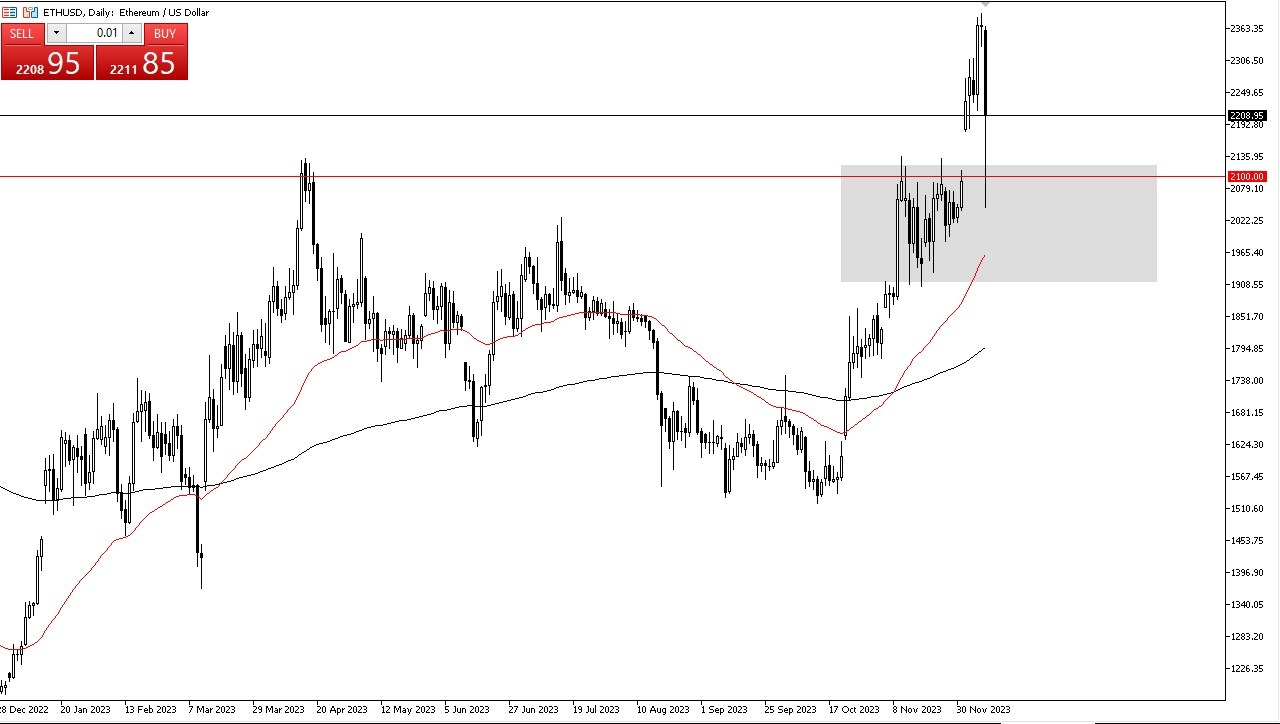

- The Ethereum market has undergone a rather impressive tumultuous ride in the past 24 hours, indicating a degree of cooling off in the market's fervor.

- This is something that I think was desperately needed and should be welcomed by the bullish traders out there.

Top Forex Brokers

ETH Gets Sold Early

Ethereum bore the brunt of selling pressure during the early hours of Monday, effectively filling the gap from the previous week. The pivotal question now revolves around the resilience of the $2,100 level. At present, it appears reasonably likely that this level will hold, but lingering concerns loom over the broader future of cryptocurrencies. Indeed, these digital assets seem to be seeking a problem to solve, with their primary utility confined to trading. While certain smaller economies have found utility in cryptocurrencies like Bitcoin and Ethereum, the overarching sentiment remains speculative, with the ever-present threat of central-bank digital currencies potentially overshadowing their existence.

Nevertheless, cryptocurrencies persist as tradable instruments, ensuring that market participants will continue to engage with them. The ultimate strength of this asset class remains uncertain, yet for the time being, there appears to be a noteworthy bullish undercurrent. All factors considered, this suggests that the market is poised to continue its ascent, albeit with the extent of further gains still shrouded in uncertainty. In the short term, an ascent to the $2,500 level seems plausible. However, it's vital to acknowledge that a reversal beneath the $1,900 mark could potentially signal the end of the prevailing uptrend. Nonetheless, Monday's trading session, marked by a market rebound, hints at the presence of a substantial buyer base.

It's essential to brace for the continued rollercoaster ride in this market, with an additional layer of volatility arising from the impending holiday season, which may see institutional funds exiting the market. Furthermore, vigilance is warranted regarding interest rate movements in the United States and other advanced economies such as the EU, as any signs of rate hikes could adversely affect the cryptocurrency landscape. In any case, it's reasonable to anticipate ongoing upward pressure in the market, notwithstanding some unforeseen noise or announcements out there. The central bank meeting this week could cause some issues, but at the same time, it should be noted that crypto is all about momentum and chasing most of the time, so that is something that you should keep in the back of your mind.

Ready to trade our Ethereum forecast? We’ve shortlisted the best MT4 crypto brokers in the industry for you.

Ready to trade our Ethereum forecast? We’ve shortlisted the best MT4 crypto brokers in the industry for you.