to be pressuring the Federal Reserve into rapid rate cuts, which, if realized, could channel more "cheap and easy money" into the cryptocurrency markets, fueling speculation and volatility. However, the forthcoming bull market in cryptocurrency may exhibit less intensity and volatility compared to previous ones, given the increasing involvement of institutional investors.

This analysis underscores the significant impact of macroeconomic factors, such as interest rates and market speculation, on Bitcoin's performance. The potential for Bitcoin ETFs and the role of institutional investors are key considerations in forecasting Bitcoin's market behavior and understanding its evolving landscape in the broader financial ecosystem. All of these things put together suggests that we are going to continue to see a lot of noise, but overall, a general situation where we go higher over time.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.