Crude oil markets demonstrated renewed vigor during Friday's trading session, signaling potential upward movements that traders continue to explore.

Top Forex Brokers

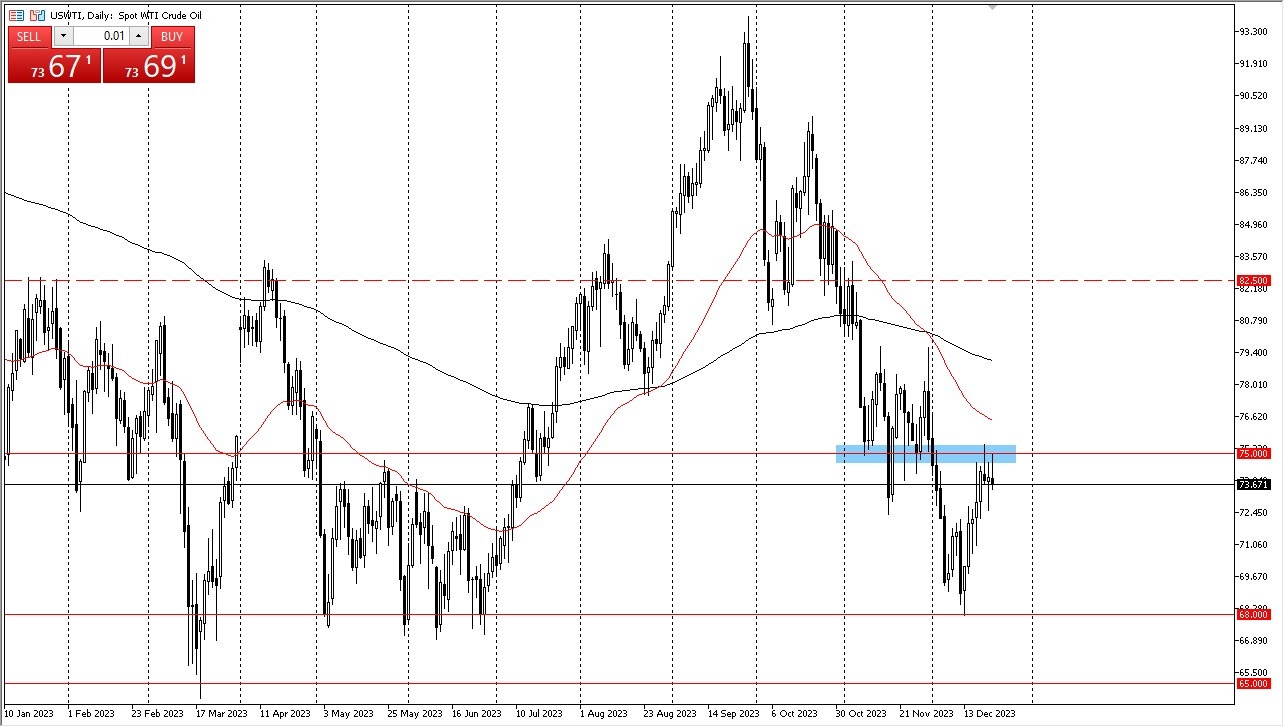

WTI Crude Oil

The West Texas Intermediate Crude Oil market exhibited a modest rally on Friday, suggesting a possible push towards the pivotal $75 level. Should this level be breached, the market may aim for the 50-day Exponential Moving Average, followed by a potential ascent to the $79 level. However, it's important to acknowledge that we currently stand at a significant resistance barrier that has played a crucial role on multiple occasions in the past. Breaking above the $75 level could potentially attract more capital into the market.

In terms of support, the $72.50 level is likely to offer some cushion, with the $68 level serving as a fundamental "floor" for the market. Nevertheless, it's important to remember that the market is expected to remain highly volatile, warranting a longer-term perspective.

Brent

- Brent crude oil experienced a notable rally during Friday's trading session, as it approached the $80 level.

- The presence of the 50-day EMA just above this level introduces a noteworthy resistance point to monitor.

- If the market manages to surpass the 50-day EMA, it could open the door to further gains, potentially reaching the 200-day EMA. Despite these potential moves, the general vicinity is likely to witness considerable volatility.

However, the market could experience a downturn if it breaks below the $78 level, potentially leading to a decline toward the $72 level. In essence, traders are currently grappling with the task of discerning the next major market direction. Given the upcoming holiday season, the next week or so is expected to be challenging. It may be advisable for traders to maintain smaller position sizes or, indeed, to remain on the sidelines until the holiday period concludes, as this is a common practice among professional traders.

At the end of the day, the recent uptick in crude oil markets suggests a willingness among traders to explore potential upward movements. The $75 level in WTI Crude Oil and the $80 level in Brent Crude represent key milestones to watch, with the presence of EMAs introducing further complexity. Nevertheless, the current market environment is marked by volatility, and with the holiday season looming, adopting a cautious approach or even abstaining from trading may be prudent, as is often the case among experienced traders.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.