Top Forex Brokers

WTI Crude Oil

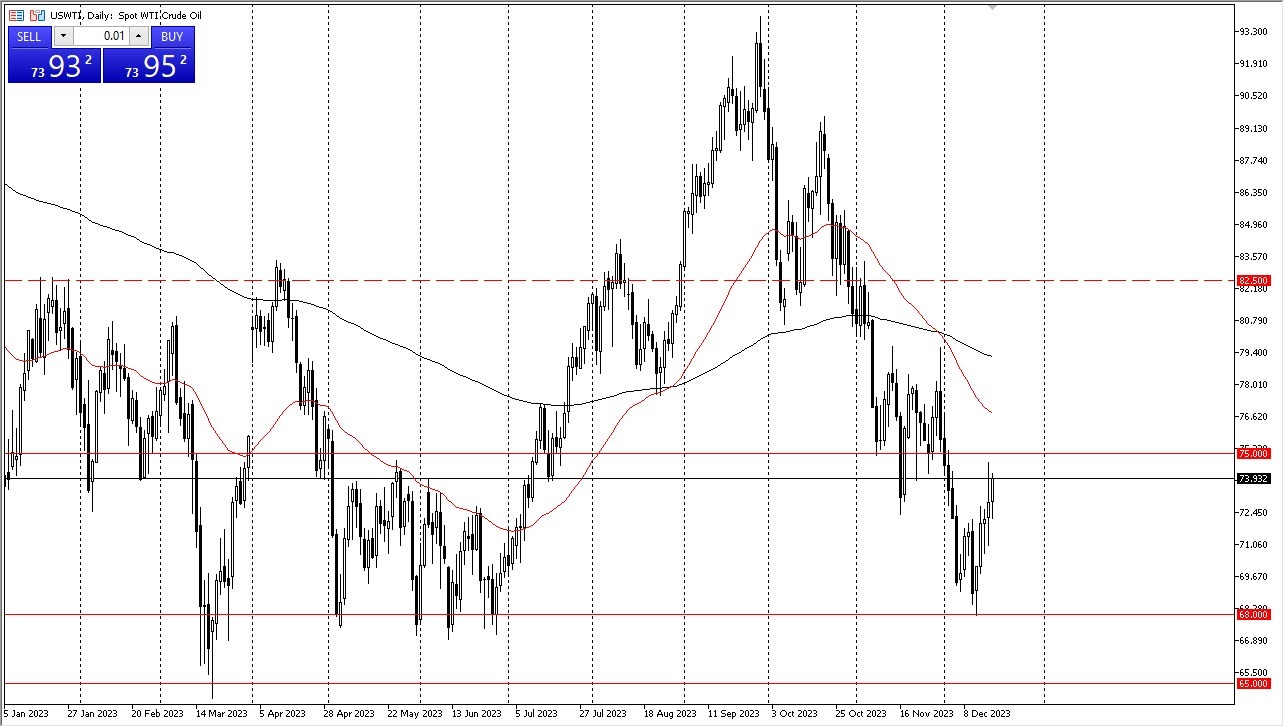

In the realm of energy commodities, the Crude Oil markets witnessed a rollercoaster ride during the recent trading session. Although prices initially dipped, determined buyers swiftly emerged, underscoring the persistent bullish undertone in the market. This trend is emblematic of the noisy and unpredictable behavior that has become the hallmark of Crude Oil trading, further compounded by a confluence of factors concurrently impacting the market.

One significant factor contributing to the ongoing market dynamics is the prevalence of short covering trades. Traders who had previously bet on lower prices have repositioned themselves, capitalizing on the opportunity to lock in profits. As we approach the holiday season, a reduction in market liquidity is anticipated, potentially amplifying the noise and volatility in Crude Oil prices. Just above the $75 level, a psychological threshold, and the 50-Day Exponential Moving Average stand as formidable resistance points, likely to challenge any upward movement. Conversely, strong support levels persist below, hinting that it may only be a matter of time before buyers seize the opportunity to acquire "cheap oil," thereby initiating a consolidation phase.

Brent

Like its West Texas Intermediate counterpart, the Brent Crude market also encountered a slight pullback during the recent trading session. Much like WTI, Brent grapples with the constraints of diminished liquidity and short covering dynamics. The psychological significance of the $80 level looms overhead, and the 50-Day EMA threatens a bearish descent. However, beneath the surface, a bedrock of support remains intact, hinting at the possibility that oil markets were, in fact, oversold initially. It appears that the market is now poised for a potential rebound, anchored by a long-standing support level that traders have consistently relied upon.

In the end, the Crude Oil markets are navigating treacherous waters characterized by volatility and short covering activities. While the prospect of a recovery looms on the horizon, the road ahead is likely to be fraught with twists and turns. Investors are advised to exercise caution and remain attuned to the evolving market sentiment, as it is clear that caution will be a prudent approach in this environment. I do think that eventually we could see upward momentum longer-term, but that’s a story for January from what I see. I have no interest in getting big in a position at this point, as next week will see the markets dry up.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.