- Ethereum displayed a modest rally during Thursday's trading session, indicating a readiness to attract more buyers in the future.

- Ethereum has been facing some pressure due to the prevailing lower interest rates, a trend that is likely to persist.

- In essence, money is searching for outlets where it can gain momentum, and the cryptocurrency sector is positioned relatively high on the risk spectrum. Hence, it makes sense for individuals to explore this alternative investment avenue.

Top Forex Brokers

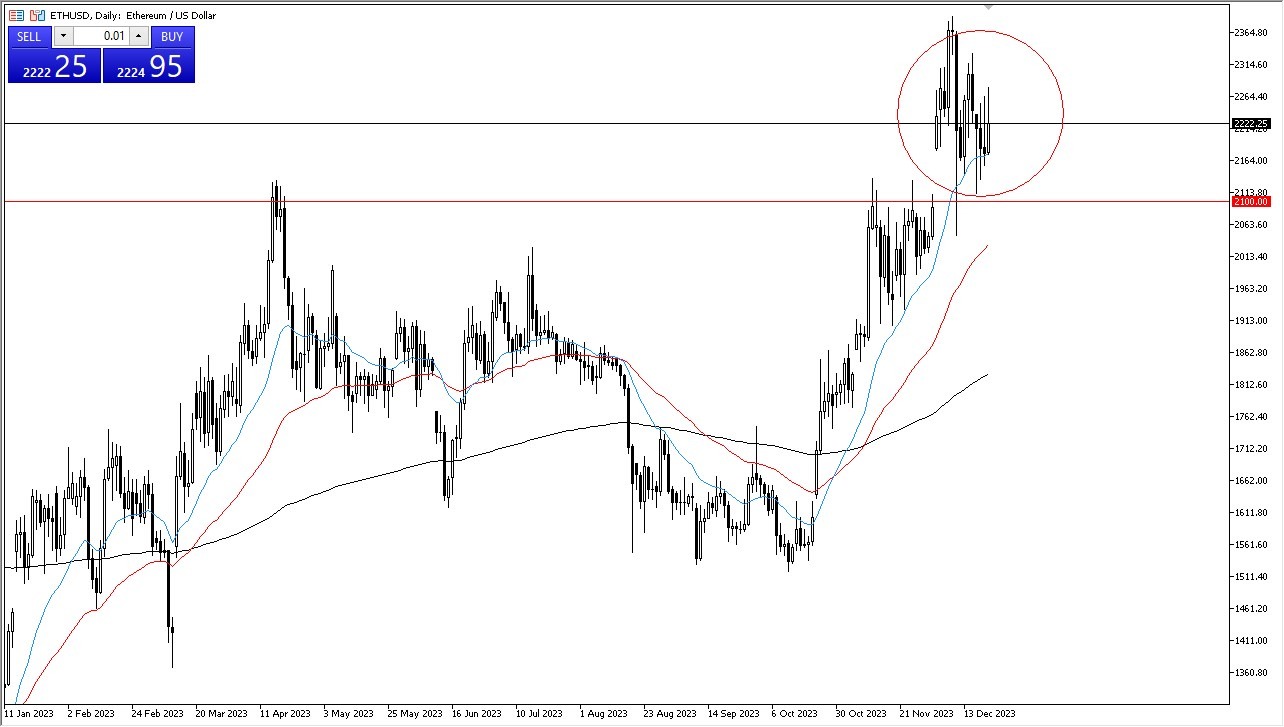

However, there are some key considerations to bear in mind in the coming days. The holiday season tends to deplete liquidity from the market, particularly concerning institutional participation. During this period, retail trading is likely to dominate. This doesn't imply that retail traders cannot influence the Ethereum market, but it does mean that a portion of the market's liquidity will be reduced. Consequently, we may witness some erratic price movements. For those with a longer-term trading perspective, the approach may involve entering the market and enduring the volatility. Overall, it's reasonable to anticipate ongoing buying interest in Ethereum, with the $2,100 level serving as a substantial support zone.

To the Upside…

On the upside, the $2,500 level is a notable short-term resistance barrier. If Ethereum manages to breach this level, it could potentially rally toward the $2,700 level. However, it's important to recognize that the next couple of weeks may present some challenges. Consequently, exercising caution in terms of position sizing is advisable. Nevertheless, considering that the 50-Day Exponential Moving Average is positioned just above the $2,000 level, it adds another layer of support beneath. As long as the interest rate scenario in the United States continues to decline, it's likely that the market will eventually attract buyers seeking to capitalize on the momentum and the favorable conditions for relatively easy gains.

At the end of the day, Ethereum appears poised to continue attracting buyers, although some challenges may arise in the coming weeks due to the holiday season. Position sizing should be approached cautiously, and the market's resilience should be recognized, with the 50-day EMA reinforcing support. The declining interest rates in the United States are expected to drive further interest in this market, creating opportunities for those seeking momentum and potential easy profits.

Ready to trade our Ethereum forecast? We’ve shortlisted the best MT4 crypto brokers in the industry for you.

Ready to trade our Ethereum forecast? We’ve shortlisted the best MT4 crypto brokers in the industry for you.