Top Forex Brokers

Bearish view

- Sell the BTC/USD pair and set a take-profit 38,000.

- Add a stop-loss at 43,000.

- Timeline: 1-2 days.

Bullish view

- Set a buy-stop at 41,300 and a take-profit at 43,000.

- Add a stop-loss at 39,500.

The BTC/USD pair retreated sharply as Bitcoin price lost its momentum and as traders started to take profits. Bitcoin retreated to a low of $40,000, its lowest level since December 4th. It has dropped by about 10% from the highest level this year.

Focus on Federal Reserve data

The BTC/USD pair has been in a strong bearish trend in the past few days as focus shifted to the latest US jobs data and the upcoming Federal Reserve decision. The sell-off started after the US published strong jobs numbers on Friday.

According to the Bureau of Labor Statistics (BLS), the economy created over 199k jobs in November while the unemployment rate dropped to 3.7%. Wages grew by 4% on a YoY basis.

Therefore, Bitcoin retreated as investors anticipated a more hawkish Federal Reserve when it concludes its meeting on Wednesday.

The Fed’s statement will likely depend on Tuesday’s consumer inflation data. Economists polled by Reuters expect the numbers to show that the headline CPI dropped from 3.2% in October to 3.1% in November. A stronger figure than expected will likely lead to a more hawkish tone by the Fed on Wednesday.

The BTC/USD pair also retreated as investors started to take profits since it has been in a strong bull run. It has risen by more than 30% in the past few weeks. In most cases, Bitcoin tends to retreat after having a strong rally.

Bitcoin’s rally has been driven by several factors recently. There have been hopes that the Fed will start to cut interest rates in the first half of the year. It has also rallied as hopes that the Securities and Exchange Commission will approve a Bitcoin ETF.

BTC/USD technical analysis

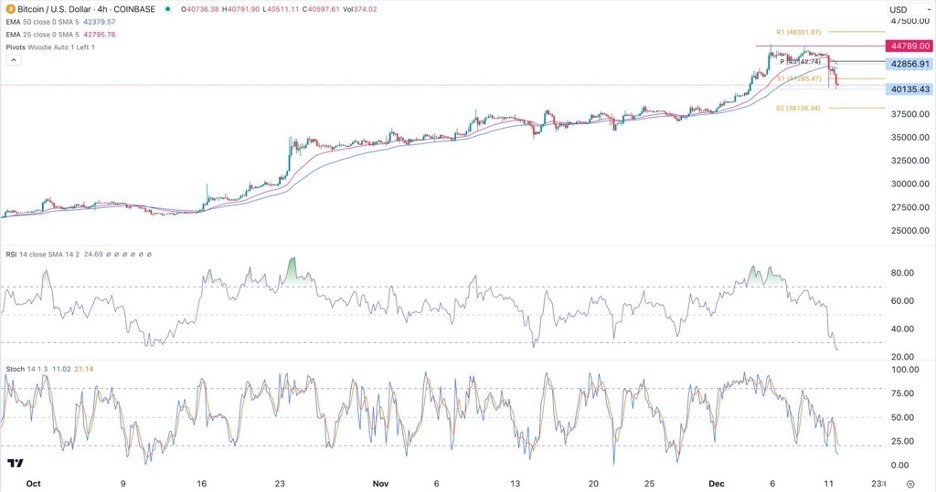

Bitcoin has pulled back in the past few days. It formed a double-top pattern at 44,790 whose neckline was at 42,856. In most cases, this pattern is one of the most bearish signs. Bitcoin has also crashed below the 50-period and 25-period moving averages.

Bitcoin has also dropped below the first support of the Woodie pivot point. The Relative Strength Index (RSI) and the Stochastic Oscillators have moved to the oversold level.

Therefore, the outlook for the pair is bearish, with the next point to watch being at the second support at 38,126. In the near term, however, Bitcoin will likely bounce back and retest the highest point this year.

Ready to trade our free Forex signals? Here are the best MT4 crypto brokers to choose from.

Ready to trade our free Forex signals? Here are the best MT4 crypto brokers to choose from.