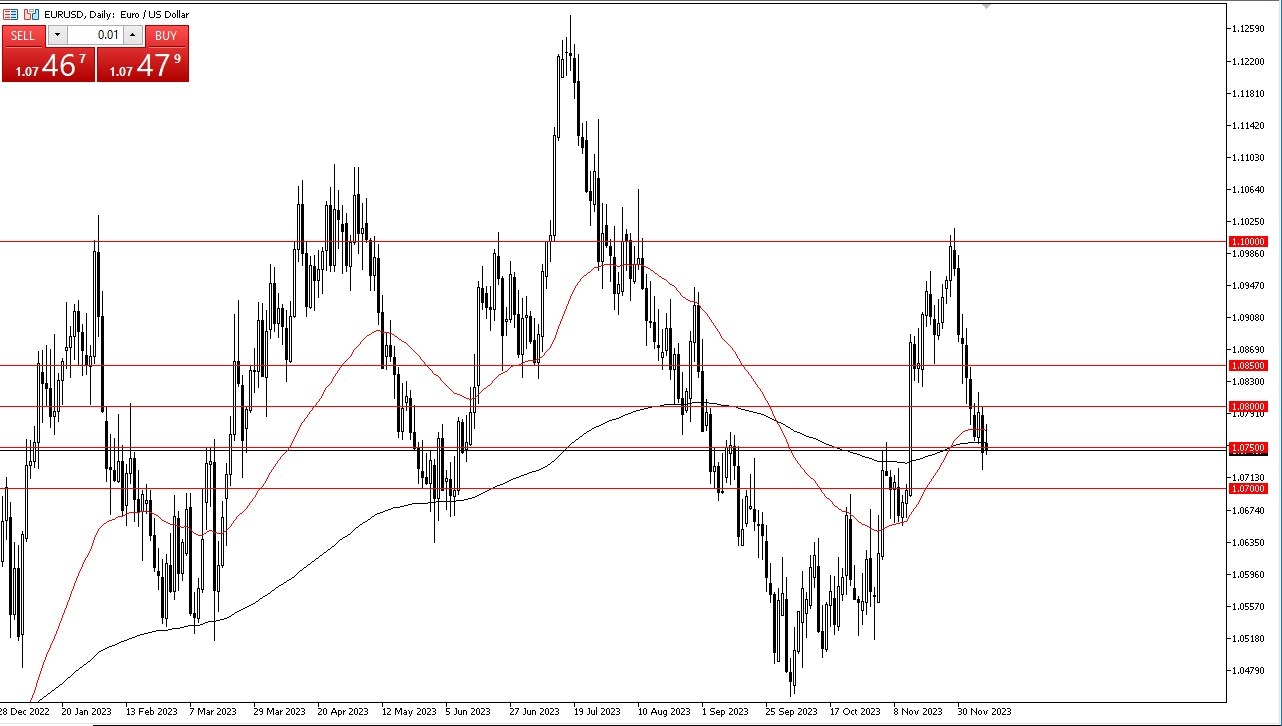

- The EUR/USD embarked on a rollercoaster journey throughout Monday's trading session, a reflection of its ongoing tussle with the critical 200-Day Exponential Moving Average.

- This market is undeniably characterized by extreme volatility, but the spotlight firmly rests on the imminent interest rate determinations of several central banks this week, notably the Federal Reserve and the European Central Bank.

- Both of those banks could have a major influence on what happens next, and therefore it is likely that we see a lot of noise to say the least.

- With this, I think it is a situation where you will have to be extra vigilant during this week, and therefore I think a lot of people are simply sitting on the sidelines.

Top Forex Brokers

A cursory examination of the chart serves as a stark reminder of the prevailing significance within our current landscape. The 1.0750 level remains an imposing and influential barrier. In the event of a breach beneath the low of Friday's candlestick, a pathway toward the 1.0650 level may emerge. Conversely, a decisive break above the 1.08 level could set the stage for a surge in buying pressure. Within this overarching climate, it is abundantly clear that the market is set to endure continued turbulence. We must grapple with the dilemma of whether the Federal Reserve will indeed tighten its monetary policy, or if the European Central Bank can successfully maintain its elevated interest rates. Compounding these concerns is the looming specter of a potential European Union recession, an assumption that might already be a grim reality.

Ultimately, the Euro Will Be Messy

In these circumstances, exercising prudence in determining the size of your positions is paramount. The week's central bank events are poised to inject a fresh dose of volatility into the market and could be a major issue over the next few sessions. Moreover, the forthcoming holiday season is anticipated to siphon off trading volume dramatically, painting a picture of potential fluctuations in the coming weeks. However, once we navigate beyond the threshold of New Year's Day, the market may gradually return to a semblance of normalcy. It is of utmost importance to approach this market with the utmost caution, recognizing that careful navigation is the order of the day. In the broader scheme of things, this market finds itself perched at a pivotal inflection point, signaling the potential for a significant and forthcoming move.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.