The crude oil markets embarked on a notable rally during Friday's trading session, emblematic of the prevailing turbulence that has come to define this market over the past several weeks.

WTI Crude Oil

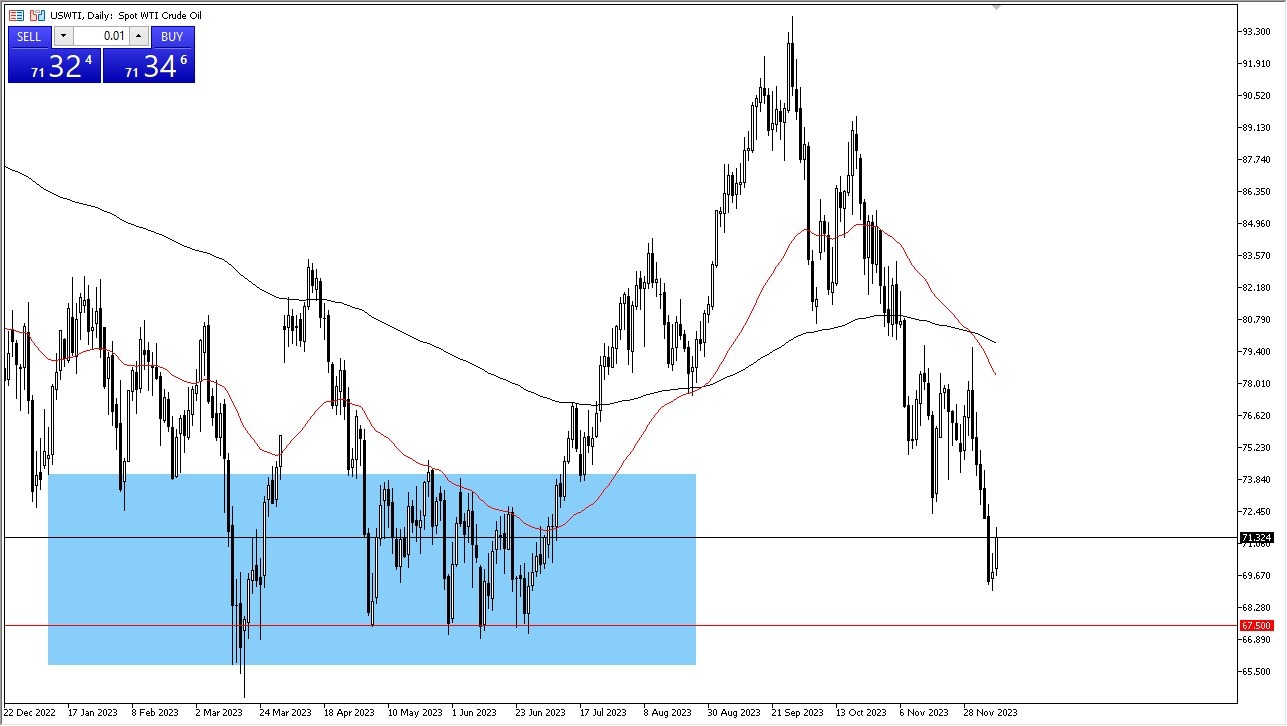

Crude oil markets exhibited a modest rebound on Friday, as they continued their recovery from a severe downturn. Nevertheless, this is not a scenario that appears conducive to chasing performance, and it seems increasingly likely that sellers will re-enter the market. A critical obstacle looms just overhead at the $72.50 level, an area of paramount significance owing to its previous role as a pivotal support. "Market memory" could well play a role in shaping market dynamics at this juncture.

As I mentioned previously, this market appears to be of the "sell the rallies" variety, and this notion seems to be playing out thus far. While there was an early rally on Friday, there remains a pervasive expectation of a global economic slowdown, a factor that casts a shadow over crude oil's value. If the sell-off persists, there is the potential for prices to decline as far as the $67.50 level.

Brent

Brent markets, too, experienced a modest rally during Friday's trading session, with an eye on the $77.50 level above. This level previously served as a significant support in the market and is likely to evoke "market memory," influencing market behavior. Presently, a preference for selling rallies appears to be the prevailing sentiment, with traders seemingly concurring, particularly towards the end of Friday's session. The rally may be attributed in part to the jobs report but may also reflect profit-taking by those who had short positions in the market.

It is important to bear in mind that the holiday season is fast approaching, with the accompanying reduction in market liquidity. In such an environment, crude oil can exhibit erratic behavior, posing risks for all involved. Accordingly, exercise caution in position sizing, while acknowledging that the market remains entrenched in a downward trend, gravitating toward underlying support levels.

Ultimately, the crude oil markets remain enmeshed in a state of volatility, typified by erratic movements and uncertainty. The rally witnessed on Friday is set against the backdrop of a broader trend that appears to favor selling rallies. The proximity of the holiday season adds an additional layer of complexity, with reduced liquidity potentially exacerbating market dynamics. In this context, prudence and astute risk management are paramount for those navigating this unpredictable terrain.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.