Top Forex Brokers

The crude oil market staged a remarkable rally during Tuesday's trading session, underscoring the presence of substantial bullish pressure as it looks like Federal Reserve policy is starting to take center stage here.

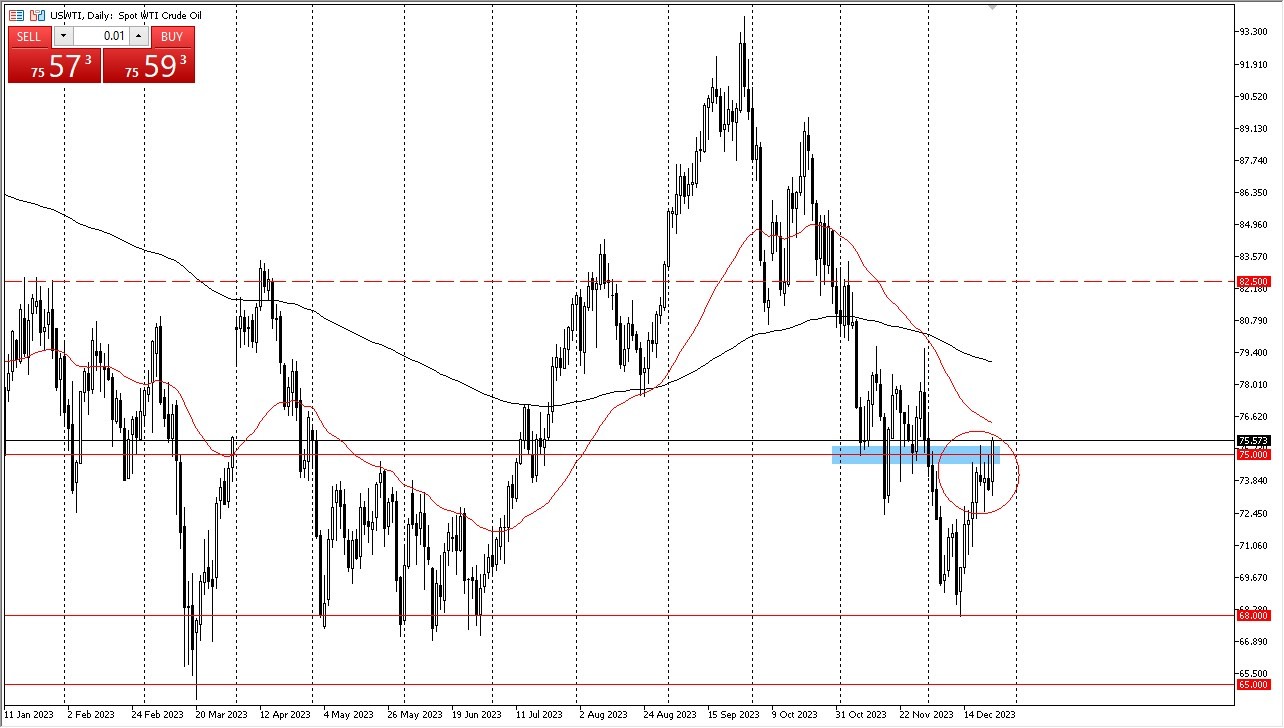

WTI Crude Oil

In West Texas Intermediate Crude Oil, prices surged significantly, breaching the crucial $75 level. This level, marked by its psychological significance and round-figure status, succumbed to the market's upward momentum. Notably, the 50-day Exponential Moving Average lies just above, potentially acting as a resistance point in the near term. Therefore, traders should remain mindful of this technical factor.

A potential breakthrough of the 50-day EMA could propel the market toward the 200-day EMA, a pivotal trend-defining point for many traders. Beneath the current price action, the $73 level persists as a formidable support zone, having recently facilitated a strong bounce. This development suggests the potential for a shift in the prevailing trend.

Brent

The Brent markets similarly experienced a substantial rally, with prices testing the 50-day EMA and surmounting the $80 level. This upward move represents a positive signal, affirming the likelihood of continued upward momentum. A daily close above the top of the 50-day EMA could set the stage for an advance toward the $83 level, with the 200-day EMA emerging as a potential target.

Beneath the current price structure, robust support is anticipated, extending down to the $78 level. Recent price action has demonstrated the resilience of this level as a support base. However, a breach below this level could introduce a measure of uncertainty into the market, although at present, Brent seems to be mirroring the recovery pattern observed in WTI Crude Oil after a significant low.

Looking ahead, the upcoming months are poised to be intriguing, with central banks, including the Federal Reserve, contemplating a loosening of monetary policy. This potential shift in monetary dynamics could stimulate positive momentum for crude oil and other commodities. Consequently, there is a sense of cautious optimism prevailing, but it is prudent to remain prepared for potential pullbacks in the market.

At the end of the day, the recent rally in the crude oil market signifies bullish sentiment, with key technical levels playing a pivotal role in shaping the trajectory. Market participants must stay attuned to these levels while keeping an eye on evolving central bank policies, which could significantly influence the direction of crude oil and the broader commodity landscape. While optimism prevails, traders should remain vigilant for any potential retracements soon.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.