Top Forex Brokers

Crude oil markets are making concerted efforts to establish a foundation during the Monday trading session, extending their quest for stabilization.

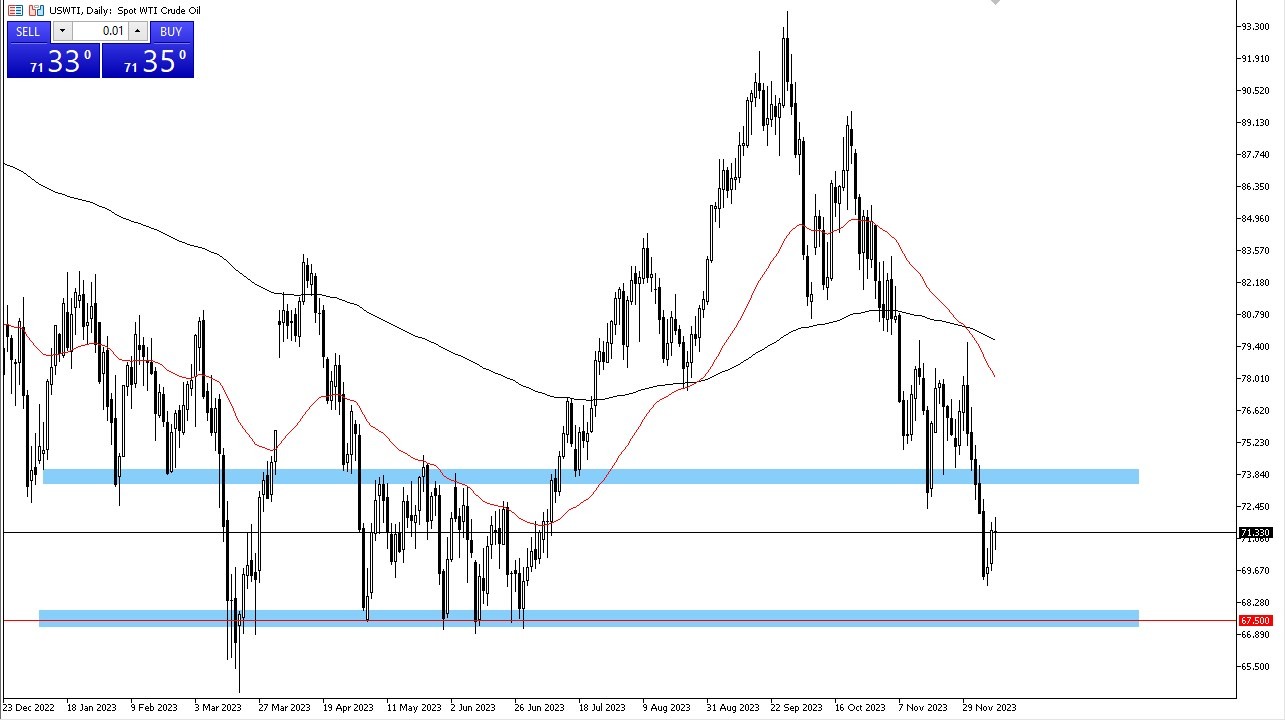

WTI Crude Oil

The West Texas Intermediate (WTI) Crude Oil market displayed a degree of noise and choppiness during Monday's trading session, reflective of its ongoing stabilization efforts. There's a notable focus on the $74 level, which once served as a significant support level, thereby invoking a sense of "market memory." A successful break above this level could potentially pave the way for a move towards the $78 mark. Conversely, if a reversal were to occur at this juncture, the market could decline to as low as $67.50, a level that has previously demonstrated substantial support.

Nonetheless, persistent concerns linger concerning recessionary headwinds and their impact on crude oil demand. The market has been grappling with considerable turbulence recently, so a modest recovery seems plausible. However, it's prudent to approach any sudden bullish sentiment with caution.

