- The Crude Oil markets experienced a surge in trading activity on Wednesday, encountering a formidable resistance barrier that has traders on edge.

- This development in the oil market has raised questions about the future direction of prices and the potential impact on global energy markets.

Top Forex Brokers

WTI Crude Oil

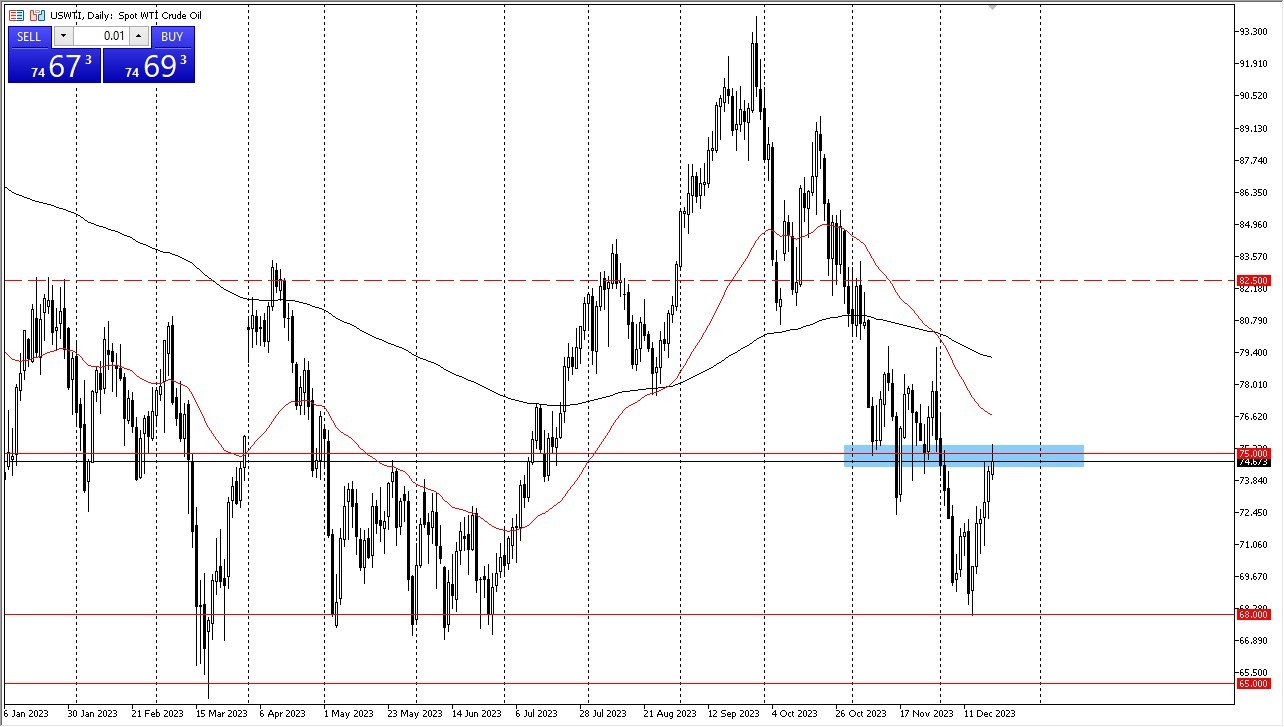

The West Texas Intermediate (WTI) Crude Oil market witnessed a significant rally during Wednesday's trading session. It encountered a major obstacle at the $75 level, a historical pivot point. Adding to the challenge is the presence of the 50-Week Exponential Moving Average above, which is likely to act as additional resistance.

While the market appears bullish, it's crucial to acknowledge the possibility of downward pressure in the near future. As liquidity exits the market, we may witness a slowdown in the rally. However, it's worth noting that short covering could also influence market dynamics. The current price range of $75 to $68 may signify an attempt to establish consolidation or an accumulation phase for the coming year.

Brent

In the Brent Crude Oil market, prices breached the $80 level during Wednesday's trading session, drawing closer to the 50-Day EMA. The market, much like its WTI counterpart, has been marked by volatile behavior. However, the recent surge appears to be overextending the market to the upside.

A pullback seems plausible, and the current momentum suggests that short covering has been a significant driver of recent price movements. Downward pressure may return as a notable factor in the market's direction. The loss of momentum, though potentially concerning in the short term, could indicate a period of consolidation.

An important support level to watch is the $72 mark, which has served as a significant price floor. Given the current situation, where prices hover around $80, the likelihood of continued downward pressure is evident.

In the end, the Crude Oil markets are navigating challenging terrain, encountering major resistance levels and experiencing periods of heightened volatility. Traders and investors should remain vigilant and consider the possibility of price corrections in the near term. As both the WTI and Brent markets seek stability, they may be in the process of establishing a foundation for future movements. The $75 and $80 levels remain crucial reference points, and market participants will closely monitor developments in the coming sessions to gauge the direction of crude oil prices.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.