- In the early hours of Monday, the EUR/USD exhibited a slight negative trend, yet it continues to find substantial support just below its current levels.

- This behavior suggests that the Monday candlestick, characterized by considerable noise, may not be a strong indicator of future market movements.

- The market appears to be in a phase of uncertainty, with no clear factors significantly altering its current trajectory. This is a market that continues to see a lot of questions asked of it, and this should cause noise to say the least.

Top Forex Brokers

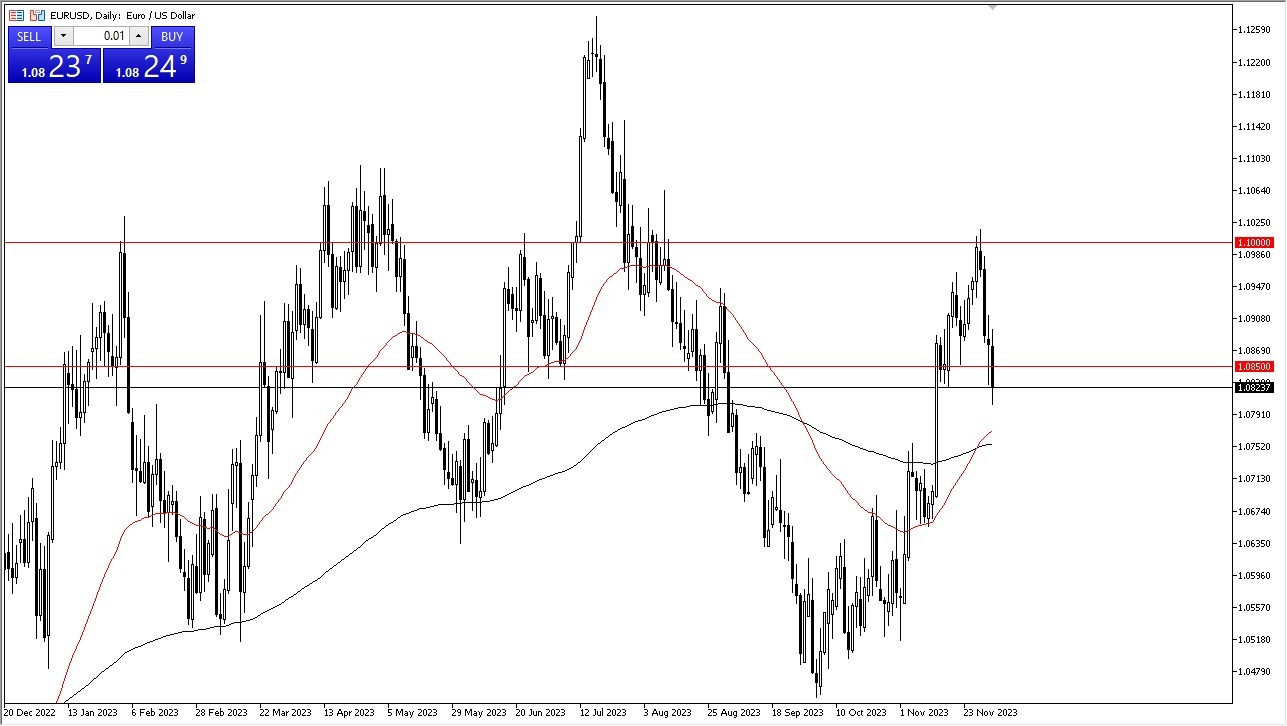

The 1.08 level has emerged as a crucial support zone, potentially extending to the 1.0850 mark. This support suggests that each dip in the market is likely to attract buyers, making a "buy on the dip" strategy seem viable, at least for the remainder of the year. This trend is influenced by the expectation that the Federal Reserve might start reducing interest rates as soon as March, a move that could weaken the US dollar's value.

However, the situation in the European Union also plays a vital role in the euro's performance. A break above the previous Friday's hammer-shaped candlestick, which was a significant bullish indicator, could propel the market towards the 1.10 level. The 1.10 mark is not only a large, round, and psychologically significant figure but also a point that has previously attracted significant market attention. Although there has been a considerable sell-off since reaching this level, the market's reaction upon retesting this height remains uncertain.

Support Underneath

Should the euro break down below the 1.08 level, the market outlook could shift dramatically, potentially initiating another decline in line with the longer-term downtrend observed until recently. This potential movement is closely linked to interest rate trends in the United States. Therefore, market participants should closely monitor the bond market to gauge whether interest rates are on the rise or fall, as these movements will likely have a significant impact on the euro's trajectory.

This analysis underscores the complex interplay between the euro and broader economic indicators, particularly interest rates in the United States and the economic climate within the European Union. The euro's future movements will be heavily influenced by these macroeconomic factors, necessitating close observation of market trends and policy decisions on both sides of the Atlantic.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.