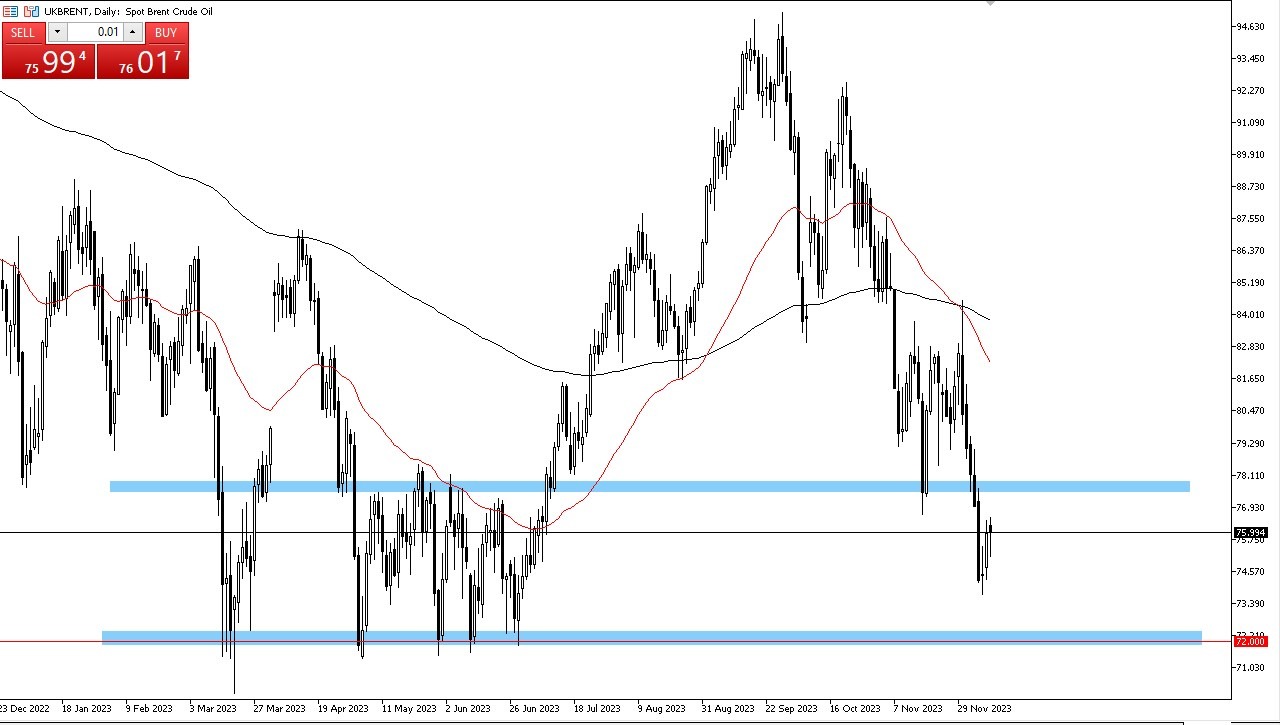

Brent

Brent oil experienced a minor decline during the trading session, only to witness the emergence of buyers. The $78 level above holds significance, having previously acted as a support level and now expected to serve as resistance. It's reasonable to assume that short sellers will seek to capitalize on their profits as the holiday season approaches, potentially leading to fluctuations in trading volume. In the event of a downward movement, the $72 level beneath stands as a substantial support level.

This market continues to be characterized by a degree of noise, compounded by concerns over liquidity, as market participants grapple with the uncertainty surrounding future demand dynamics. Indecision appears to be the prevailing sentiment, warranting prudence in managing position sizes. Nevertheless, a couple of previously mentioned levels are poised to be key points of interest over the coming weeks.

Crude oil remains on somewhat unsteady ground at this juncture. However, it's essential to acknowledge that the support levels beneath us hold significance in the longer-term context, suggesting that we may be approaching the end of the selling pressure that has persisted in recent times. Investors will be keenly observing how these factors unfold in the weeks ahead, and keep an eye on your position sizing, as volatility could continue to be a major issue at this point in time. I would be very careful in this market.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.