Top Forex Brokers

The crude oil markets exhibited significant volatility in early Thursday trading, with market participants adjusting their positions ahead of the holiday season.

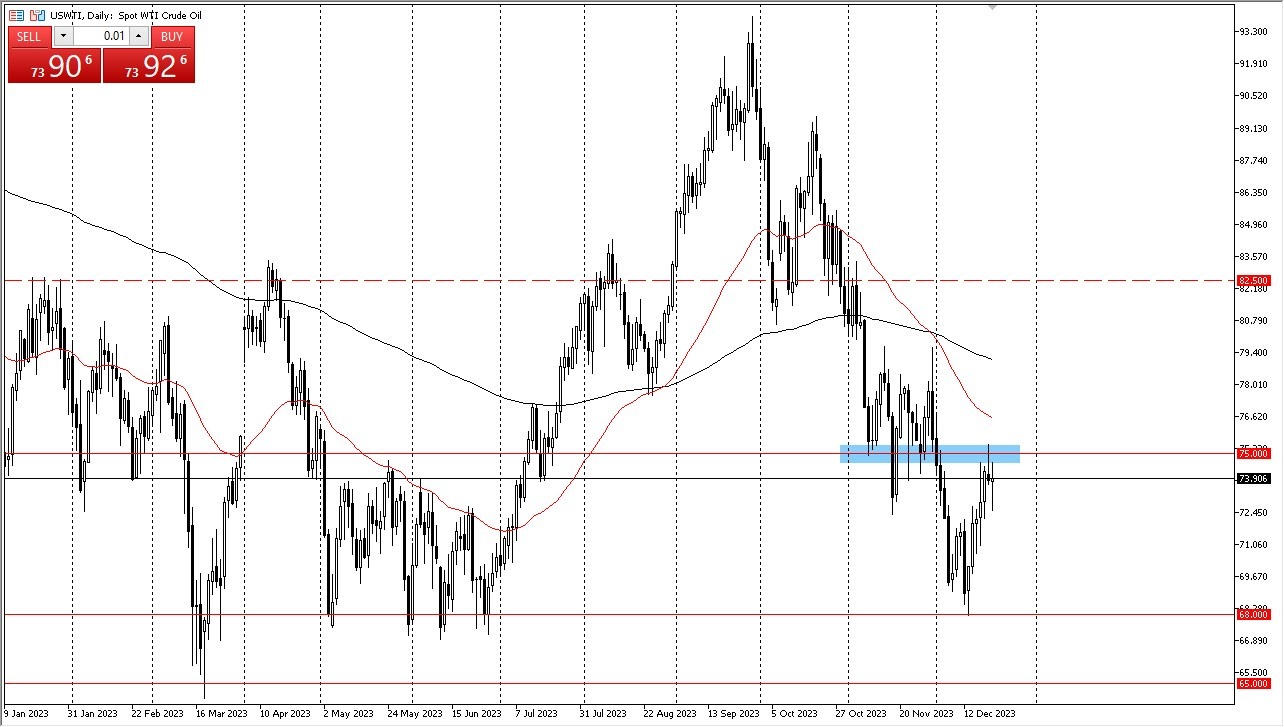

WTI Crude Oil

The West Texas Crude Oil market experienced considerable fluctuations during Thursday's trading session as traders continued to navigate their positions in anticipation of the holidays. We recently tested the $75 level but have seen a decline in that area, which is logical as it previously served as support, and market participants tend to remember these levels. These levels will be the key to determining what happens next.

An intriguing aspect is that this area also represents an options barrier, adding to its significance. Additionally, the 50-Day Exponential Moving Average has dropped and appears to be heading towards the $75 level. Below that, the $68 level could become a target. Currently, it seems we are in a situation where retesting that area is possible, and some recent movements may be attributed to short covering as traders aim to secure profits for the holidays.

Brent

Brent markets also displayed a lot of noise in recent trading sessions, initially attempting to breach the $80 level before reversing course and showing signs of negativity. Given the circumstances, it's likely that we will continue to witness turbulent behavior leading up to the holidays, with a notable concern being the limited liquidity for at least a week. Therefore, it's advisable not to read too much into market movements during this period, apart from the possibility of some short covering that occurred in the days leading up to Wednesday. After all, there is a lot of profit that was made over the last several months.

If there's a reversal and a breakthrough above the 50-Day EMA, then the market could set its sights on the 200-Day EMA, an indicator that tends to draw significant attention. However, the current market sentiment suggests an oversupply of crude, which is likely to keep exerting downward pressure. Moreover, trading during the holiday season can be particularly challenging. Notably, Monday is Christmas, and markets will be closed. It's also uncommon for major traders to actively influence markets between Christmas and New Year's Day. Because of this, I think that you are better off just sitting on the sidelines, maybe just short-term trading in a range once it settles into one.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading platforms to check out.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading platforms to check out.