- The volatility of crude oil markets in recent days has left investors grappling with uncertainty, as the commodity searches for a way out of a major consolidation zone.

- This is something that short-term traders continue to revel in, but sooner or later will have to break out.

Top Forex Brokers

Starting with the West Texas Intermediate Crude Oil market, Friday's trading session was marked by extreme volatility, reflecting the ongoing challenges that the crude oil sector is grappling with. At the forefront of these concerns is the ability of OPEC to effectively manage the supply, an issue exacerbated by the underwhelming announcement made by the organization. Simultaneously, market participants are pondering whether demand will rise or fall. With looming recession fears in the backdrop, the outlook for oil remains clouded.

Currently, the market appears to be engaged in a relentless dance within a trading range, a characteristic pattern for this particular commodity. The $79 level above serves as a formidable resistance point, while the $72.50 level below offers crucial support. This tug of war between buyers and sellers is likely to persist.

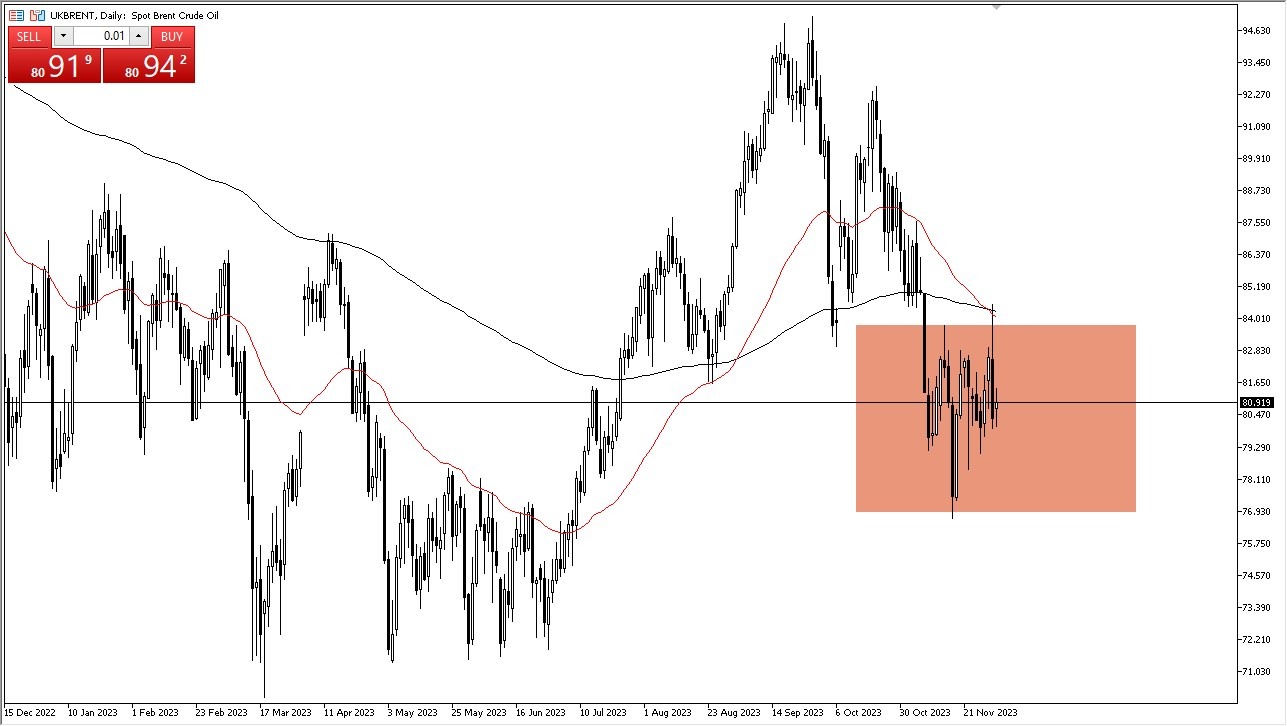

Shifting our focus to the Brent market, it too exhibited erratic behavior during Friday's trading session, with the $80 level acting as a focal point. Notably, the $84 level presents a substantial resistance barrier, additionally featuring the 50-Day EMA and the 200-Day EMA indicators. Beneath this, the $77 level stands as a key support level. Presently, the market is wrestling with the task of charting its course.

Market Finds Itself in a State of Flux

In light of the prevailing uncertainties, it is reasonable to anticipate continued indecision. The specter of recession looms large, and the question of whether we will navigate 2024 unscathed remains unanswered. A recession-free trajectory could potentially drive crude oil prices higher. However, for the time being, the market appears to be trapped in a repetitive cycle of oscillation between the previously mentioned price levels. This is something that keeps a lot of “big money” out of the market. (Well, that and the end of the year approaching.)

In the end, the crude oil market finds itself in a state of flux, with participants grappling with complex factors and unanswered questions. Investors seeking to navigate this tumultuous terrain may find themselves adopting a range-bound trading strategy, given the predominant theme of indecision that continues to shape this market. As the market sits firmly in the middle of its current range, opportunities for decisive action remain limited.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading platforms to check out.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading platforms to check out.