- Ethereum experienced a significant surge in its value during the early hours of Monday, spurred by the anticipation of the Federal Reserve potentially cutting interest rates by the end of March.

- This upward trend in Ethereum's market is largely attributed to traders' reactions to the fluctuating interest rates, with current market conditions indicating a halt in the Federal Reserve's rate hikes.

- This perceived pause in rate increases has led to an influx of "hot money" into cryptocurrencies, including Ethereum.

Top Forex Brokers

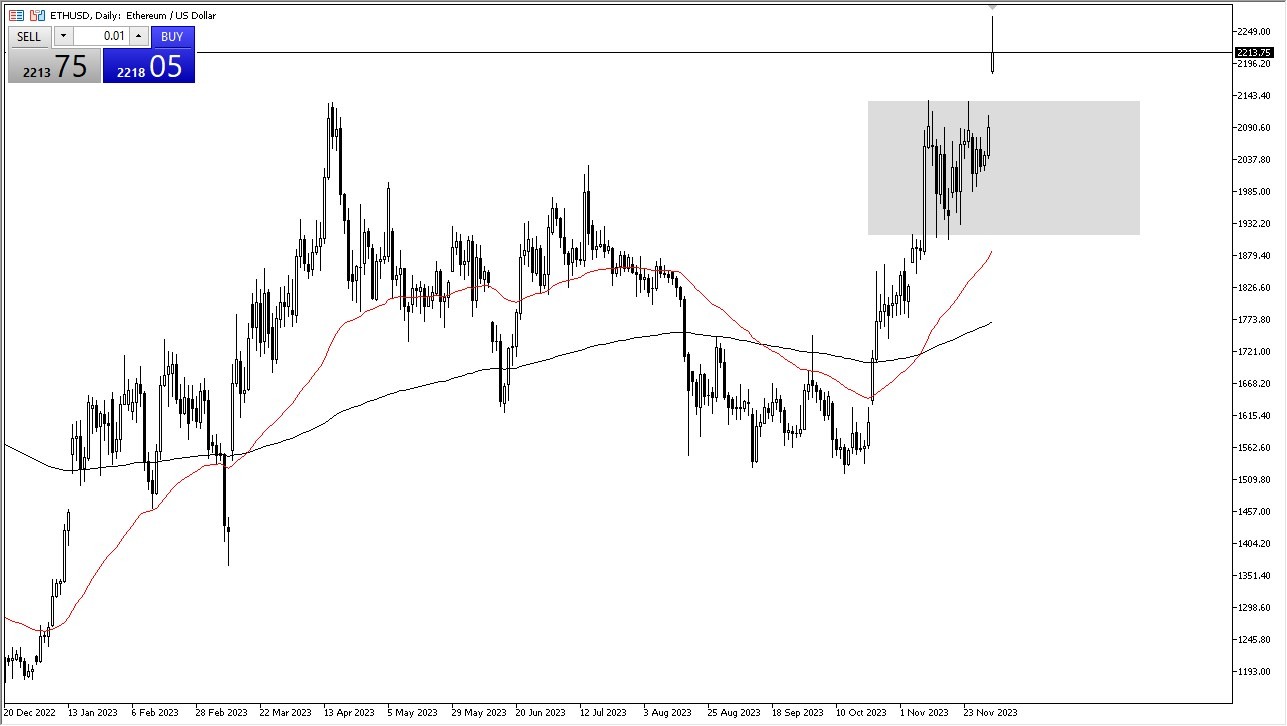

The prospect of lower "risk-free rates" has made Ethereum an attractive option for traders seeking higher returns. Despite the appealing yields offered by bonds, there's a notable downward trend in bond yields, prompting investors to redirect their focus towards cryptocurrencies. Ethereum, in particular, is drawing attention due to its perceived stability and growth potential. The $2100 mark, previously a point of resistance, is now seen as a key support level. This shift in market dynamics, coupled with a sense of "market memory," suggests that Ethereum is a valuable buy at current levels. Investors willing to take a calculated risk of around $250 per coin are likely to lean towards a bullish stance on Ethereum, given the current market trends.

No Real Ethereum Sellers Out There

The reluctance to short Ethereum stems from the strong presence of buyers in the market and the anticipation of a continuous upward trend. A significant breach of trust would be indicated if Ethereum falls below the $1900 support level, potentially leading to a change in the overall market trend. However, as it stands, the dominance of buyers in the market makes any dip in Ethereum's value a potentially lucrative buying opportunity. Analysts believe that Ethereum has the potential to reach and surpass the $2500 threshold in the foreseeable future, highlighting its strong position in the cryptocurrency market.

This analysis reflects the current sentiment and trends in the cryptocurrency market, specifically focusing on Ethereum. The interplay between interest rates, market dynamics, and investor sentiment is crucial in understanding Ethereum's recent performance and its potential trajectory. The market's sensitivity to interest rate changes and the shifting balance between risk and return are key factors influencing Ethereum's value and appeal to investors.

Potential signal: Its obvious that “risk assets” are in vogue again. I am a buyer of dips in ETH and would be aggressive near the 2100 USD level. I would have a stop at the 1980 level, with a target of 2480.

Ready to trade our daily Forex signals? Here’s a list of some of the top 10 forex brokers in the world to check out.