- Crude oil markets experienced a significant upswing during Monday's trading session.

- This surge in oil prices is largely attributed to expectations that the Federal Reserve will shift its policy, potentially boosting risk appetite among investors.

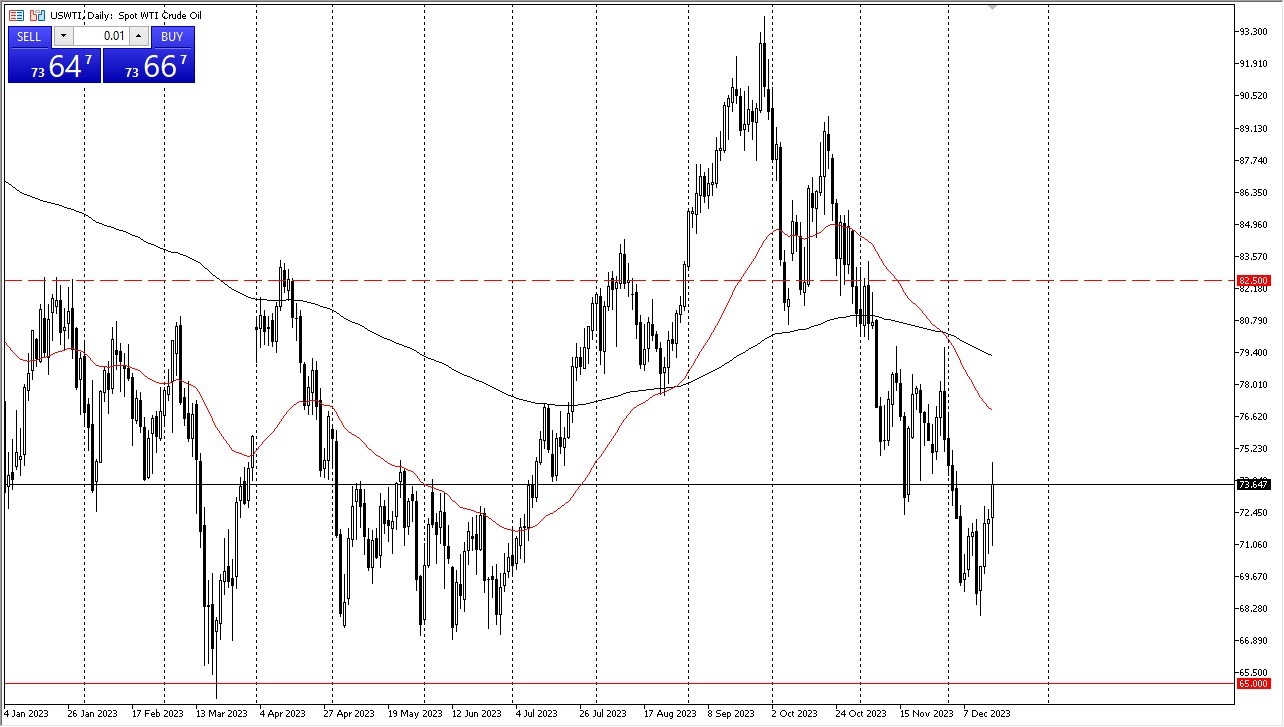

West Texas Intermediate (WTI) Crude Oil

The session saw West Texas Intermediate Crude Oil, a key benchmark for oil prices, initially fall but then rally as the day progressed. This rebound suggests a growing optimism in the crude oil markets. Several factors are driving this positive sentiment, notably the anticipation that the Federal Reserve will cut interest rates in 2024. If this happens, it's expected that the economy will be stimulated, increasing demand for crude oil as people and businesses ramp up their spending and investments. However, there's also a possibility that the recent price increase is due to short-term market strategies as the year ends. It's important to note that the market was nearing a significant long-term support level, which may have also influenced the rally.

Brent Crude Oil

Similarly, Brent crude oil markets, another major benchmark, also witnessed a significant rally. This trend suggests that a strategy of buying during price dips could be beneficial in the short term. However, market liquidity might be somewhat constrained for the next couple of weeks, indicating that traders should look for valuable opportunities during this period. The market's recent pattern, including a strong weekly performance, supports this approach.

The question remains whether this upward trend in oil prices can continue in the upcoming weeks. The signs point towards more potential for growth than decline. The expectation of a more relaxed monetary policy by the Federal Reserve is likely to favor riskier assets like crude oil. Furthermore, as financial conditions ease, it's anticipated that economic momentum will pick up. Previously, there were concerns about a severe recession, but it will be interesting to see if this outlook changes soon. If perceptions shift back towards recession fears, we might see a complete reversal in oil price trends.

In the end, crude oil markets are currently showing a positive trend, buoyed by expectations of a policy shift from the Federal Reserve and the potential for economic stimulation. However, traders should remain cautious and attentive to market changes, especially given the possible fluctuations in market liquidity and global economic perceptions.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.