Top Forex Brokers

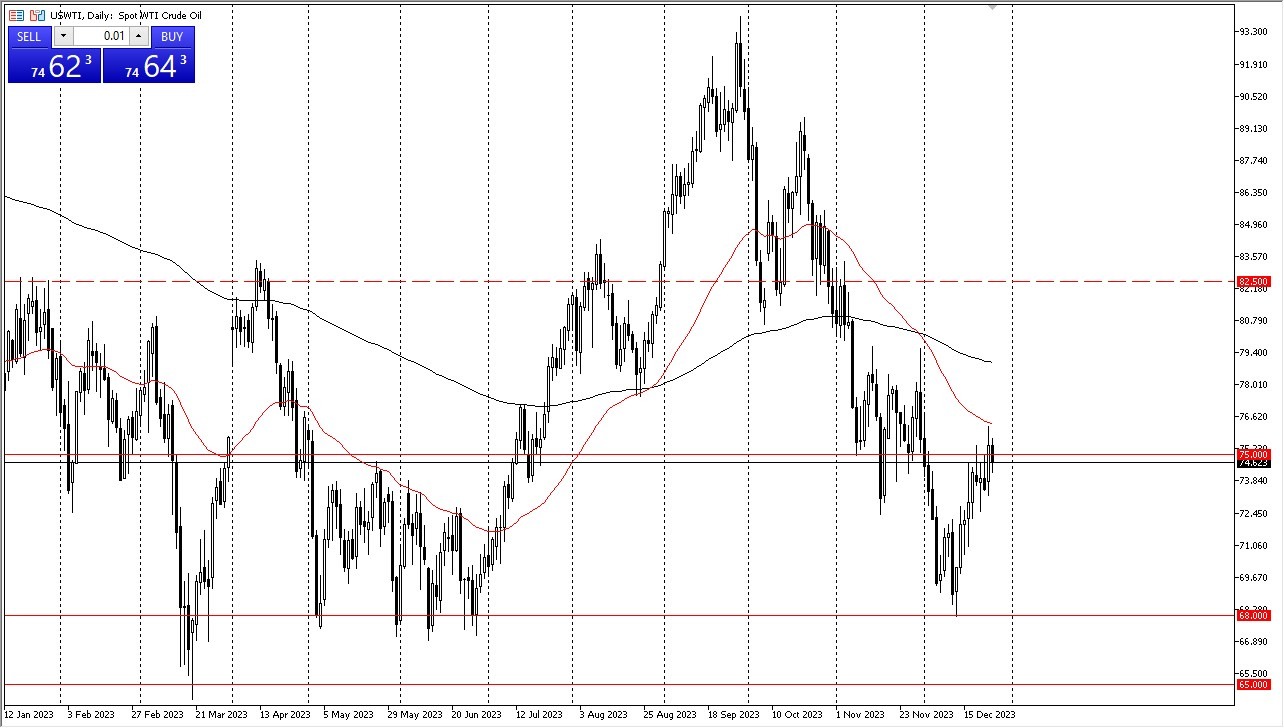

Crude oil markets experienced a slight retracement in Wednesday's trading session, dipping below short-term support levels before witnessing a resurgence of buyer interest.

West Texas Intermediate (WTI) Crude Oil:

The WTI Crude Oil market initially displayed a minor pullback during Wednesday's trading session, hinting at some negativity. However, the market swiftly saw buyers reentering, aiming to provide support to crude oil prices. This juncture in the crude oil market presents an intriguing scenario, marked by several concurrent factors.

One noteworthy thing to think about is the timing, as we find ourselves approaching the year's end, a period where liquidity concerns often come to the fore. Simultaneously, market participants are contemplating the possibility of the Federal Reserve implementing a looser monetary policy in 2024. This potential policy shift has led many traders to anticipate increased crude oil demand, given the likely economic expansion driven by enhanced liquidity.

Brent:

Similarly, Brent crude oil is expected to continue attracting buyers during pullbacks for similar reasons. Wednesday's trading session witnessed this trend in action. Additionally, the presence of the $80 level further reinforces this sentiment, as it represents a significant psychological and round figure in the market.

It's worth highlighting that both of these crude oil markets recently tested and rebounded sharply from major lows, suggesting the emergence of a market floor. Currently, the preference lies in buying pullbacks in both markets. However, it's essential to acknowledge that this time of year may also feature short-covering activity, limiting the extent of bullish pressure. The inclination to sell crude oil has diminished, and there is a preference for waiting for multi-day pullbacks before initiating longer-term trades extending into 2024.

The situation is further complicated by the influence of external factors, such as the activities of the Houthis and their attacks on the Red Sea, which significantly impact crude oil shipping. This geopolitical element adds an additional layer of uncertainty to the crude oil market's dynamics.

TL;DR: the crude oil markets are navigating a complex environment characterized by short-term fluctuations and potential long-term opportunities. The interplay between end-of-year liquidity concerns and expectations of looser monetary policy from the Federal Reserve contributes to this dynamic. Buyers are currently active in both WTI and Brent markets, but caution is advised due to the potential for short-covering and external geopolitical influences.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.