Crude oil markets have recently experienced a rally during the early Thursday trading session. This surge suggests that the market may be establishing a foundation for further growth as the Fed has implied, they were going to ease in 2024.

West Texas Intermediate (WTI) Crude Oil

The WTI Crude Oil market exhibited a significant upswing on Thursday, indicating an effort to establish a solid base for an upward trajectory. This momentum is partly attributed to perceptions of loosening monetary policies by central banks, especially the Federal Reserve. As a result, investors are increasingly considering alternatives to the US dollar, with crude oil emerging as a potential beneficiary. The anticipation of a demand increase, driven by central bank policies aimed at stimulating the economy, also plays a crucial role in this trend.

However, navigating this upward movement in the oil market may not be straightforward. The market is currently exploring the potential for economic recovery and its positive impact on crude oil. Despite the optimistic outlook, investors should be prepared for volatility and possible liquidity challenges as the year approaches its end.

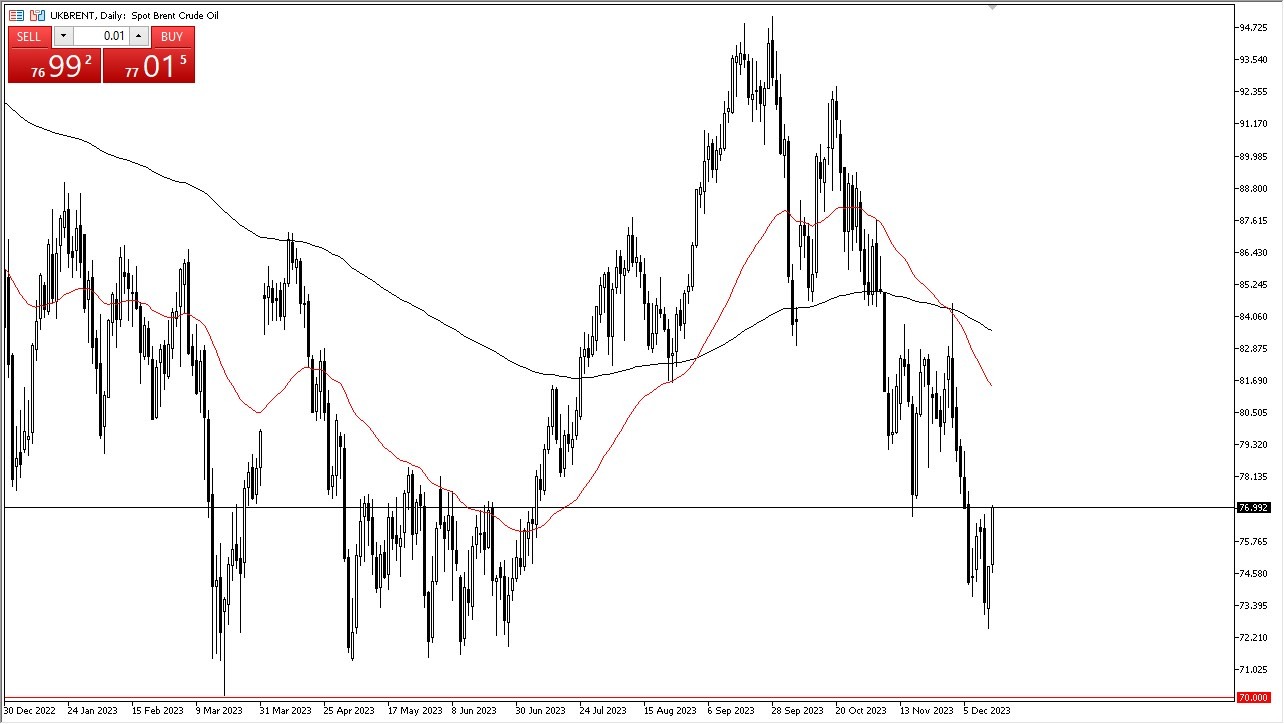

Brent Crude Oil

Similarly, Brent crude oil markets are showing bullish trends, with a key short-term target being the $77 level. Like WTI, Brent is facing the challenge of potential volatility and a temporary reduction in market liquidity, especially as the New Year approaches. The current market dynamics are heavily influenced by the expectation that relaxed central bank policies, notably from the Federal Reserve, will boost energy demand.

The next few weeks are anticipated to be turbulent as the market seeks a stable foundation. While significant momentum is expected in the new year, the forthcoming weeks might witness sudden and unpredictable movements due to the reduced liquidity. At present, the market appears to be closer to finding its bottom rather than approaching its peak, suggesting a more optimistic outlook for the near future.

In the end, both WTI and Brent crude oil markets are exhibiting signs of a potential upward trend, influenced by expectations of relaxed monetary policies and subsequent economic stimulation. However, investors must navigate through anticipated volatility and liquidity challenges, especially in the short term. The market seems to be on the verge of establishing a stronger position, with significant developments expected as the new year unfolds.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.