During Wednesday's trading session, crude oil markets experienced an initial decline, reflecting the ongoing efforts to establish a stable price floor. This trend was evident in both the West Texas Intermediate (WTI) and Brent crude oil markets.

Top Forex Brokers

WTI Crude Oil

- The WTI market has been characterized by volatility, with the $69 level emerging as a potential support zone. This level is being closely watched as the market seeks stability.

- However, it's important to note that there could be further declines down to the $65 level before encountering more substantial, longer-term support.

- The current market movements suggest a phase of short covering rather than a definitive trend reversal.

While there's potential for a rally from this point, it's advised to wait for a clearer trend change before committing to new positions. The approach should be cautious, especially considering the upcoming holiday season, which is likely to bring increased volatility and reduced trading volumes. In this context, it might be premature to sell crude oil. Instead, investors are advised to wait for a more definitive, longer-term signal that could indicate a buying opportunity based on value. After all, in this part of the year, things can get strange to say the least.

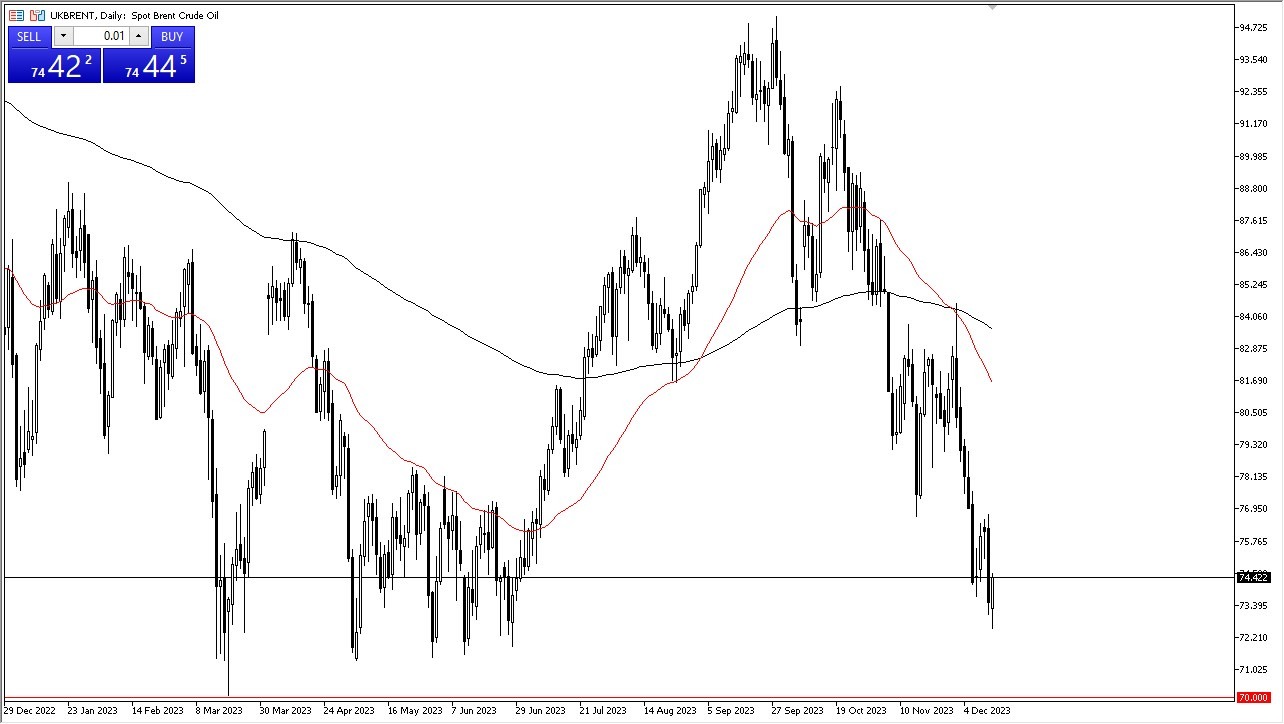

Brent Crude Oil

Similarly, the Brent market is exhibiting patterns like WTI, with the key difference being that the major support level appears to be around $70. The market is in a phase of searching for a stable floor, but it seems that this level has not been firmly established yet. Therefore, jumping into trades at this stage could be premature, and a more prudent strategy would be to adopt a 'wait and see' approach.

The next several trading sessions might not offer clear opportunities as the market is still in flux. Additionally, upcoming meetings of central banks worldwide could introduce further volatility and liquidity challenges, complicating the trading landscape. Currently, the crude oil market appears to be in an accumulation phase. However, this phase could last for an extended period, ranging from weeks to months, adding an element of unpredictability.

Overall, both WTI and Brent crude oil markets are navigating through a period of uncertainty. Traders are advised to stay vigilant, monitoring market developments closely, and avoiding hasty decisions. The focus should be on identifying stable support levels and watching for signs of a trend reversal before making significant trading decisions. With external factors like central bank decisions and seasonal variations in play, the market's direction remains uncertain, calling for a strategic and patient approach to trading in crude oil.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.