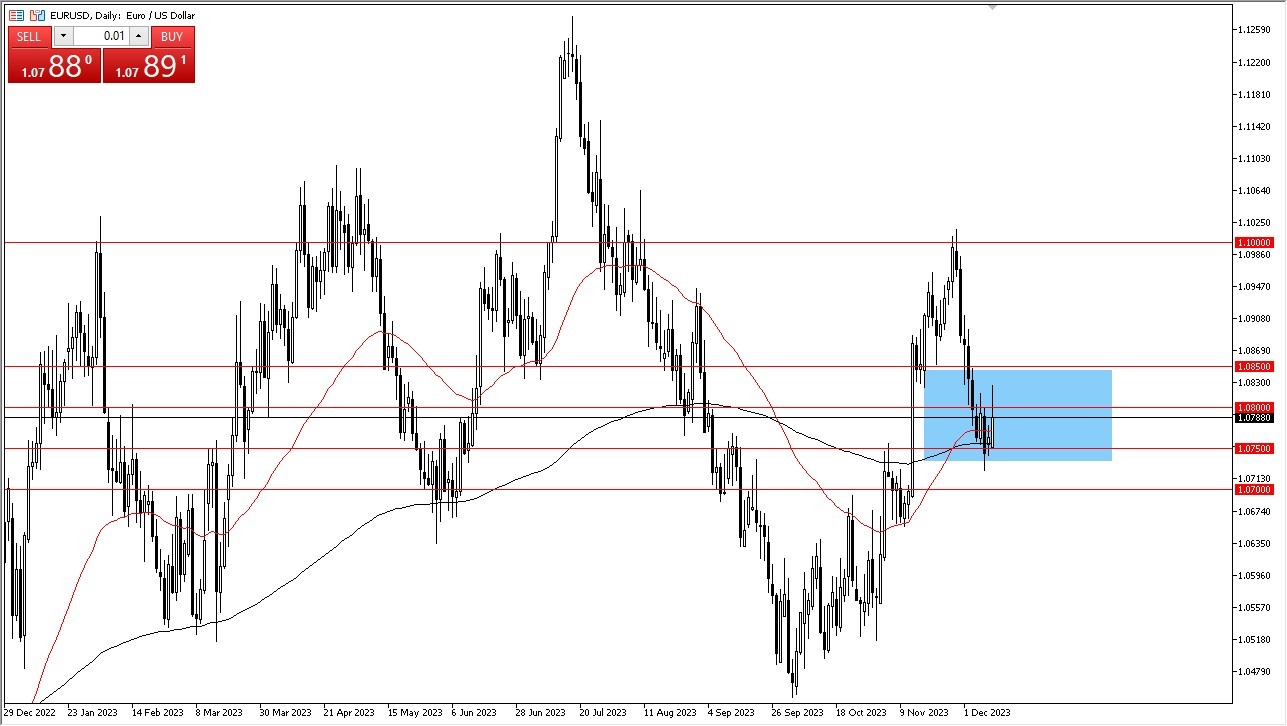

- The EUR/USD showed a remarkable surge in Tuesday's trading session, opening at the 1.08 level in New York, as investors positioned themselves ahead of pivotal central bank announcements from the Federal Reserve and the European Central Bank later in the week.

- This anticipation is driving optimism that these central banks might ease their monetary policies, potentially causing the US dollar to weaken.

Top Forex Brokers

However, the road ahead is expected to be turbulent, with a high probability of significant market fluctuations. Caution should be exercised in such an environment, as traders brace for the impact of central bank decisions.

In the event of a downward correction, the 1.0750 level is likely to attract substantial buyer interest, as it has served as a reliable support level in the past. Even if prices slip below that point, the 1.07 level presents itself as another level of support. Notably, the 200-Day Exponential Moving Average is closely aligned with the 1.0750 level, potentially reinforcing its significance as a short-term floor. However, the outlook may shift once the dust settles following the central bank meetings.

Central Bank Dynamics Shape Euro's Fate

Much of the euro's recent performance hinges on the actions of the Federal Reserve. Traders are hoping for a more accommodative stance, and if Federal Reserve Chairman Jerome Powell leans towards a dovish tone, it is highly likely to boost the euro's value. Nevertheless, the European Central Bank's (ECB) stance also plays a crucial role. Should the ECB adopt a dovish outlook, it could counteract the positive impact of a dovish Federal Reserve. The interplay between these central bank decisions will be a pivotal factor in determining the euro's trajectory.

As we approach the holiday season, it is important to consider the potential impact of reduced liquidity. Historically, trading volumes tend to thin out during this period due to traders taking time off for the holidays. This decrease in market activity can amplify price movements and create unexpected market dynamics.

In the end, the euro is currently demonstrating signs of strength as traders anticipate central bank announcements. While short-term positivity prevails, the euro's ability to break above the 1.0850 level remains uncertain. Investors are advised to maintain patience for a longer-term signal, while closely monitoring the developments in central bank policies. With holidays on the horizon, market participants should also be vigilant regarding potential liquidity fluctuations that could add further complexity to the euro's journey in the coming weeks.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.