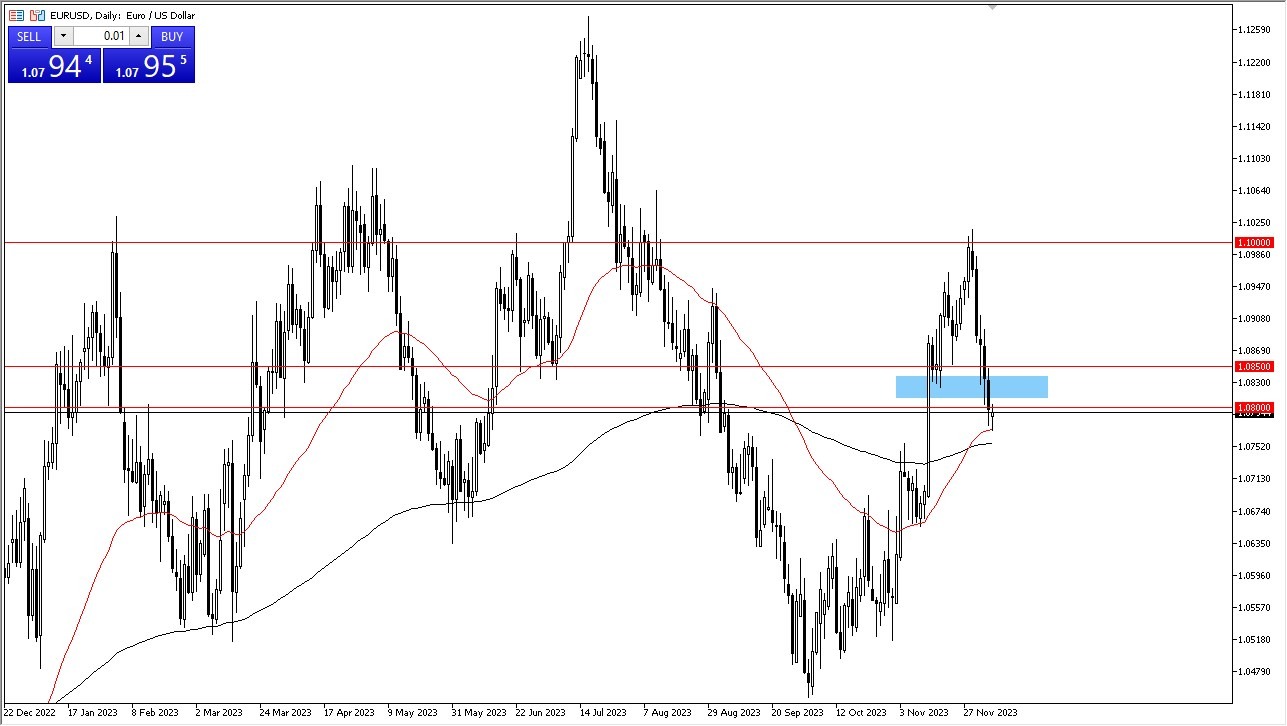

In Wednesday's trading session, the euro experienced a downward shift, touching the crucial 50-Day Exponential Moving Average (EMA) and dipping below the 1.08 level. The currency's ability to further decline is a topic of speculation, particularly with the 200-Day EMA located just beneath the current level. This situation indicates substantial technical support in the lower region, adding complexity to the euro's trajectory. The upcoming Non-Farm Payroll announcement on Friday is expected to be a focal point for the market in the coming days. Market reactions to this data are anticipated to be heavily influenced by the bond market, specifically the movements in yields.

Top Forex Brokers

The euro had previously attempted to surpass the 1.10 level, facing resistance around the 61.8% Fibonacci retracement level. Despite not being a firm advocate of Fibonacci-based trading strategies, it's acknowledged that these levels are significant for a large portion of traders. Currently, the euro is approaching the 50% Fibonacci level, presenting a case for potential movements in either direction. However, in the short term, the market appears somewhat oversold, with indications of support in its current range.

Jobs Numbers

- After the jobs report release on Friday, market focus is expected to shift towards holiday trading conditions, likely impacting market liquidity.

- This could lead to erratic movements in the euro following the announcement.

- Until then, the market is anticipated to enter a period of relative calm and stabilization as participants await insights from the Bureau of Labor Statistics.

A key level to watch is the 1.0850 mark. A break above this level would be a bullish indicator for the euro. Conversely, a downward movement below the 200-Day EMA could signal a more bearish outlook. These technical thresholds are crucial in determining the short-term sentiment towards the euro.

In the end, the euro market is navigating through a complex landscape shaped by technical indicators and impending economic data releases. The upcoming Non-Farm Payroll announcement is particularly significant, as its impact on bond yields could dictate the euro's direction. Traders and investors are advised to monitor these developments closely, as they will play a pivotal role in shaping the euro's trajectory in the near term. The current market conditions suggest a balance between potential bullish and bearish outcomes, underlining the importance of staying informed and vigilant in this evolving environment.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.